With the evolution and growth of the legal U.S. Cannabis Industry, there have been significant shifts due to competitive pricing trends and overall competitive brand landscape. Both have left a major impression and fueled significant issues in the legal U.S. Cannabis Industry.

The onset of Covid-19 pandemic in 2020, brought a significant boost to legal cannabis sales. This bump in sales was followed by significant price declines beginning in 2021. Unfortunately, this issue has become one of the largest ongoing issues in the legal U.S Cannabis Industry to date.

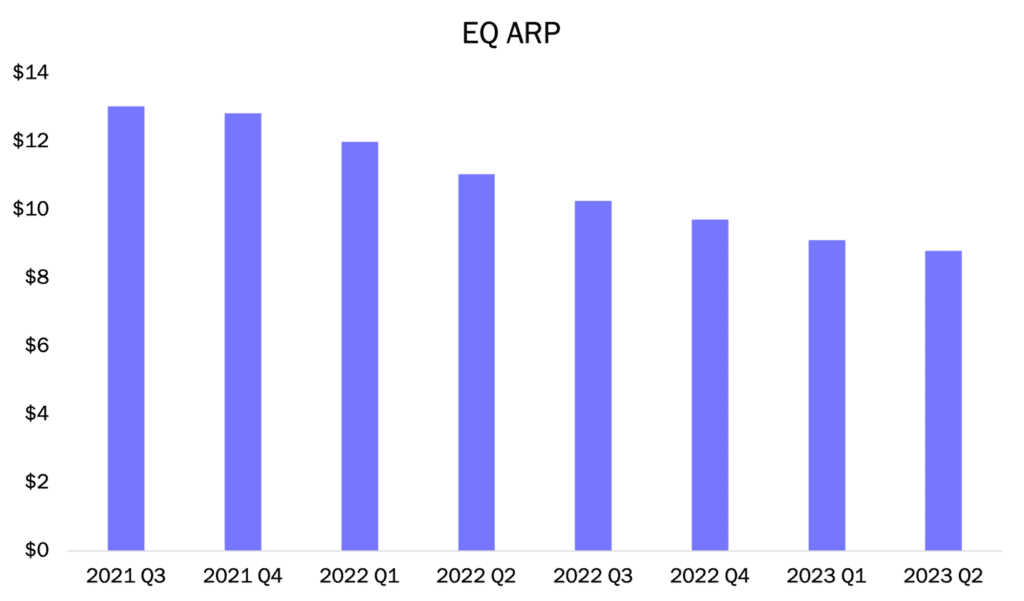

BDSA Retail Sales Tracking showcases that the equivalent average retail prices (EQ ARP) dropped a whopping -32% (from their peak in Q3 2021 to Q2 2023). This price decline, in concert with continued inflation which has increased costs for labor and materials for licensees, has made the industry even more competitive. In turn, this has put significant strain on brands and retailers that already had to deal with razor thin margins.

[Source: BDSA Retail Sales Tracking; AZ, CA, CO, FL, IL, MA, MD, MI, MO, NV, OR, PA]

Brand Landscape: Competition and Consolidation

As the industry has expanded and markets continue to mature, the brand landscape in legal cannabis has also become more competitive. A look at mature cannabis markets gives some perspective on the brand shift in cannabis, with BDSA data showing that the number of brands across mature cannabis markets (California, Colorado, Massachusetts, Michigan, Nevada and Oregon) grew +8% between Q2 2021 an Q2 2023.

Another feature of this evolution in the brand landscape is the larger role played by Brand Houses. Across all BDSA-tracked markets, the share of total sales held by the five best-selling brand houses grew by +14% between Q2 2021 and Q2 2023, showcasing the degree to which brand consolidation is already taking off in the legal cannabis space.

Conclusion

The U.S. legal Cannabis Industry is more competitive than ever, with more brands competing for increasingly thin margins. However, it’s not all doom and gloom for legal cannabis businesses. The U.S. legal Cannabis Industry is set to total $29.6 BN in 2023. It’s important to remember that the industry still has plenty of room to grow. Let’s not forget, it has barely been a decade of legal U.S. Adult-Use Sales.

States with the biggest potential market are still constrained by prohibition. For instance, Texas still lacks any significant legal market. Similarly, other high population states like Florida, Ohio and Pennsylvania are on the precipice of expanding into the legal Adult-Use market. When that happens, there is likely to be another major shift of evolution in the U.S. legal Cannabis Industry.