A BDSA response to a recent MJ Brand Insights piece.

While brands producing lower-THC products for the microdose consumer have seen a surge in popularity in recent years, heavier and more frequent cannabis consumers continue to be a driving force of cannabis sales and growth. BDSA’s Consumer Insights, cannabis consumer data work, proves that the majority of cannabis consumers are in fact heavy, frequent, daily consumers.

The demographic makeup of cannabis consumers via BDSA’s ongoing Consumer Insights tracking (by state and by province) paints a much different picture than many might expect. While consumers skew younger, 40% of consumers are over the age of 40. The consumer data also disproves notions of the cannabis user being a “lazy burnout,” with +50% of consumers holding down a full-time job and +80% having at least some college education.

Should we be rethinking the derogatory connotation of the term “stoner,” considering so many cannabis consumers might technically fit that description based on frequency and amount of consumption?

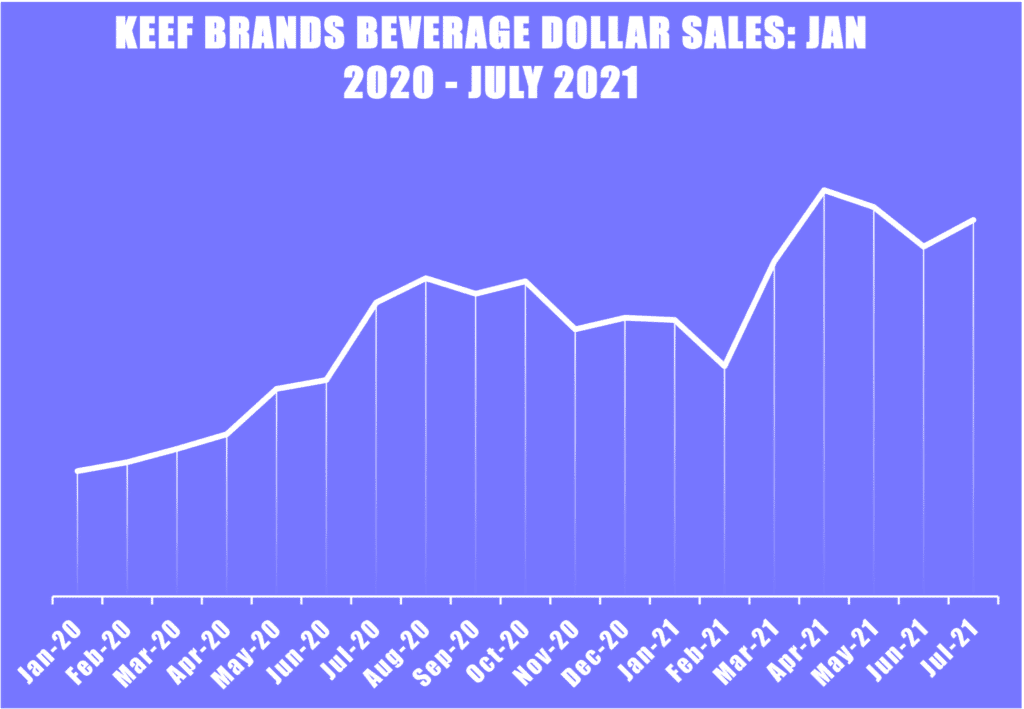

Keef Brands, the number one beverage brand by dollar sales in 2021 in BDSA tracked markets, recognizes that heavy consumers are one of the main reasons they have risen and remained at the top of the cannabis beverage space. Further, they have seen their own dollar sales in the first half of 2021 more than double those from the same period in 2020.

“A core ethos of our company is that we invite everybody to the party, from your cannabis newbie to someone who’s worked in the industry for 10+ years and has a high tolerance. This belief drives a lot of our product mix decisions, making sure we have a balanced offering for both groups.”

Travis Tharp: President and CEO, Keef Brands

While many consumers consume for medical benefits, the majority of consumers have multi-faceted consumption behaviors, consuming for both medical and social/recreational reasons. In medical markets, ~70% of consumers consume for recreational or social reasons. AND the same percentage (~70%) also claim to consume medicinally. Not surprising, the affinity towards recreational consumption is even stronger in adult-use markets, where ~75% describe their consumption as at least partly recreational versus ~60% claiming to consume for health or medical reasons.

