Top 5 Best-Selling Missouri Cannabis Brands

One of several Midwestern states that continued to grow its cannabis sales as mature cannabis markets stagnated, Missouri brought in $1.3B in total sales in 2023, with roughly $1B of this total coming from the fledgling adult-use channel. With the young adult-use market still seeing strong growth, Missouri’s cannabis market is expected to bring in $1.4B in total sales in 2024, and grow to $1.73B by 2028.

Strategies to Increase Extract Sales on 7/10

7/10 is the unofficial holiday of cannabis concentrates, designated as such by concentrate aficionados who saw that the date resembled “OIL” spelled backwards. With a careful, data-driven approach to assortment and pricing, your brand can drive significant revenue on 7/10.

Top Five Best-Selling Brands in the Ohio Medical Market

Ohio became the 24th state to legalize cannabis after 56% of voters said yes to adult-use on November 7, 2023. While rules for adult-use are pending until December 7, Ohio’s robust medical market and diverse brand landscape deserve more attention.

Fastest Growing Disposable Vape Brands

Between Q1 2022 and Q1 2024, disposable products grew their share of vape dollar sales by +92%, and the disposable category now makes up a 25% market share of vape sales across BDSA-tracked markets. With 56% of vape consumers citing ease of use and 44% citing convenience as their reasons for choosing vapes, disposable vapes are well positioned to meet vape consumers need states and are expected to see strong growth for years to come.

St. Patrick’s Day Cannabis Sales: Capture More Sales with this Green Opportunity

In recent years, it’s not just beer and whiskey fueling St. Patrick’s Day festivities—cannabis has become a major player in the holiday rush.

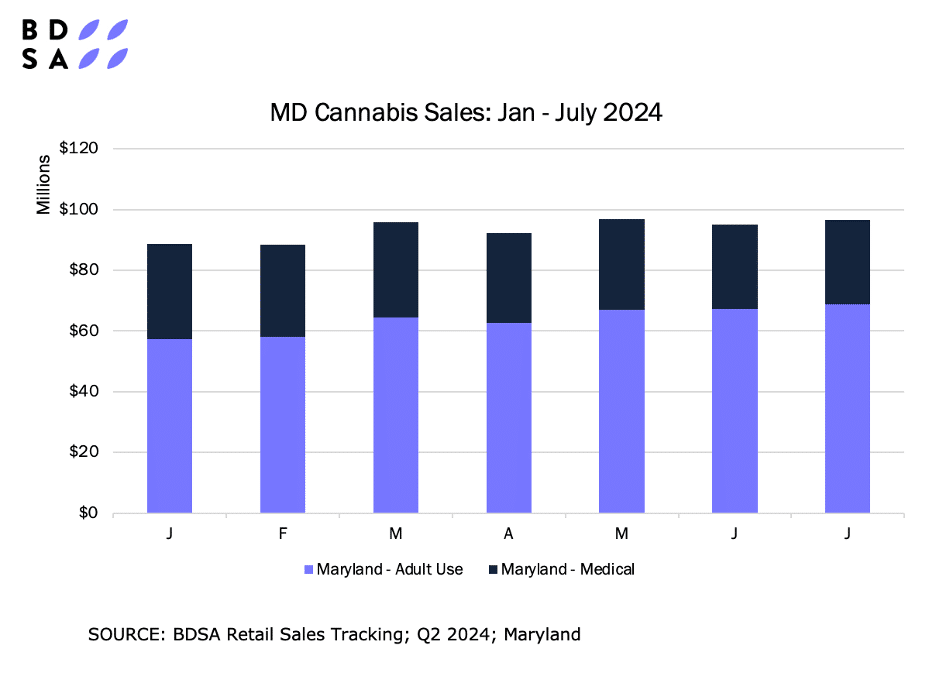

Top Five Best-Selling Brands in the Maryland Adult-use Market

Maryland adult-use is still growing after its strong launch. BDSA projects Maryland adult-use sales to reach $795MM in 2024, pushing total sales to $1.07B.

Rising Cannabis Categories: Disposable Vapes

Making up 26% of dollar sales across BDSA tracked markets in 2022, vapes have grown to become the second best-selling cannabis form factor behind flower. A growing trend in the vape space for the past year has been the rise of the disposable vape subcategory. From the start of 2022 to the end of 2022 […]

“Homegrown Brands” Holding Strong Since the Launch of Adult-Use Cannabis Sales in Arizona

Following the launch of Adult-Use (AU) cannabis sales on January 22, 2021, Arizona’s legal cannabis market has grown rapidly, with sales growing ~30% to total ~$1.3 billion for the full year per BDSA Retail Sales Tracking. Already a mature medical cannabis market, the start of AU sales has brought the Arizona cannabis market to another […]

With the EVALI Crisis in the Rear-View Mirror, BDSA Knows Vape will Continue to Survive and Thrive in 2022

After experiencing major disruptions being the subject of the first public health crisis in the cannabis industry, vape has solidified its place as a top cannabis product category. As concern grew over the E-cigarette and Vaping Associated Lung Injury crisis in the fall/summer of 2019, monthly vape dollar sales across BDSA-tracked markets dropped over 10% […]