Cannabis Industry Shift: Adult Use Markets Launch Quicker and Medical Channel takes the Hit?

In 2022, total U.S. legal cannabis sales increased to $26.4 Billion (+38% vs. total 2020 annual sales). This sales growth is just one of many stories that reflect the evolution of the U.S. legal Cannabis Industry.

Not only are Adult Use channels increasingly driving growth, but Adult Use markets are coming online faster. With a highly competitive brand landscape, diverse and innovative product category mix, and enticing consumer, brands in cannabis experience the same issues as their counterparts in other consumer-driven markets. Brands are constantly working to find new ways to build consumer loyalty, and a thorough understanding of the evolution of Adult Use and Medical markets is key to targeting specific consumer segments.

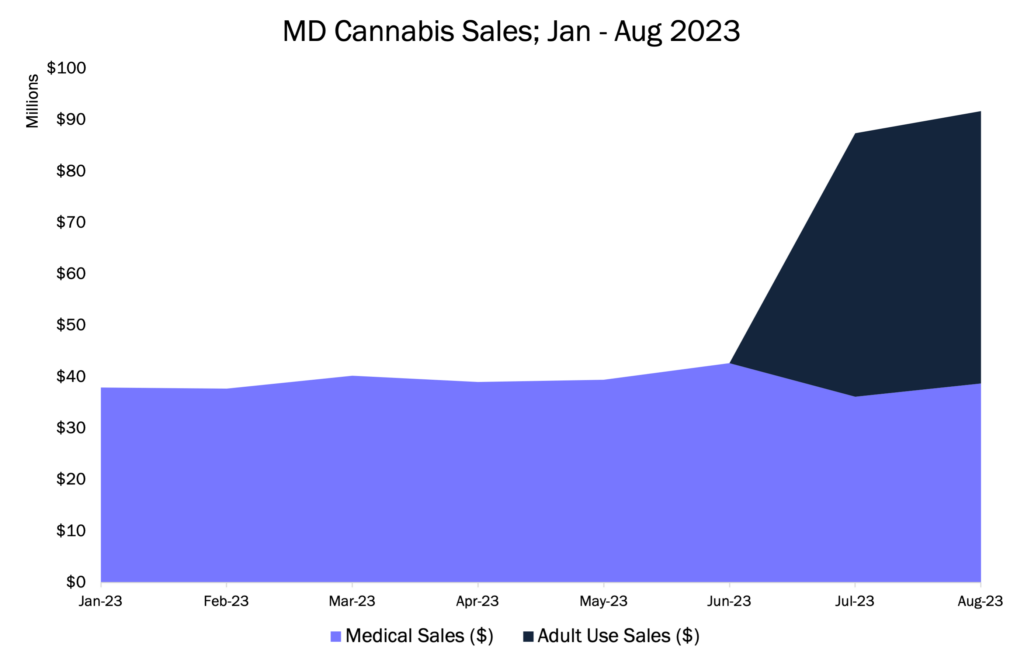

Adult-Use Brings Rapid Growth to Maryland Legal Cannabis Market

It’s no surprise why Maryland is one of the most closely watched markets in 2023, as the state posted massive sales growth in July with the addition of Adult-Use market on July 1st. Here are some of the top takeaways from the first month of legal sales in the Bay State.

