Cannabis Insights

Sparking Cannabis Business Growth with Strategic Insights

Gain critical insights into consumer behavior and preferences with BDSA’s Cannabis Consumer Insights, driving strategic decisions that enhance customer loyalty and boost sales.

Data that informs strategy.

Transform your cannabis brands and dispensary with actionable insights from BDSA, refining your strategies for enhanced market presence. Access comprehensive data on cannabis consumer and non-consumer demographics, behaviors, attitudes, product preferences, need states, consumption dynamics, and purchase drivers. Leverage actionable data to eliminate guesswork and base your consumer-facing decisions on real cannabis market insights.

Strategic Consumer Targeting

Increase brand loyalty and customer satisfaction with tailored marketing and product strategies for diverse cannabis consumers.

Data-Driven Messaging

Craft compelling marketing messages by utilizing insights into your customers’ purchasing motivations.

Unlock Market Potential

Explore growth opportunities by analyzing detailed studies on cannabis consumption and market dynamics.

Optimize Product Assortment

Adjust your inventory based on reliable consumer demand data so that your products meet current market trends.

Drive Innovation

Anticipate and respond to emerging trends, fostering innovation in your product offerings and distinguishing your brand in the competitive landscape.

BDSA Retail Sales Tracking Product Details and Coverage

Markets

Comprehensive coverage of cannabis markets across the U.S. and Canada.

Channels

Data spans both medical and adult-use channels in the cannabis industry.

