BDSA Marketing Content Manager

Brendan Mitchel-Chesebro

The pressure to price competitively and produce winning premium consumer-loved cannabis products is greater than ever, especially given the current state of the U.S. legal cannabis industry.

Although the industry is growing with new state markets, the coveted exponential sales growth from U.S. Legal Adult-Use markets is short-lived given fluctuations in consumer demand and increasingly volatile brand/manufacturer competition.

The state of the U.S. Legal cannabis industry may seem very doom and gloom, but it’s not. If anything, it’s an opportunity to strategically think outside the box, understand the needs of today’s modern U.S. consumer, and develop winning products that solve those needs.

Targeting Rising Cannabis Subcategories

To set the scene, BDSA data show that cannabis sales in the U.S. continue to be dominated by products such as flower and vape. Nevertheless, premium items like infused pre-rolls, solventless extracts, and minor cannabinoid-infused edibles have gained traction and play a much bigger role in the legal cannabis market in recent years.

Leveraging BDSA Retail Sales Tracking to dig deeper into the industry and respective state market data, there are other sizable transformations occurring at the product subcategory level. For instance, product form factors primed for premiumization make up larger shares of their respective subcategory sales.

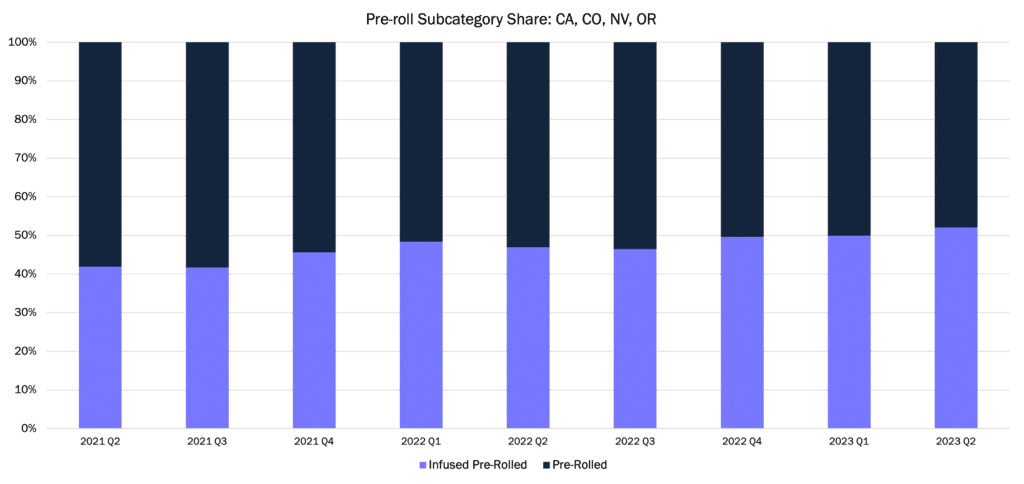

Across California, Colorado, Nevada and Oregon, infused pre-rolls grew USD sales share of their parent category by +10% from Q2 2021 to Q2 2023, reaching 52%. Similarly, USD sales share for solventless products in the extract subcategory increased by +9% within the same time frame, reaching 24%. Amongst solventless, rosin form factors have produced the strongest sales performance.

This 10% and 9% shift may seem minor. That’s why data is just the first ingredient to the magic sauce to marketplace winning. A deeper look into that shift reveals an important insight. There is an opportunity for brands to grow sales by building their assortment of premium cannabis products. BDSA Retail Sales Tracking of Q2 2023 industry performance further spotlights that the average retail price (ARP) for infused pre-rolls was +63% more than the parent category ARP and the ARP for solventless products was +34% higher than its respective parent category ARP.

All in all, reinforcing that these innovative products (infused pre-rolls and solventless products) are emerging pillars growing their respective subcategory USD sales share. And they are also an optimal product focus for retailers, brands, and manufactures to generate additional revenue.

* * * * * * * * * * * * *

Hungry for more insights? Check out our recent blog in the Industry Landscape Shift Series.

Want to learn more about how BDSA can serve as your data & industry partner? Request a demo.