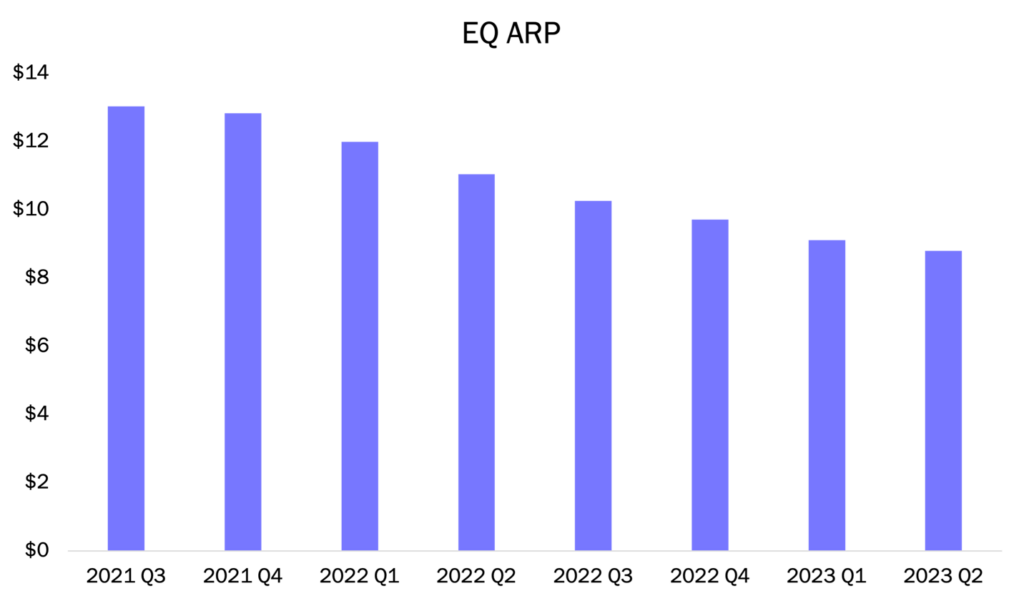

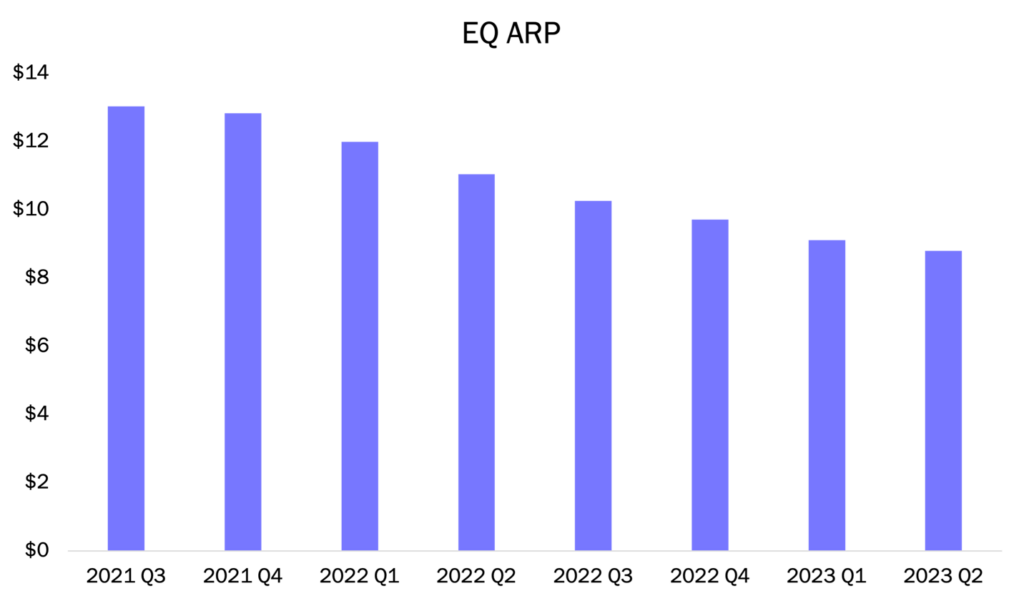

Cannabis Industry Shift: Pricing Compression & Brand Consolidation

With the evolution and growth of the legal U.S. Cannabis Industry, there have been significant shifts due to competitive pricing trends and overall competitive brand landscape. Both have left a major impression and fueled significant issues in the legal U.S. Cannabis Industry.