Sample

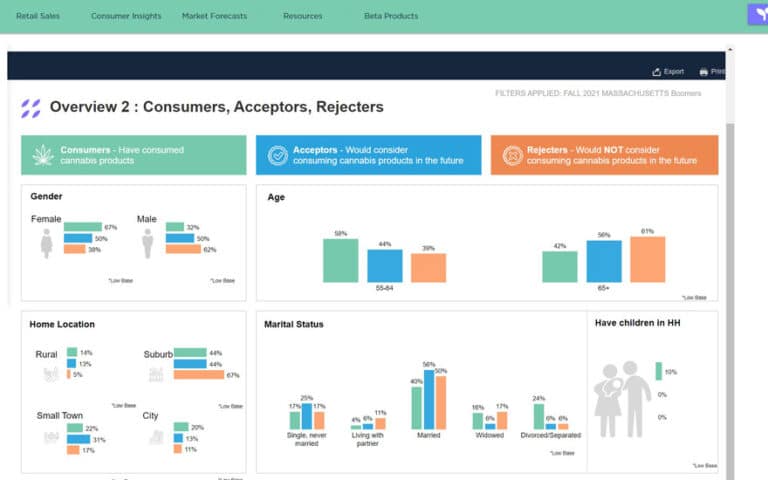

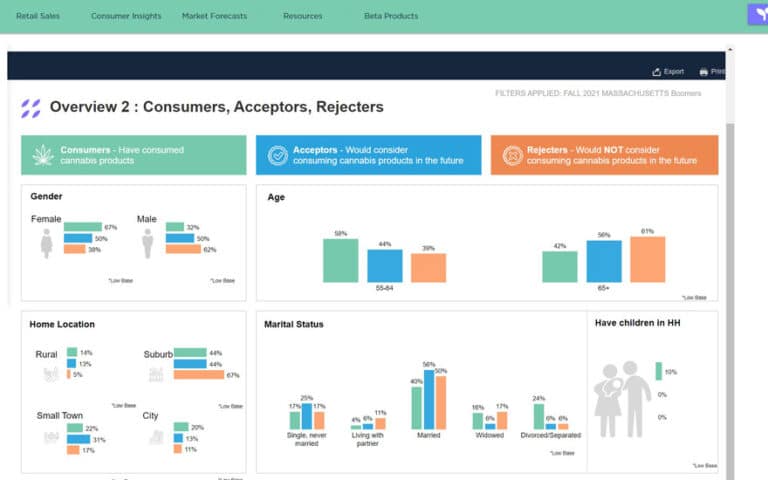

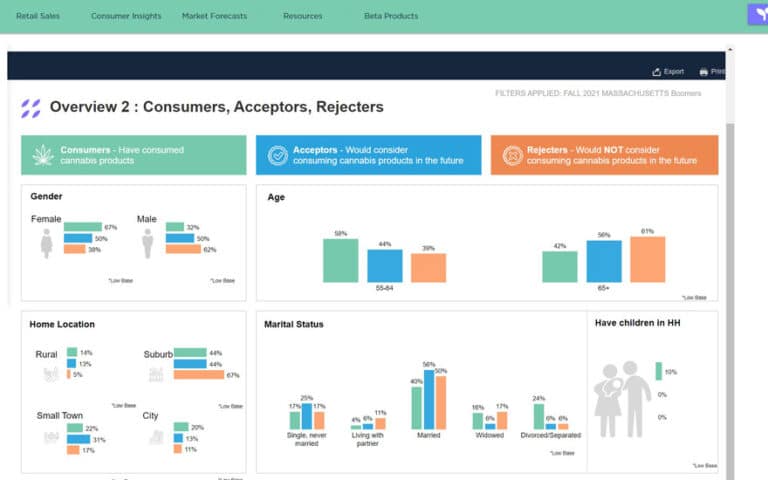

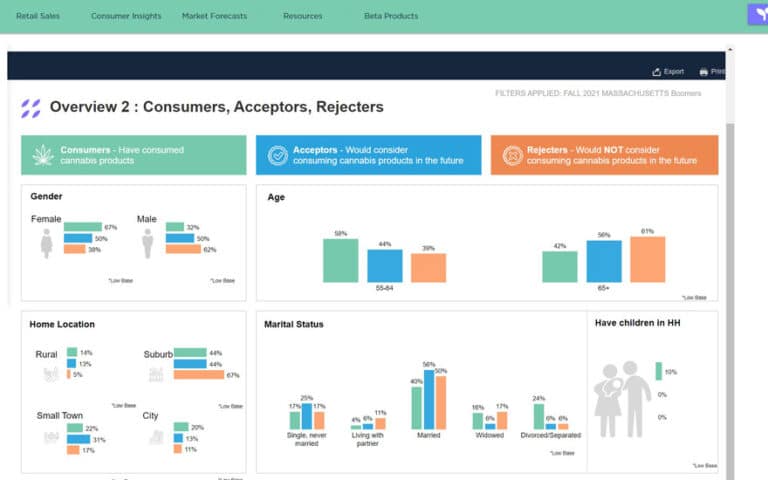

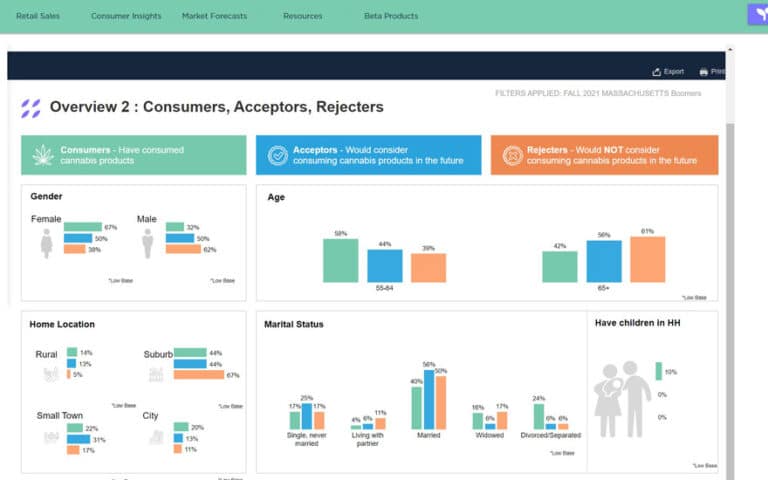

Research diverse cannabis consumer groups: Consumers®, Acceptors®, and Rejecters®.

