In an industry as dynamic and rapidly growing as cannabis, its crucially important to understand the unique challenges of the cannabis markets you operate in as you set and refine your pricing strategy. With mature markets like California still struggling from two years of price compression, and emerging markets like New York struggling to compete on price with the illicit market, pricing presents a particularly difficult challenge to cannabis brands looking to boost revenue and gain market share.

Regardless of which cannabis market you’re in, one approach that can be used to boost your brand’s performance at retail to evaluate price tier dynamics. In this blog, we will show how evaluating price tiers can help you identify winning segments in your market, and price with confidence to make sure that you’re maximizing revenue for your brand.

What exactly are price tiers?

Price tiers are defined as segments within a specific retail price percentile range. This concept of price tiers is dynamic and can be viewed as widely as total market, or as specifically as an identified pack size for a single subcategory.

• Value:

Items in the bottom 25th percentile for price.

• Mid-Tier:

Prices between the 25th and 75th percentiles.

• Premium:

Items priced above the 75th percentile.

Identifying Price Segments Primed with Opportunity

1. Identify products with higher representation in total sales (dollars) than the number of products in that tier

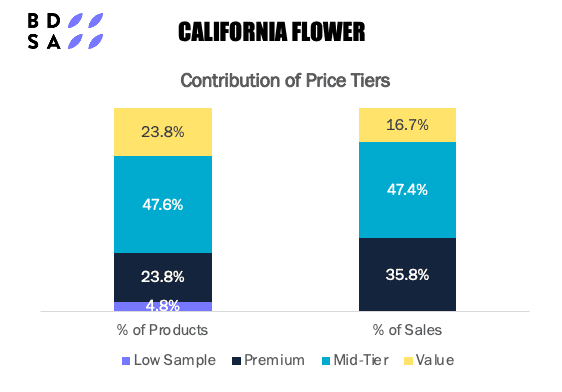

Even just a snapshot of this pricing performance metric can be useful when approaching a new market or optimizing an existing brands performance. Looking at flower category sales from Q1 2024, we see that premium flower products in California are punching way above their weight, making up a hefty 36% share of sales, even though premium level flower only represented 24% of products in the market. Data like these make it clear that there is sizable opportunity for premiumization in the California flower market.

2. Identify price levels driving the most growth

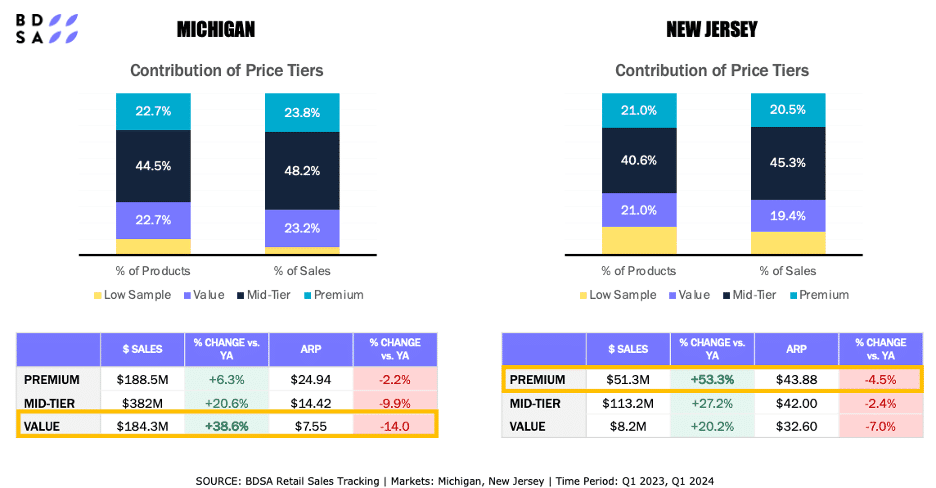

A single snapshot of pricing performance can be a useful level set on where there is opportunity and demand, but the largest tier also generally means the most competitive environment. Another important layer is what price tier is driving the most growth in the market and category. We can look at an example of how important it is to evaluate tiers market-by-market with Michigan and New Jersey. When comparing price dynamics of these two states in Q1 2024, we see that while both states have strong premium and value segments, mid-tier products are driving most of the sales volume. Both states seeing mid-tier products make up a larger share of dollar sales than their percentage of total products on the market, but the price segment driving the most growth is different in the emerging New Jersey market than in the mature Michigan market.

When we look at the price tier driving the most growth in the Michigan market, where we already expect to see lower average retail prices due to its maturity, value products drove the largest amount of growth between Q1 2023 and Q1 2024. Looking at that growth figure, it is apparent that brands looking to maximize a growth can do so by strategically targeting the value price segment.

Pricing data from New Jersey presents a different story, with premium products driving the largest year-over-year percent change in sales. For a brand looking to launch New Jersey, this shows that premiumization presents a potential advantage across the board in the emerging New Jersey market.

3. Evaluate the competitive set

In addition to size and growth of a tier, it’s critical to evaluate what brands and products fall into each tier within your market and category. Products and brands that are priced within your tier will be compared with your own brand and products, so you want to make sure you take care in not elevating a product that can’t compete on the value proposition or devaluing a product with premium attributes. Considering this perspective will help you to evaluate your own product portfolio against the competitive landscape and whether your existing products should be priced higher or lower to fit into another tier. The other consideration is whether you don’t have a product in your portfolio that fits well within a tier that is primed for opportunity, and in that case it may be worth considering whether you want to launch a product line tailor made for that price tier and competitive set.

Whether you are a new brand looking to enter a market, or an established brand aiming to enhance sales performance, using price tiers to build a targeted pricing strategy can significantly boost your revenue and market share. At BDSA, we offer actionable pricing tools such as price tiers, to support your pricing and innovation strategies. For a deeper analysis, BDSA offers custom analytical solutions, including as Price Elasticity projects, to give your team precise insights on price adjustments and the resulting revenue opportunities

Looking for more insights on how to approach cannabis pricing? Check out our recent webinar on Data-Driven Pricing. Request a demo to learn more about BDSA products and services.