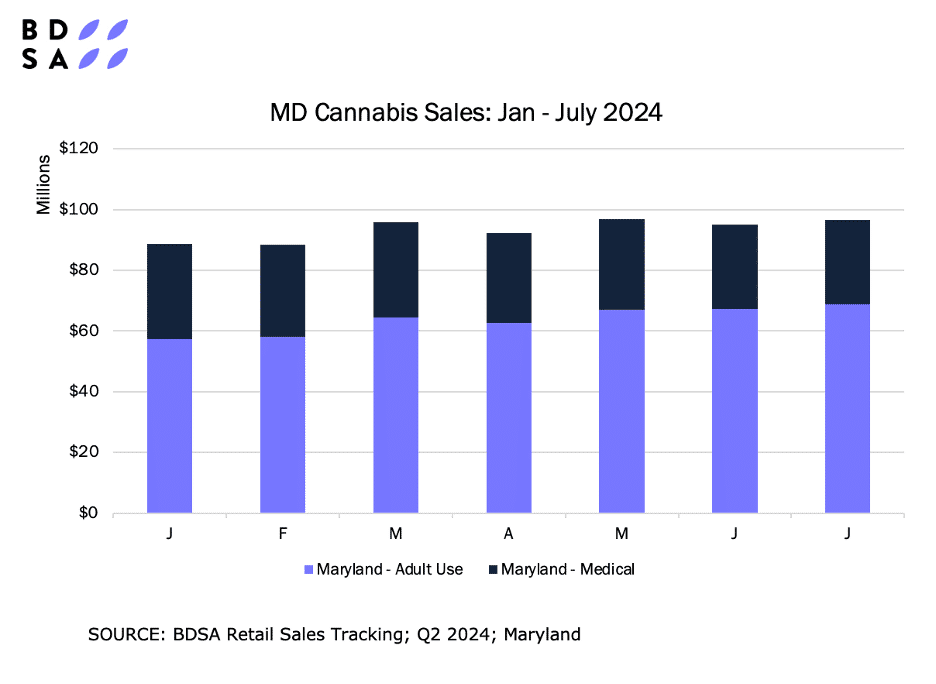

Since the launch of adult-use sales in July 2023, Maryland has been driving the Northeast to be one of the strongest regional cannabis markets in the country. The adult-use channel brought in a total of $330MM in 2023, pushing total annual sales to $783MM. As the Maryland adult-use market continues to gain steam, both local brands and multi-state giants stand to significantly increase their sales. BDSA Retail Sales Tracking spotlights that this is already occurring amongst the top five best-selling brands:

Maryland’s Top Five Best-Selling Brands in Q2 2024

SunMed Growers

Based in Warwick – SunMed Growers has been a fixture of the Maryland cannabis market. It was one of the original 15 cultivators licensed in the state. Since their founding in 2015, SunMed Growers has steadily expanded their footprint in the Bay State. As a result, it was primed to deliver on the large adult-use market demand, and has continued to hold a dominant position in the market since. In Q2 2024, the brand brought in $15.6MM in sales through the adult-use channel. 61% of that total came from flower sales, while 18% and 16% stemmed from pre-rolled and vape category respectively.

Curio Wellness

Founded in 2015 in Baltimore – Curio Wellness is another homegrown mainstay of the Maryland cannabis scene. Along with their own brand, Curio Wellness is well known for their exclusive partnership with a host of other well-known brands; such as Dixie, Fuzed, Mary’s Medicinals, and Smokiez Edibles. Curio was the number two best-selling brand in Maryland’s adult-use channel in Q2 2024. It delivered $14.2MM in adult-use sales that quarter. Of that total, 60% came from flower sales, while 13% stemmed from edible sales, 15% from pre-roll, and 12% from vape.

Rythm

Rythm

A brand owned by the multistate giant Green Thumb Industries, Rythm has had a substantial presence in the Maryland market for years. In Q2 2024, the brand became the third best-selling brand in the Maryland adult-use market. It delivered $10.6MM in adult-use sales; 68% of which came from flower sales, while 30% and 2% came from vape and extracts sales.

Fade Company

A newer entry to the Maryland adult-use market, Fade Company has seen a rapid sales growth so far in 2024. With sales in Maryland, Arizona, and California, Fade Company claimed the number four spot on our best-selling brands list for Q2 2024. In Q2 2024, Fade Company’s Maryland adult-use sales brought in $9.2MM; 87% of which was driven by flower sales, and 13% of which came from pre-rolls.

District Cannabis

Emerging from the dynamic Washington D.C. cannabis scene – In 2019 District Cannabis entered the Maryland market. District Cannabis became the fifth best-selling brand in the Maryland adult-use market. In Q2 2024, it brought in $8.3MM in adult-use sales. 72% of that came from flower sales, while pre-roll sales delivered 20% and vapes provided 7% of total adult-use sales.

Maryland adult-use is still growing after its strong launch. BDSA projects Maryland adult-use sales to reach $795MM in 2024, pushing total sales to $1.07B. The state is projected to become a billion-dollar cannabis market next year! The market is anticipated to grow total sales to $1.5B by 2028.

Check out our latest blog on Top Beverage Trends to get more insights on the future of the legal cannabis industry. Request a demo to learn more about BDSA products & services.