With ~45% of adults now consuming in fully legal states (BDSA’s 1H 2021 Consumer Insights), we are not talking about infrequent, social consumption. We are talking about cannabis consumption being part of consumers’ DAILY lives. A whopping 62% of INHALABLE consumers in medical and adult-use legal states consume cannabis AT LEAST daily. Narrow down to a single mature legal state like CO, and we see ~70% of INHALABLE consumers consuming AT LEAST daily and ~40% of EDIBLE consumers consuming AT LEAST daily.

Not only are lots of consumers using cannabis daily, but consumption occurs morning, noon and night. Many cannabis consumers utilize inhalable products in the evening as they wind down from the day, but the “wake and bake” occasion STILL represents a sizable piece of the consumer base. The late evening is the most popular time to consume cannabis, with ~60% of consumers in adult-use states consuming in the evening. However, a sizable ~30% of consumers are still “wake and bakers.” AND ~30% also consume later in the morning. For many, consumption fits across day parts and need states.

Not surprisingly, the largest categories sold in dispensaries (flower and vape) are also consumed most frequently. ~60% of inhalable consumers report consuming flower at least daily, while ~50% say that they consume vapes at least daily. Going further, product categories marketed towards heavier cannabis consumers, such as infused prerolled joints, have experienced dollar growth across BDSA tracked markets. In California, infused preroll sales share of total preroll sales rose from 24% in January 2020 to 45% in June 2021.

Cannabis Consumer Data from BDSA suggest that the “stoners” among us are not just a sizable segment of the consumer base, but they have also played a crucial role in driving the growth of legal cannabis markets.

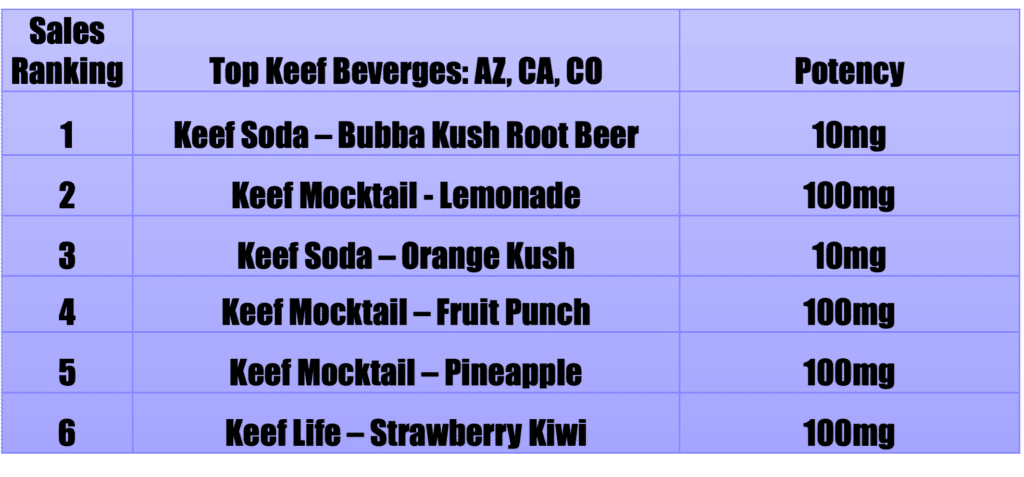

A segment of the cannabis consumers are drawn towards low-potency products, but high-potency products have been a mainstay in the industry and continue to drive sales. When looking at edible preferences, BDSA data show that cannabis consumers vary greatly in what their preferred THC dosage is. 17% of consumers in fully legal adult-use states prefer a lower dose of 2.5-5m mg THC at a time, STILL a similar percent (16%) prefer a dose of greater than 200 mg. YES, 200 mg. With 4 of their top 6 skus being 100mg products, it is clear that the Keef Brands team gets it.

“Heavier consumers have been instrumental to our success as a brand. We owe them so much for helping us get off the ground and allowing us to grow into the all inclusive brand that we are today. These medical patients or ‘cannaseurs’ have always been the backbone of the industry, and will continue to be pivotal in its advancement.”

Kim Stolz: Marketing Manager, Keef Brands