After nearly a decade of adult-use sales, the cannabis industry has undergone substantial growth and transformation since its early days of legalization. One notable domain that has experienced profound changes since the industry’s inception is the consumer landscape.

Specifically, it is the interplay of a burgeoning consumer base and growing retail access that impacted the U.S. legal cannabis consumer landscape, with consumer demographics at the forefront of this evolution.

A result of the expanding consumer base has been a clear distinction between new consumers (started consuming in the past year) and experienced ones (have been consuming for longer than 2 years). Specifically, these two groups vary in their preferences for cannabis product form factors, their retail selection criteria, and the factors influencing their product preferences.

Cannabis Consumer Landscape Growth

As cannabis legality spreads throughout the U.S., consumer consumption has increased. In Spring 2023, BDSA Consumer Insights broadcasted that 46% of consumers in Adult-Use & Medical legal states consumed cannabis in the past six-months. This represents +48% growth in the consumer participation rate since Spring 2020.

U.S. legal cannabis consumer base demographics have transformed with the growth of U.S. consumer engagement (e.g., buying, growing, consuming) across the country. Although there has been minimal change in race, age, and household income, there has been a major shift in gender. The once male dominated space has evolved. In Fall 2019, the consumer base was 59% male and 41% female. By Spring 2023, 51% of consumers identified as male, 48.5% as female, and 0.5% as nonbinary.

Cannabis Consumer Dynamics: New vs. Experienced Consumers

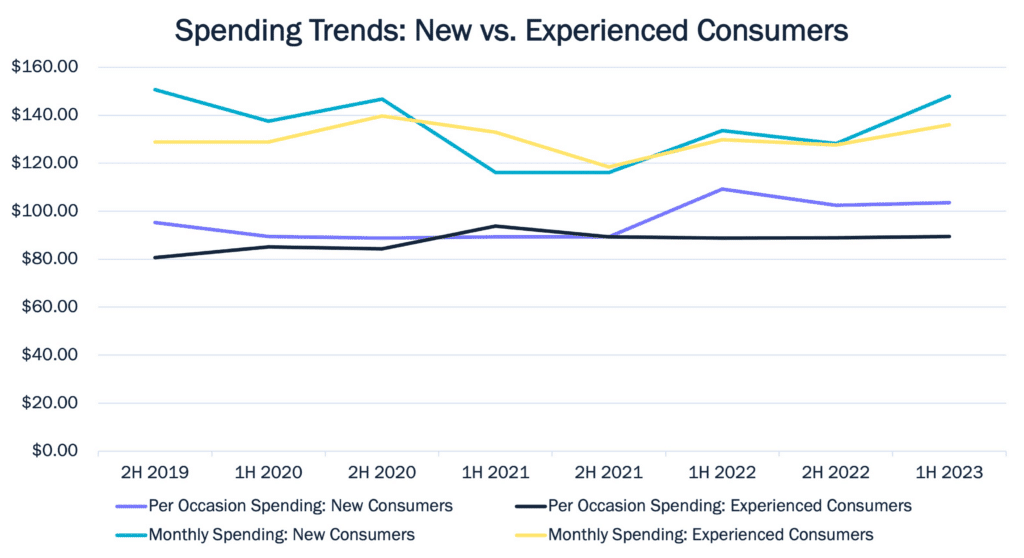

Both new consumers and returning consumers possess strong buying power and impact industry sales performance. However, how you engage and sell to these two sets of consumers will differ.

Targeting New Cannabis Consumers

Form Factors

If you’re focused on growing your new consumer base, it is important to invest in the proper product category. New consumers tend to be less experienced with cannabis and tend to gravitate towards form factors they are familiar with (e.g., gummies) and/or are easy to learn (e.g., pre-rolls). This presents an advantageous sales and marketing opportunity to engage new consumers to shop and buy.

