BDSA has expanded its coverage of legal cannabis markets to include Missouri, making that the 12th state covered by our Retail Sales Tracking service (MO joins AZ, CA, CO, FL, IL MA, MD, MI, NV, OR, PA). The third Midwestern market added to BDSA’s market tracking (joining IL and MI), Missouri’s cannabis industry has seen rapid growth since the launch of medical sales in late 2020.

COMPARABLE MARKET ASSESSMENT: MISSOURI vs. MARYLAND

BDSA analysts have decided that the Maryland cannabis market offers a good point of comparison to show the relative strength of the Missouri medical cannabis market. Maryland has already grown to become one of the stronger medical-only cannabis markets in the country, and factors in play in Missouri lead BDSA analysts to expect even faster growth in Missouri’s young cannabis market, setting the stage for a strong adult-use entrance.

Missouri’s cannabis market brought in just shy of $23 million in sales in September 2021 according to BDSA’s Missouri Retail Legal Cannabis Sales Tracking. This is an impressive figure for a medical market that launched legal sales less than a year prior. In comparison, the Maryland medical cannabis market, which launched sales in December 2017, took almost two years to surpass this monthly threshold.

While there is no perfect proxy market to compare the Missouri cannabis market to, BDSA analysts have identified several similarities between the medical cannabis market in Maryland to that of Missouri. These two states have:

- Similar demographics and consumption patterns,

- Tightly regulated medical markets,

- Are on the verge of legalizing adult-use sales.

Missouri legalized medical cannabis in 2018 by ballot proposal and saw sales begin in October 2020. While the cannabis program institutes strict license caps, it also has an expansive list of qualifying conditions, few product restrictions, and allows home grow for patients who apply for a separate medical cannabis cultivation card.

