BDSA Marketing Content Manager

Brendan Mitchel-Chesebro

In 2022, total U.S. legal cannabis sales increased to $26.4 Billion (+38% vs. total 2020 annual sales). This sales growth is just one of many stories that reflect the evolution of the U.S. legal Cannabis Industry. That evolution is moving fast and so is the industry, especially since the onset of Adult Use sales that began in Colorado nearly a decade ago (in January 2014).

In that decade, the legal Adult Use channel has increasingly driven the growth of the U.S. legal Cannabis Industry, with some (falsely) assuming that any venture in the cannabis industry is a recipe for pure growth. Not only are Adult Use channels increasingly driving growth, but Adult Use markets are coming online faster. With a highly competitive brand landscape, diverse and innovative product category mix, and enticing consumer, brands in cannabis experience the same issues as their counterparts in other consumer-driven markets. Brands are constantly working to find new ways to build consumer loyalty, and a thorough understanding of the evolution of Adult Use and Medical markets is key to targeting specific consumer segments.

Top-line Sales Trends Shifts

The speed to market from legalization has played a vital role in US legal Cannabis markets. In recent years, we have seen market launches occur much sooner after legalization when compared to the first states to legalize cannabis. Colorado, the first state to legalize Adult Use in 2012, began legal sales 14 months after legalization had passed. Nevada picked up the pace with their speed to market, launching legal sales in just under eight months after legalizing in the 2016 General Election. Since then, we have seen Arizona shatter the ‘speed to market record’, starting Adult Use sales less than 90 days after legalizing cannabis in November 2020.

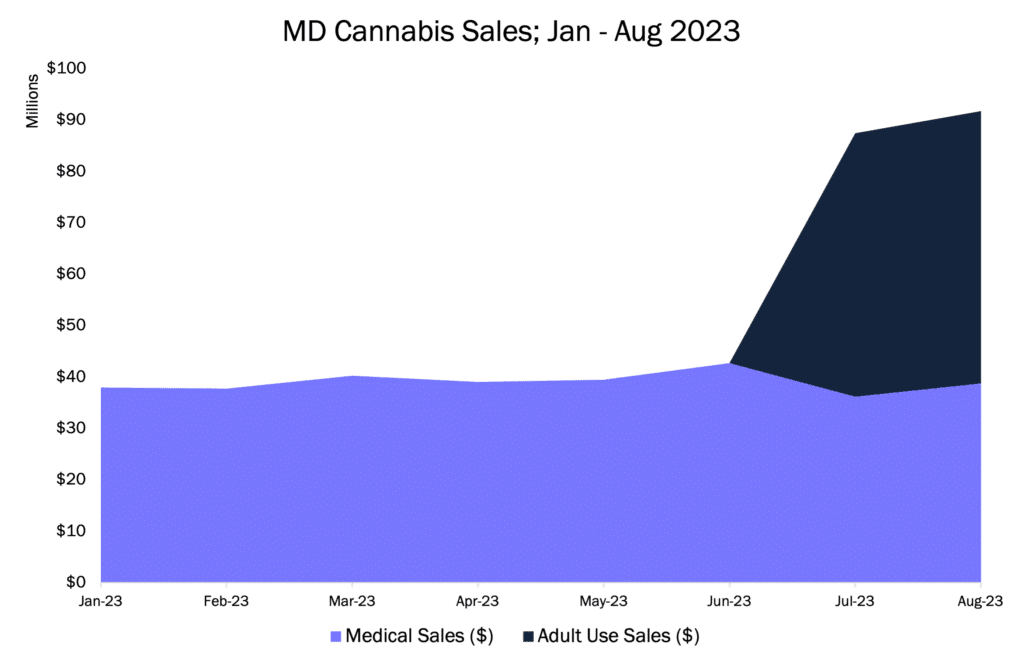

It comes as no major surprise that Emerging U.S. state markets (i.e., states that recently legalized and launched markets) are quickly identifying Adult Use sales as a catalyst to speed up market performance. Most recently, Maryland launched its Adult Use market on July 1, 2023. In that month alone, Maryland legal sales skyrocketed to $87 MM, a +105% increase in legal sales vs. June 2023 legal Medical market only. Of that $87 MM, a little more than 60% was driven by Adult Use sales.

Impact on Medical Channel Sales

The drawback? The onset of Adult Use has corresponded to a significant decline in the legal U.S. state Medical market performance. This may seem like an insignificant trend, but the rapid contraction of Medical sales has big implications for cannabis brands and retailers who built their market presence by catering to the specific needs of Medical consumers. Colorado, a Mature state market that launched recreational sales in 2014, didn’t experience Medical market sales decline until roughly 2 years after Adult Use market launched. This contrasts with more recent market launches, such as in Michigan, where Medical channel sales dropped by -25% in the first full year of Adult Use (2020). With Emerging markets (i.e., U.S. states that recently began Adult Use sales) rapidly launching Adult Use to expand market opportunity and performance, there has been a rapid and negative impact to state Medical markets. This was the case in Arizona, an Emerging market, which had Medical market sales drop -38% in the first full year of Adult Use sales (2022).

Like you, we are excited for the continued evolution of the U.S. Cannabis Industry. From recent events like Maryland Adult Use market to the U.S. HHS’s recommendation to reclassify Cannabis, there’s never a dull moment in the industry.

To learn more about U.S. Industry insights, check out BDSA’s recent blog about the ongoing trends of price compression and brand consolidation in legal cannabis.