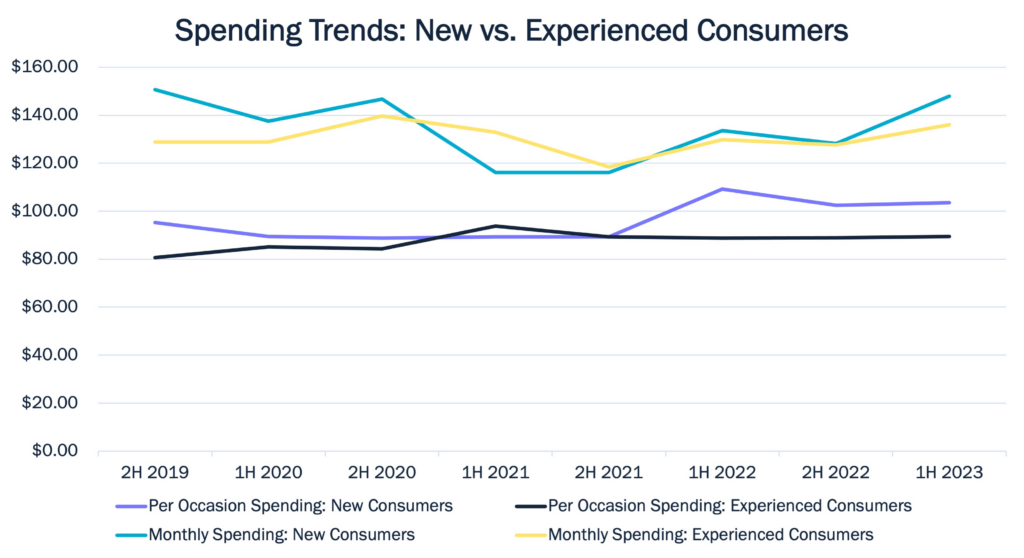

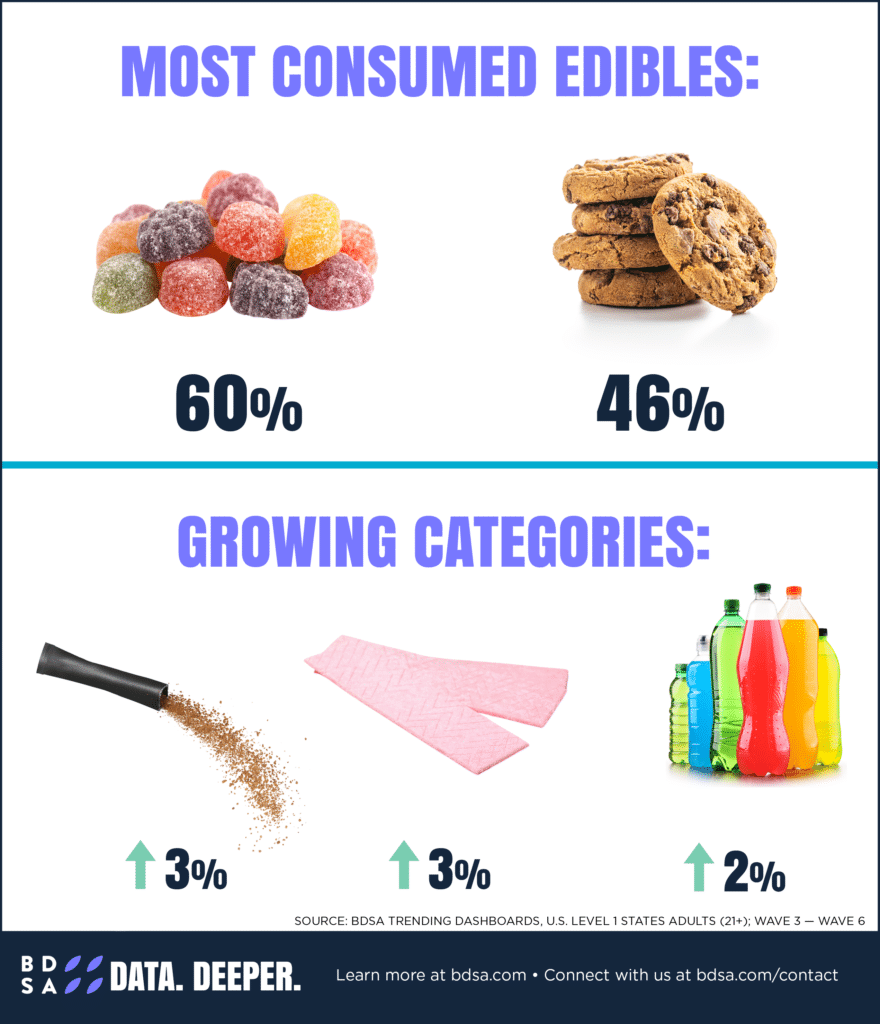

Industry Growth & Transformation: Unveiling Today’s Modern U.S. Cannabis Consumer

As cannabis legality spreads throughout the U.S., consumer consumption has increased. In Spring 2023, BDSA Consumer Insights broadcasted that 46% of consumers in Adult-Use & Medical legal states consumed cannabis in the past six-months.