BDSA Consumer Insights further validates the insight that today’s modern new consumers are more likely to use pre-rolls and gummies than past new consumers. From Fall 2019 to Spring 2023, the share of new consumers who reported consuming pre-rolls in the past six months grew + 30% and the share of new consumers who claimed consuming gummies in the past six months grew +25%.

Product Choice Drivers

When choosing a product, new consumers tend to engage in more emotionally influenced and trust-inspired decision drivers. Compared to experienced consumers, new consumers are +13% more likely to choose products based on brand reputation, +18% more likely to choose a product based on healthcare professionals’ recommendation, and 51% more likely to choose a product based on high quality, premium packaging. All three decision drivers provide a sense of trust and validity in their product choice, especially when new consumers may lack personal experience or cannabis knowledge.

This stands in contrast with more experienced consumers who tend to choose products based on experience and value-based decision drivers. For example, more experienced consumers are +8% more likely than newer consumers to choose a product based on familiarity with the strain or product class as experienced consumers seem to value consistency and draw on prior positive experiences, seeking what has worked well for them before. We also see that more experienced consumers are +5% more likely than newer consumers to choose products based on low price. Having used marijuana for a while, experienced consumers prioritize cost-effectiveness, seeking greater value for their money. We also see that more experienced consumers are +8% more likely than newer consumers to choose products based on organic labeling, as with more knowledge about marijuana, experienced consumers seem more likely to prioritize health and environmental considerations, leading them to seek organic options when available.

Targeting Experienced Cannabis Consumers

Need States

Experienced consumers are more likely to identify and use certain recreational need states to help drive their purchasing decisions. In Spring 2023, BDSA Consumer Insights recorded experienced consumers as two-times more likely than new consumers to consume cannabis with the intent to “get high or stoned” and +70% more likely to consume with the goal to “relax or be mellow”. Focusing on recreational form factors with high THC is a keen marketing and sales strategy for targeting experienced consumers.

Retail Choice & Shopping Frequency

Experienced consumers are more motivated to buy from retailers that are conveniently located (+49% more likely vs. new consumers), carry the products they like (+30% more likely than new consumers), and have the lowest prices (+12% more likely than new consumers). Although experienced consumers tend to be retailer loyal; they aren’t frequent shoppers. Experienced consumers are likely to shop on a less than monthly basis (24% of exp. Consumers), or monthly basis (23% of exp. Consumers). New consumers are more likely to be frequent cannabis purchasers, with 17% claiming to buy daily and 17% claiming to buy cannabis once or twice a week.

[Source: BDSA Consumer Insights; 2H 2019-1H 2023]

Targeting New & Experienced Consumers

The difference in cannabis experience and product familiarity between new and experienced consumers has a major influence on how consumers shop and consume. Successfully targeting both groups mean identifying how to educate new consumers and equip them with similar experience and skills that experienced consumers value and use in their purchasing decisions. For example, Level (the second best-selling Pill brand in Q2 2023), leaned into mood and effect marketing to deliver strong sales performance. Level has been successful in building its product marketing and positioning on mood and effect (to attract new consumers to purchase and feed them basic cannabis education) in conjunction with spotlighting minor cannabinoids (to attract experienced consumers and nurture them with holistic cannabis science and horticultural education).

Why Understanding the New Consumer Landscape Matters

With more new consumers entering the industry, there are major shifts in preferred products, motivations for consuming, and how consumers buy products. Understanding these shifts and adjusting sales and marketing tactics is increasingly critical and necessary to adapt as the typical cannabis consumer continues to transform. Before brands and retailers can craft a strategy of how to win their market, they have to know their consumer.

Thankfully, with the host of brands in the current cannabis industry, there are multiple examples of brands that have been able to see big growth by tailoring their strategy to the evolving consumer base, especially new consumers. We would love to hear from you on what brands and/or retailers you think are target new consumers and experienced consumers well. Let us know at Marketing@bdsa.com or on any of our social platforms (e.g., LinkedIn, Instagram).