BDSA Blog

May 5, 2025

It’s no surprise why Maryland is one of the most closely watched markets in 2023, as the state posted...

April 28, 2025

BDSA reports that cannabis beverages, though comprising just about 1% of total cannabis sales, achieved...

March 31, 2025

The essence of a winning 4/20 approach lies in the careful calibration of attractive discounts with genuine...

March 14, 2025

In recent years, it’s not just beer and whiskey fueling St. Patrick's Day festivities—cannabis has become...

September 26, 2024

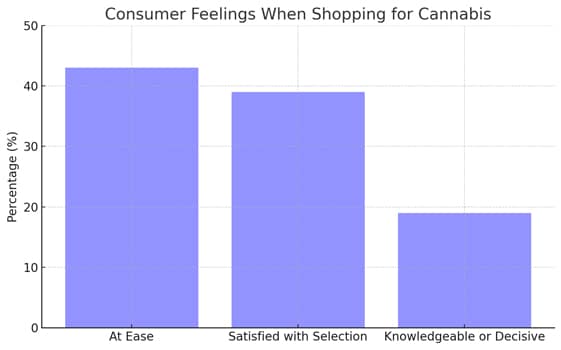

Exploring the tension between consumer data and brand narratives in cannabis marketing.

September 12, 2024

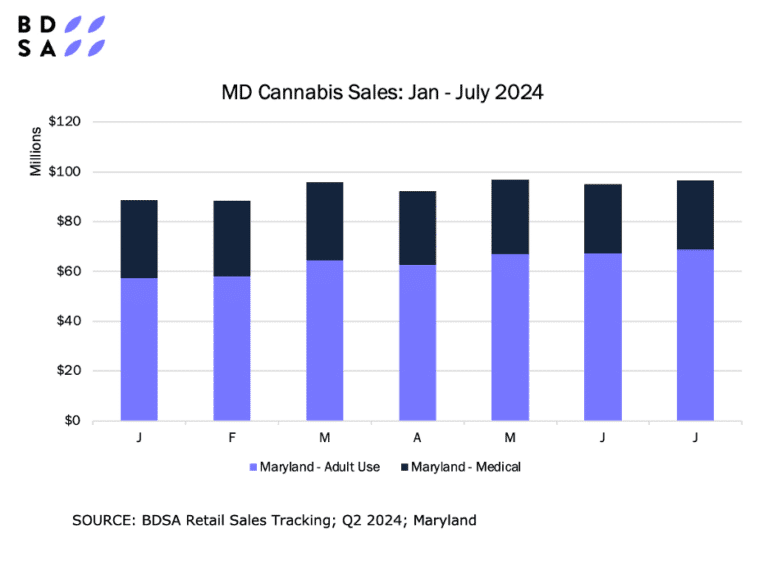

Maryland begins legal adult-use sales on July 1, 2023. Despite declines in the medical channel, adult-use...

September 12, 2024

Arm your sales team with data-backed sales stories. Use sell-through, rank, velocity, and other metrics...

September 10, 2024

With the legalization of low-THC hemp, a new wave of intoxicating hemp-derived products hit the market,...

August 29, 2024

Use your Total Addressable Market (TAM) to identify growth opportunities, make informed strategic decisions,...

August 29, 2024

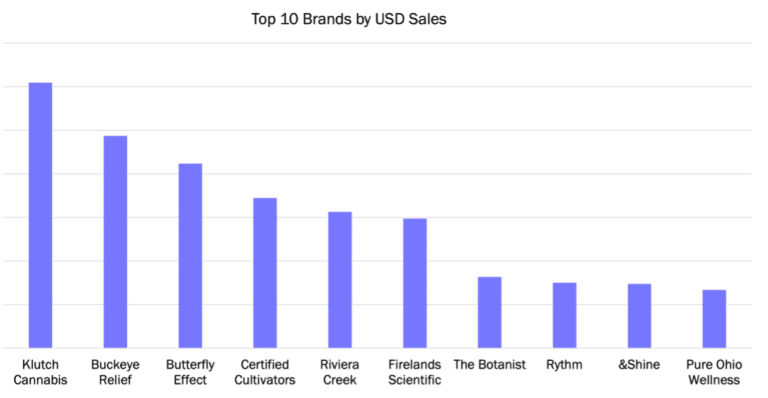

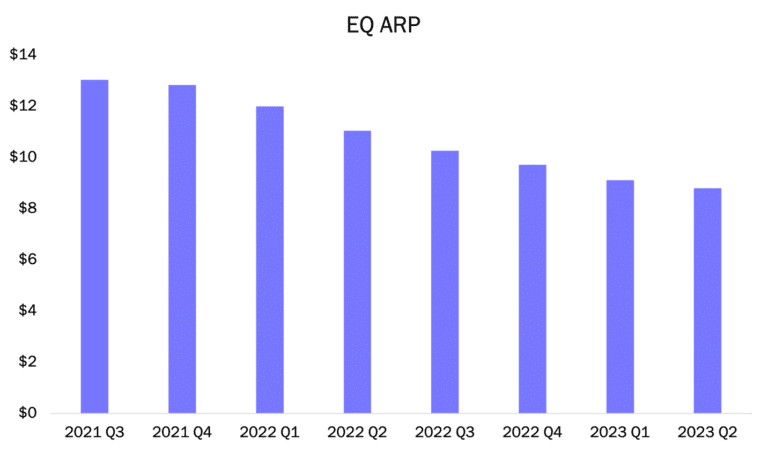

Just eight months after the legalization of adult-use cannabis, Ohio has already launched adult-use sales!...

August 26, 2024

Maryland adult-use is still growing after its strong launch. BDSA projects Maryland adult-use sales to...

No posts found