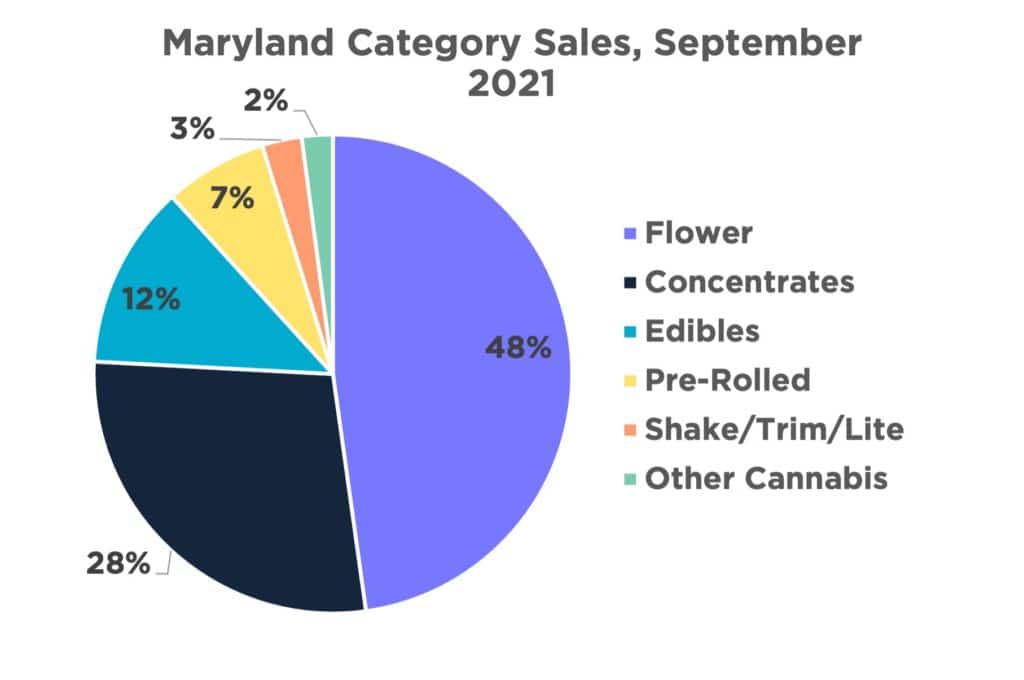

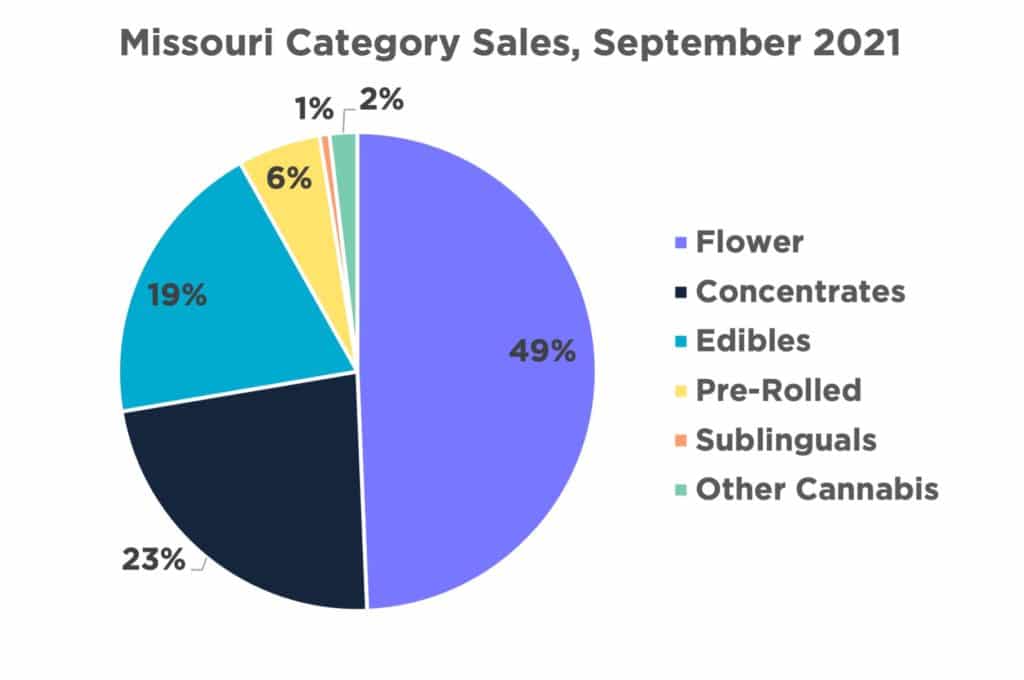

When assessing dollar share by category in Missouri, BDSA’s Retail Legal Cannabis Sales Tracking shows similar category share to Maryland, despite having very different regulatory schemes. As in most cannabis markets (adult-use and medical-only), Flower holds a dominant share of the Missouri and Maryland markets, making up ~50% of dollar sales.

Behind Flower is another Inhalable sub-category with Concentrates claiming ~30% of dollar sales in both Maryland and Missouri per BDSA’s Retail Sales Tracking. While both states limited access to cannabis Edibles in the early months of medical sales, both have developed robust medical markets, with Missouri seeing Edibles take up a significantly larger share of category sales at roughly 19% of dollar sales in September 2021. Currently the Edible market in Missouri is bringing in a larger share of sales than even the most mature medical markets. A quick look at BDSA’s tracking of the Colorado medical cannabis market exposes Edibles bringing in 17% share of dollar sales in September 2021.

BDSA is tracking average retail prices in the Missouri cannabis market to be higher compared to other tracked legal cannabis markets, but the prices seen in MO are not unprecedented when compared to other Emerging Markets. In September 2021, the average retail price (ARP) for flower in MO came in at ~$14/gram, significantly higher than the $11/gram seen in Maryland. However, this price point is still on par with the ARP in Illinois during this same time period.

The average prices of concentrate products show a similar trajectory, with concentrates in the Missouri cannabis market coming in at an ARP of $58 per unit, slightly higher than prices in the much more developed Illinois cannabis market, where concentrates sit at an ARP of $50 per unit.

Average Retail Prices, September 2021

| Category | Missouri | Maryland | Illinois |

|---|---|---|---|

| Flower | $14/gram | $11/gram | $14/gram |

| Concentrate | $58/unit | $44/unit | $50/unit |

Activists in both Maryland and Missouri have been pushing for adult-use legalization for the past few years. While efforts have fallen short to this point, legalization still has strong support (~60%) in both states. BDSA predicts Missouri to legalize in 2022, with adult-use sales forecast to begin in 2024. BDSA also anticipates Maryland to launch adult-use sales in 2024. While sales are expected to be higher in Maryland as their adult-use markets emerge, the state’s medical market has had a head start of 3 years.

So far BDSA has seen faster growth in the Missouri market than in the similarly populated state of Maryland, and we expect this trend to continue. With BDSA’s MO Retail Legal Cannabis Sales Tracking now live, the team at BDSA is excited to have a front seat in watching both Missouri’s and Maryland’s groundbreaking legal medical cannabis markets grow, develop, and mature.