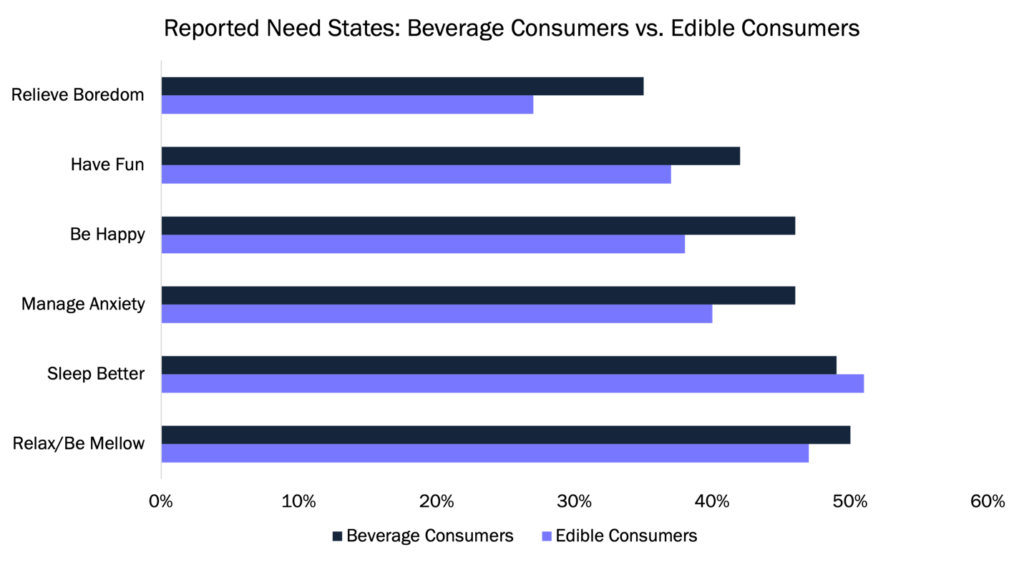

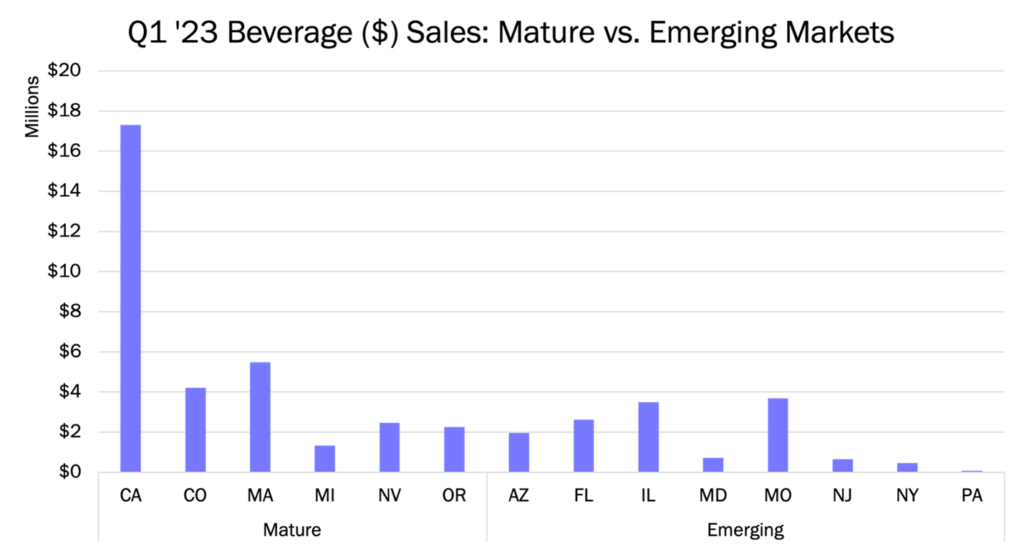

Realizing the Opportunity of the Cannabis Beverages Market

Even with all the opportunity in the Beverage space, building a winning cannabis Beverage venture is not a simple task.

