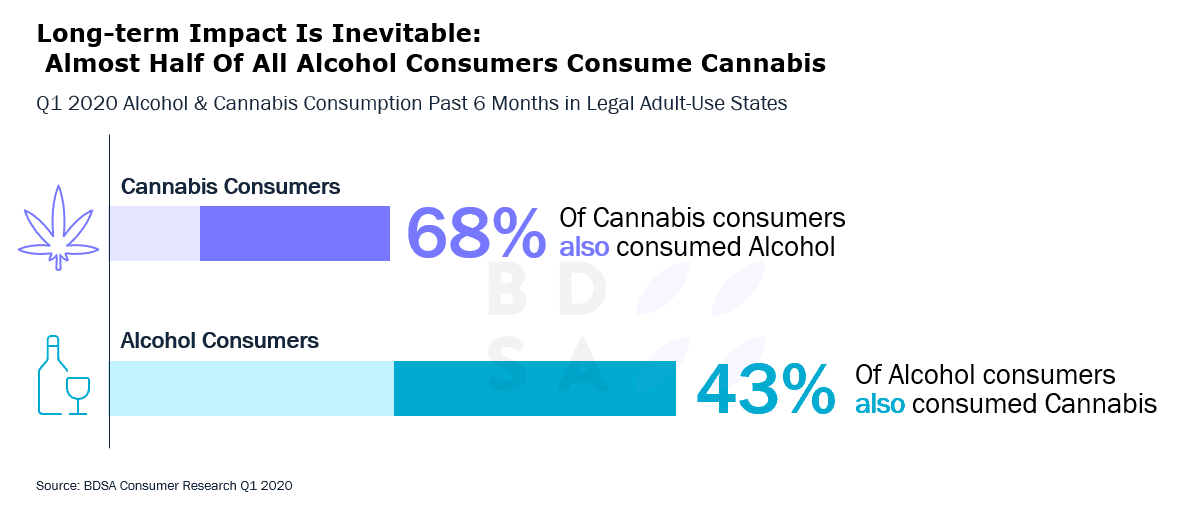

43% of alcohol consumers also consume cannabis

An interesting interaction is evolving between beverage alcohol and cannabinoid products that is becoming an increasingly important issue for both alcohol and cannabis brands and retailers to watch as worldwide cannabis consumption grows. Growing acceptance and consumption of cannabis, consumption of both alcohol and cannabis and cannabis product innovation are three factors influencing beverage alcohol consumption.

State of the Cannabis Industry

BDSA anticipates the worldwide cannabis market will grow from $19.7 billion in sales this year to $47.2 billion by 2025. In states where cannabis is legal today, 36% of consumers currently consume one or more forms of cannabis, and another 33% are open to consuming cannabis in the future. Digging a little deeper, the stereotype of the cannabis consumer as a twenty-something stoner is completely archaic. Today’s consumers reflect a cross-section of U.S. society in terms of age, race, gender, socio-economic background, motivations, need states, income, geography and other demographics. Reasons for usage are equally multi-purpose and multi-faceted; e.g., recent BDSA research reveals 72% consume for recreational reasons, 59% for health or medical reasons and 37% consume for both.

When thinking about the relationship between beverage alcohol and cannabis, it’s important to remember it’s not a 1 for 1 situation; there are many cannabis need states, use cases and functional benefits where beverage alcohol does not fit as a viable replacement.

Cannabis beverages sold through the dispensary channel are rapidly evolving but are still only about 5% of the edible category. The big growth drivers in this category are high-CBD beverages and lower-dose THC beverages. These produce a faster onset and faster offset reaction, creating an experience more familiar to the experience of consuming alcohol. There is much focus on improving the experience these products create and making them feel more familiar to the experience with alcohol. Among the new products are beverages with THC dosages where consumers can drink a whole can at one time. Previous cannabinoid beverages might include as much as 100mg of THC, which most people cannot tolerate at one time. With these improvements, consumers are starting to see these cannabinoid beverages in more general retail, in places like Sprout’s, Whole Foods, convenience and grocery stores.

Cannabis – Beverage Alcohol Relationship: It’s Complicated

Looking more closely at consumer behavior today; 68% of cannabis consumers also consume alcohol, while 43% of alcohol drinkers also consume cannabis. This dual usage is largely driven by the fact that many reasons people consume cannabis are mutually exclusive from reasons they drink alcohol. People might consume cannabis to deal with an injury, a situation where they’d likely never turn to alcohol. On the other hand, there are times cannabis is a substitute for alcohol; on a Friday night hanging out with a couple of friends, consumers might choose an edible over a beer.

When looking at when people consume, half of consumers state they drink alcohol and consume cannabis at different times of day or days of the week, i.e., they consume alcohol and cannabis at different times. The other half are made up consumers who report that alcohol and cannabis are good for consuming at the same time of day or day of the week, and consumers who state that alcohol and cannabis consumption are good for both same and different times of day and day of week.

These latter groups create risks for the beverage alcohol industry. One risk is pairing; of those who consume both, some consumers frequently pair the two, meaning in the same setting they are consuming cannabis and drinking alcohol. In those situations, people tend to drink less, so this is not a lost occasion for alcohol, but a lost unit of consumption.

On the other hand, substitution is the situation where people choose cannabis over alcohol. Occasions for beverage alcohol that tend to be “safe” from the impact of cannabis are often high energy situations, such as going out or celebrating, events that typically involve multiple people. There is more risk for alcohol when consumers seek to relax and unwind, perhaps after work or on the weekend. These tend to be either solo or small group occasions.

However, most “dualists” who consume both have not changed their alcohol consumption because of their marijuana consumption, with those who have kept their alcohol consumption the same in the mid-60% range. Craft beer appears to be most insulated, with 69% of people stating they have not cut back on craft beer consumption due to cannabis, which is not surprising given the profiles of craft beer and cannabis consumers.

In closing, we offer five takeaways for beverage alcohol companies for continued success:

- Motivations for consumption of cannabis are multi-faceted and complex, and many times distinct from motivations for consumption of alcohol,

- Growth of cannabis consumption is affecting every consumer industry, not just beverage alcohol,

- Cannabis represents a long-term risk to alcohol sales that producers and retailers must address effectively and aggressively,

- It also presents opportunities for craft beer producers to gain greater share of the consumer if they innovate and plan well,

- Today’s cannabis market is confusing and rapidly changing, it’s important for beverage alcohol manufacturers to keep up to take advantage of opportunities and thwart risks.