It’s no surprise why Maryland is one of the most closely watched markets in 2023, as the state posted massive sales growth in July with the addition of Adult-Use market on July 1st. Here are some of the top takeaways from the first month of legal sales in the Bay State.

Maryland Medical Program Recap

Maryland first legalized limited Medical cannabis use in 2013, then went on to establish a comprehensive Medical program in 2014 with the passing of House Bill 881, which paved the way for a legal market in the state. Medical sales launched in 2017 and steadily grew, reaching their peak in 2021 at $551 MM.

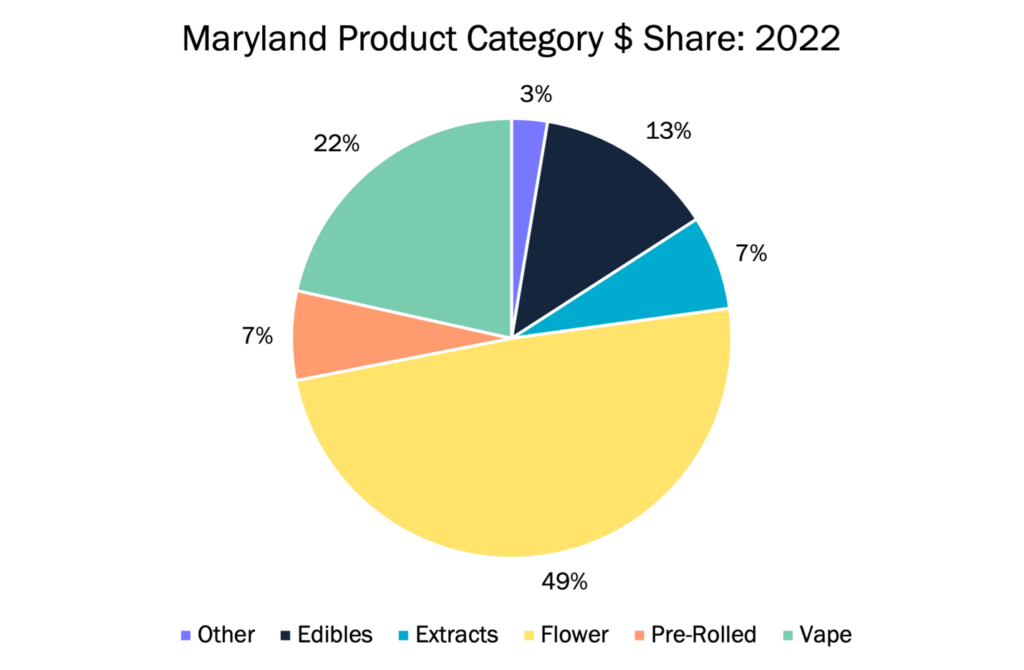

The Maryland market fell for the first time in 2022. Leveraging BDSA Retail Sales Tracking, we start to see sales declining -7% to total $511 million for the year. A deeper look at FY2022 MD Medical market sales, the flower category had the largest share of dollar sales, making up a whopping 49% of dollar sales. Vape product category trailed in at a distant second place, with 22% market share, followed by the edible category (13%) in third place.

[Source: BDSA Retail Sales Tracking; dollar sales, Maryland, 2022]

Maryland’s legal cannabis market experienced the same price compression trend as most U.S. legal cannabis markets, with equivalent average retail prices (EQ ARP) sharply dropping in Q3 2021. From then to Q4 2022 the EQ ARP fell -40% in the Maryland market, though prices stabilized in the first two quarters of 2023 from their low point in Q4 2022.

Adult-Use Legalization and Launch

Maryland legalized Adult-Use cannabis in November 2022 via the passing of Maryland Question 4. State legislators then passed a law outlining a plan to launch Adult-Use sales on July 1, 2023.

Per data from the Maryland Cannabis Administration, 94 of the 97 existing MD retailers were able to get in compliance to make Adult-Use sales by the launch of the market. Aided by this healthy retail availability, Maryland’s legal cannabis market rapidly grew its sales. As a result, total July 2023 legal sales skyrocketed to $87 MM, a +105% increase in legal sales vs. June 2023 legal Medical market only sales. Of that $87 MM, 59% was driven by Adult-Use sales (per Maryland Cannabis Administration Report). The remaining 41% ($36 MM of Medical market only sales) represented a -22% decline in Medical sales vs. June 2023.

Average retail prices saw a significant increase in July with the addition of Adult-Use sales. BDSA data show that the EQ ARP for the total Maryland market grew by 29% between June 2023 and July 2023.

Comparing the Maryland’s July 2023 product category mix in Medical vs. Adult-Use markets, flower, prerolls, vape and edibles all made up a larger share of total sales in the new Adult-Use market than in the Medical market. The biggest difference in product category market share between Adult-Use and Medical sales was seen with extracts, as Maryland currently does not allow Adult-Use consumers to purchase dabbable extracts or RSO. BDSA Retail Sales Tracking data showcases extracts were 7% of Medical channel sales in July 2023.

Expectations for the MD market…

BDSA forecasts emerging markets on the East Coast to be the biggest drivers in total U.S. cannabis sales growth out to 2027. Maryland has begun to prove itself as one of the key drivers of this trend. With a 21+ population of roughly 4.6 MM, Maryland is dwarfed by nearby states like New York, New Jersey, and Pennsylvania, but with a successful launch of Adult-Use the Bay State is already punching above its weight class and is on its way to being a cannabis powerhouse. BDSA Forecasts that Maryland will exceed a billion dollars in 2023, reaching $1.3 Billion USD by 2027.