Cannabis Beverages Hold Significant Opportunity Across Saturated Mature Markets & Open Emerging Markets

Maryland begins legal adult-use sales on July 1, 2023. Despite declines in the medical channel, adult-use is expected to help the Maryland market return to growth for years to come, with adult-use sales contributing nearly a third of the forecasted 2023 state legal sales of $642 million.

Top 5 Best-Selling Cannabis Brands (Beverage) 2023

Maryland begins legal adult-use sales on July 1, 2023. Despite declines in the medical channel, adult-use is expected to help the Maryland market return to growth for years to come, with adult-use sales contributing nearly a third of the forecasted 2023 state legal sales of $642 million.

BDSA Launches Retail Sales Tracking in Canada

With launch of Retail Sales Tracking, BDSA Provides Comprehensive Suite of Market and Consumer Insights on the Canadian Cannabis Market BDSA has launched retail sales tracking data for Canada, providing brands and retailers with greater insight into the world’s largest nationally legal cannabis market. BDSA forecasts Canada’s cannabis industry will reach CAD$3.3 billion ($2.5 billion) […]

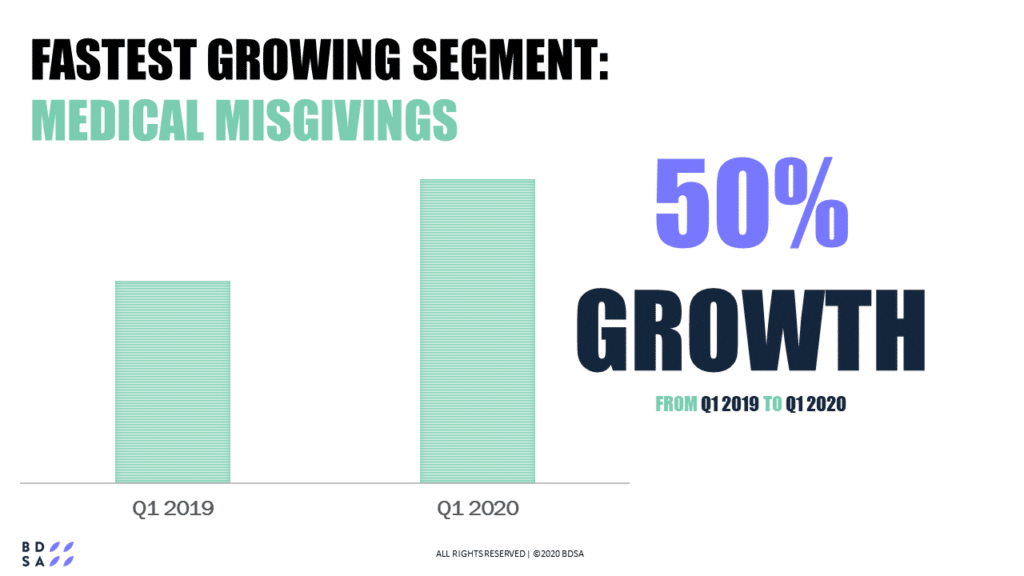

BDSA Consumer Research Identifies 10 Segments of Diverse Cannabis Consumers and Non-Consumers

Cannabis consumers are a diverse group, as clearly demonstrated by BDSA’s consumer research. At the highest level, BDSA divides respondents into:

What is Driving the Surge in Per Capita Cannabis Spending?

When Colorado first launched adult-use (recreational) sales in 2014, the existing medical market opened up to a wave of new consumers, including those from the sizable illicit market as well as new consumers who previously had little or no experience with cannabis.