Cadence

Twice a year, providing nine waves of trended data and insights into cannabis consumption and market trends.

Measures

Demographics, psychographics, attitudes, and detailed behaviors of cannabis consumers, alongside product usage and purchasing dynamics to guide cannabis retail.

Add-Ons

BDSA’s Attitudinal Consumer Segmentation—targeting six exclusive cannabis consumer segments and four non-consumer segments.

Delivered

Data delivered through BDSA’s GreenEdge® platform for timely access to data-driven insights for the cannabis business.

BDSA Cannabis Consumer Insights Capabilities

- Topline Cannabis Market Overview

- Cannabis Consumer Demographics Attitudes, Behaviors, and Lifestyles

- Cannabis Consumption Methods, Usage Occasions, and Need States

- CBD Focused View

- Interactive Data Tools & Visualizations

Understand and accurately size the cannabis consumer landscape across the U.S. and Canada. Data delivers critical insights for dispensaries into the demographics, psychographics, and behaviors of cannabis Consumers® and Acceptors®.

- Utilize granular data on the demographics and attitudes of cannabis Consumers® and Acceptors® to develop precise market profiles and adapt to shifting consumer bases.

- Use trending consumer dashboards to track and respond to the evolving preferences and behaviors of cannabis shoppers, effectively guiding your market expansion efforts.

- Analyze the main hesitations among Acceptors® and create targeted strategies to boost the adoption and consumption rates among cannabis Consumers®.

Gain a detailed breakdown of the consumer base across U.S. and Canadian markets. This allows cannabis brands, dispensaries, and investors to cut through misinformation and stereotypes surrounding the modern cannabis consumer.

- Develop marketing strategies that speak to cannabis consumer attitudes and sensibilities.

- Refine in-store experiences and improve consumer targeting by basing your strategy on who the audience profile is, not just what they purchase (though you can see that too!)

- Use consumer lifestyle data to identify brands and products that address the needs of the changing cannabis consumer market.

Explore what cannabis form factors and product subcategories are most commonly favored by dispensary customers and cannabis consumers in general—and learn the reasons why.

- Focus on cannabis consumption occasions and need states so that your brand gets the most out of its product portfolio.

- Optimize dispensary retail space and win cannabis consumers in-store by taking into account purchasing drivers

- Explore consumer preferences down to granular cannabis product attributes to expand, innovate, and stock the perfect mix.

Capture essential details on the demographics, psychographics, and purchasing behaviors of CBD consumers, covering both hemp and marijuana-derived products across adult-use legal states, medical legal states, and Canada.

- Build dynamic messaging for hemp or CBD brands or products with granular profiles of cannabis Consumers® and Acceptors®.

- Stay ahead of the trends by identifying top hemp and cannabis product categories and usage occasions.

- Improve distribution strategies and target the right retailers by leveraging in-depth insights into CBD purchasing behaviors.

- Analyze and clarify how CBD brands and products differ between cannabis dispensaries and mainstream retail environments.

Harness the full potential of your data with sophisticated resources that provide a powerful lens through which to view complex data sets. This enables more strategic decision-making across dispensaries and cannabis businesses.

- Harness the full potential of your data with sophisticated resources that provide a powerful lens through which to view complex data sets. This enables more strategic decision-making across dispensaries and cannabis businesses.

- Interact with tools that reveal extensive data on market trends and consumer patterns, with the ability to explore all data with filters on individual markets, demographics, and purchasing preferences.

- Employ our intuitive visualizations to easily identify opportunities and challenges within the cannabis market.

- Remain agile and keep a pulse on the ever-changing preferences and behaviors of cannabis consumers with real-time dashboards.

Expand Your Cannabis Consumer Insights.