Cannabis consumers are a diverse group, as clearly demonstrated by BDSA’s consumer research. At the highest level, BDSA divides respondents into:

- Consumers: those who report consuming cannabis within the past six months,

- Acceptors: who do not currently consumer cannabis but are open to it, and

- Rejecters: who do not use cannabis and are not open to it.

By performing a cluster analysis of consumer research conducted in the first quarter of 2020, BDSA was able to define market segments to help clients better understand cannabis consumers and make more informed business decisions. As cannabis legalization spreads to more markets each year and existing legal markets grow, understanding the cannabis consumer is crucial to success within the legal industry.

BDSA’s segmentation enables dispensaries, retailers and manufacturers to identify and gain a deep understanding of key consumer & non-consumer groups in order to make more informed decisions.

How dispensaries and retailers can use segmentation:

- Optimize marketing and promotions to appeal to the most valuable customers

- Tailor inventory assortment to meet target customer needs

How manufacturers can use segmentation:

- Develop and refine target markets across product portfolio

- Identify innovation opportunities to deliver on key consumer groups’ unmet product needs

- Identify penetration opportunities among non-consumers

Our research seeks to determine the rate at which cannabis is consumed, demographic differences between consumers and non-consumers, what drives consumers to seek out cannabis and which products they prefer. This detailed segmentation provides a more nuanced look into the attitudes of Consumers Acceptors and Rejecters and what characteristics determine their outlook.

This consumer segmentation analysis of BDSA’s wave six research identifies 10 segments according to their responses to survey questions.

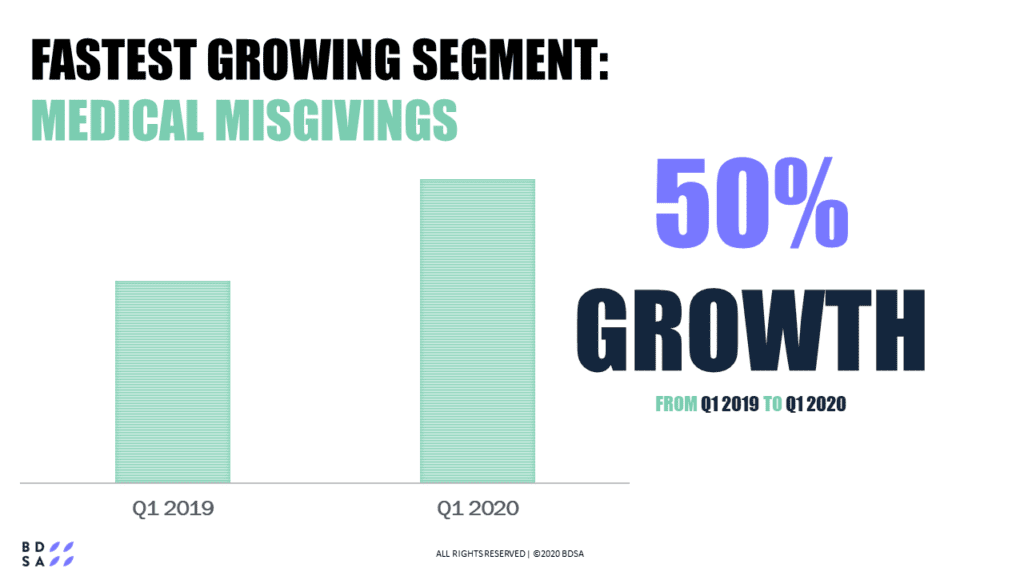

As expected, respondents from Consumer segments are more likely to be in favor of legalization than Acceptors and Rejecters. That is especially true of those in the two biggest Consumer segments: “recreationalists” and “socializers”, each representing 7% of respondents. Two other segments, “medically motivated” and “medical misgivings,” whose members consume mostly for health reasons are mostly opposed to full legalization. Consumers in those segments are also less likely to opt for inhalable products, preferring edibles and topicals. The medical misgivings segment is most likely to be cautious of full cannabis legalization and believe that more testing and research is needed to learn of the potential risks. While significant portions of all Consumer segments report going to medical or adult-use dispensaries, all but “cannabis advocate,” commonly obtain their cannabis through a friend or family member.

Those grouped into the non-consumer segments hold a diverse array of opinions on cannabis, ranging from those in the “complete rejecter” segment, who remain almost completely opposed to legalization, to the “legally limited” segment, of which 96% agree with full legalization. Respondents in non-consumer segments cite several reasons for not consuming, the most common being that it does not fit their lifestyle. Non-consumers tend to be older and hold more conservative views on cannabis than Consumers, with complete rejecters at a mean age of 51. When asked which types of cannabis they would consider consuming, non-consumers are far more likely to consider topicals or edibles than inhalable cannabis.

While there are still some who remain fully opposed to cannabis, both personally and politically, those who are either currently consumers or open to trying cannabis made up the vast majority of those surveyed. Of those who are open to cannabis, one issue preventing them from becoming consumers is lack of legal access, a problem that will be easily remedied as legalization expands access across the United States. Aside from the inevitable spread of legalization turning over some of these non-consumers, those in the industry can push to expand the pool of consumers by focusing on education. By providing information about the ways cannabis can fit into different lifestyles and how safe legal cannabis products are, it is possible that a large portion of those non-consumers could be brought into the pool of consumers and greatly expand the size of the total legal market.