The cannabis industry is more competitive than ever in 2024, so it’s no wonder that brands and retailers are always on the hunt for innovative products that can boost sales and help gain market share. Cannabis category share has largely stabilized at the top level, with flower making up the largest market share, followed by vape and edible products. But when we take a granular look at product category data, we see that there are still shifts happening in the cannabis product landscape.

One notable shift underway is the rapid growth of disposable vape products. Between Q1 2022 and Q1 2024, disposable products grew their share of vape dollar sales by +92%, and the disposable category now makes up a 25% market share of vape sales across BDSA-tracked markets. With 56% of vape consumers citing ease of use and 44% citing convenience as their reasons for choosing vapes, disposable vapes are well positioned to meet vape consumers need states and are expected to see strong growth for years to come.

5 Fastest Growing Cannabis Disposable Vape Brands

Disposable Category Dynamics

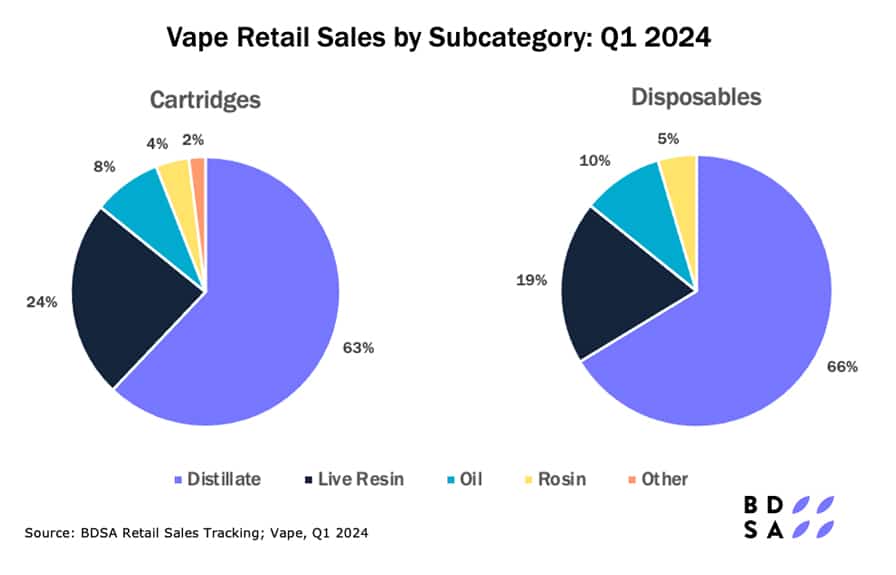

Looking at the vape category overall, there are a few key differences between the disposable and cartridge vape subcategories. While distillate products dominate both the cartridge and disposable subcategories, followed by live resin and oil, there is some variance between the two. Compared to disposable vapes, the vape cartridge subcategory sees a larger share of sales coming from Distillate, Oil, and Rosin, whereas Cartridges have a greater share of Live Resin.

Another key difference can be found when evaluating the best-selling products. Best-selling disposable vape products are less likely than best-selling vape cartridges to be strain specific products. Out of the 20 best-selling vape disposable products in Q1 2024, nine were labeled as being fruit flavored or “blends” of cannabis flavors. On the other hand, from vape cartridge top products, all but two were sold as strain specific products.

Here are a few of the fastest growing disposable vape brands:

Fuzed

California-based Fuzed has seen rapid growth in the disposable vape category, with sales of their fruit-flavored vapes skyrocketing in 2023, especially after an expansion to the Maryland market in the summer of 2023. Fuzed grew its total sales 1944% between Q1 2023 and Q1 2024, with the brand bringing in over $4M in disposable vape sales across California, Maryland, and Ohio in Q1 2024.

Cake

Cake has rapidly grown their Arizona and California disposable sales with their line of “designer distillate” products that offer fruit-forward flavors in a unique form factor. The brand reached $6.4M in disposable sales in Q1 2024, a 1091% increase of the brands sales in Q1 2023.

Select

The number one best-selling disposable brand across BDSA-tracked markets, Select grew rapidly after their 2019 acquisition by Curaleaf, driven in part by an expansion to several booming East Coast markets. Select’s disposable vape products saw a rapid rise over the past year, with sales growing 577% between Q1 2023 and Q1 2024, with a total of$32M in Q1 2024. Selects products were sold across 11 BDSA-tracked markets in Q1 2024 (AZ, IL, MD, MA, MI, MO, NV, NJ, NY, OH, and PA), with the largest share of sales coming from Illinois and New Jersey.

Gold Flora

California based Gold Flora dramatically grew its disposable sales over the past year, and was the number five best-selling brand in the California market. With a product portfolio featuring strain specific products, fruit-flavored products, and a line of rosin disposables, Gold Flora grew its disposable vape sales 471% between Q1 2023 and Q1 2024, with a total of $3.5M in disposable sales in Q1 2024.

BLOOM

The number five best-selling disposable brand across all BDSA-tracked markets, BLOOM has seen especially strong performance in California with their line of strain-specific distillate disposables. The brand was the number two best seller in California in Q1 2024, at $12M, an increase of 324% from Q1 2023.

With a product category that’s grown as rapidly as disposable vape has over the past two years, it certainly warrants consideration from brands as they consider their own portfolio expansion. While the opportunity is there, cannabis is still hyper-competitive regardless of the subcategory you target, so a data informed approach is a must for any brand looking to see success when venturing into new territory. BDSA’s suite of data tools offer the solutions to your questions when it comes to fine tuning pricing and promotions, capturing sales opportunities, deciphering consumer trends, competitive brand landscape, product assortment, and so much more.

Need more insights on what’s coming in the cannabis industry? Check out our most recent blog on what to expect for 420 this year. Interested in learning more about BDSA? Reach out here to request a demo.