Despite ongoing industry headwinds, the cannabis industry is still growing rapidly, with BDSA forecasting that US cannabis retail sales will total more than $38 billion in 2024. While THC beverage market makes up a small share of total cannabis sales, the beverage category can yield significant returns for brands that take a strategic, insights-driven approach to product assortment, formulation, and audience targeting.

How are Cannabis Beverages Performing in 2025?

Beverages make up 1%-dollar share (.9% to be exact, and holding steady) of all cannabis sales, and totaled $54.6 million sales in Q1 2025 with an increase of +15% between Q1 2025 and Q1 2024.

Narrowing the focus to the universe of edibles, Beverages made up 6% share of Edible sales in Q1 2025, and is the fourth biggest edible category behind Candy (79% share), Chocolates (6% share), and Pills (5% share).

The Drinks subcategory remains the largest Beverage subcategory (making up 78% of Beverage sales), followed by Shots (11%), Powdered Mixes (7%) and Other Beverages (3%). Notably, powdered drinks has seen a decline over the last year, down from 12%, with most of the share previously belonging to shots moving into drinks.

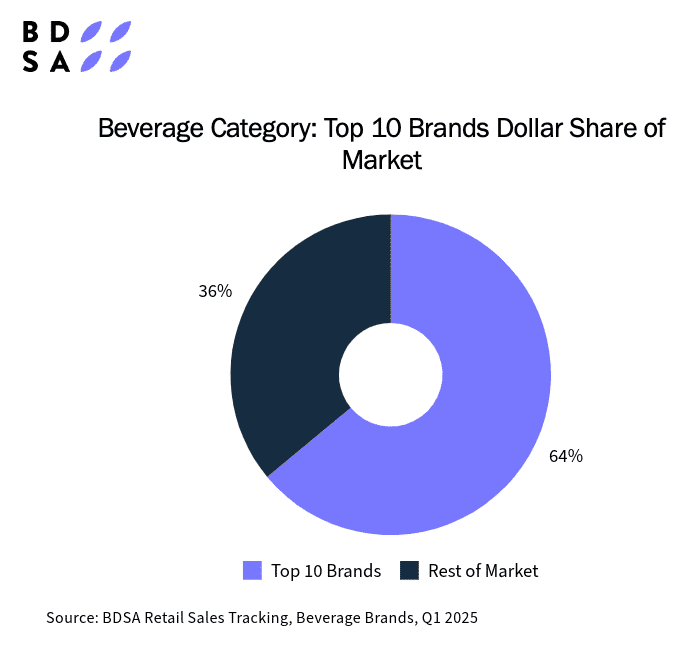

The beverage brand landscape is consolidating and the largest players are gaining share in the overall category share. In Q1 2025, there were 117 total brands selling Beverage products across BDSA-tracked markets, down from 148 total brands just a year ago. The top 10 brands make up 64% of sales, which is up from 52% just a year ago. 61 of the brands are multi-state brands, and 56 multi-category brands.

THC Beverage Performance by Market

Emerging markets like New York, Michigan, and Ohio are seeing major expansion in beverage sales, while some more mature markets like Arizona, Oregon, and Colorado are contracting slightly. California is a slow-growth market, but at its size that growth can be impactful.

Largest Growth:

- Michigan grew by 112%, more than doubling beverage sales Q1 2025 compared to Q1 2024.

- Ohio posted a strong 79% increase.

- Illinois saw a 47% rise.

- Maryland recorded 35% growth.

Largest Declines:

- Arizona had the sharpest decline, with sales dropping 26% compared to Q1 2024.

- Colorado declined by 14% year-over-year.

- Nevada and Oregon both experienced a 10% decrease.

Beverage Product Attribute Trends

A careful consideration of consumer preferences and product attribute trends is a key step for any brand looking to launch a new product. This is especially true in smaller categories like cannabis beverages, where attributes like dosage and flavor can be make or break for a brand looking to make a splash with a new product.

Looking at consumer preferences, BDSA Consumer Insights show that 42% of edible consumers in adult-use states prefer a dosage of 10 mg or less of THC per occasion, with dosages between 2.5 mg and 5 mg of THC being the most preferred (with 17% preferring this dosage).

BDSA Retail Sales Tracking show that 68% of beverages sold in Q2 2024 were 100 mg products, suggesting that there is an audience expansion opportunity for brands that can effectively launch a lower-dose product, especially in markets with a less saturated beverage brand landscape. Of course, the brand must also align to enough frequency and consumption occasions for the audience to be an effective revenue driver.

With “taste or flavor” as a top driver of their product choice, so flavor is another attribute that brands looking to enter the beverage category should consider. Unlike the Gummy subcategory, which is dominated by berry flavors, top flavors in the Beverage category are playful flavors you may see with niche beverage products in grocery or convenience stores with Strawberry Lemonade, Fruit Punch, and Root Beer taking the top three spots in the best-selling flavors list.

Beverage Brands

Best-Selling Beverage Brands of Q1 2025

- Keef Cola

- Uncle Arnie’s

- St. Ides

- Ayrloom

- Sip Elixers

Fastest Growing Brands so far in 20252

- Ayrlom

- Not Your Father’s Root Beer

- Manzanita Naturals

1BDSA Tracked Markets include: AZ, CA, CO, FL, IL, MA, MD, MI, MO, NJ, NV, NY, OH, OR, and PA

2BDSA Tracked Brands with >$500K in Q1 2025 Sales

Looking for more cannabis industry insights? Check out our recent blog on Maximizing Cannabis Brand Revenue Through Product Mix Optimization and SKU Rationalization. Want more information on BDSA products and services? Reach out to request a demo.

Updated April 28, 2025