As cannabis legalization continues to progress across the country, many are looking to emerging markets, particularly on the East Coast, as the biggest opportunities for growth in the legal cannabis industry. Maryland is set to begin legal adult-use sales on July 1, 2023. To some this has been a long wait, with the approval of Maryland Question 4 in November 2022, though compared to other states it may be considered a quick roll-out.

The East Coast has been the home to some recent adult-use states that have very high expectations for sales over the coming years, such as New York and New Jersey. Maryland may present a smaller opportunity compared to those heavy-hitters, but don’t be fooled, the state has built up a robust medical market infrastructure in the years leading up to adult-use. This has helped Maryland set the stage for considerable growth with the expansion into adult-use sales.

Maryland Medical Cannabis Market Recap

Maryland first legalized medical cannabis in 2013, with a limited bill that allowed medical cannabis to be distributed through academic medical centers. However, it wasn’t until 2014 when the state passed a comprehensive medical cannabis bill which allowed broader access through dispensaries. In 2017, the Maryland medical cannabis program kicked off with nine dispensaries licensed to sell cannabis across the state.

The medical program in Maryland steadily grew from there, with annual legal sales peaking in 2021 at $546 million. Despite growing total patients +10%, the market declined for the first time in 2022 to $491 million (-10% vs PY). BDSA Retail Sales Tracking data shows that much of that market decline is due to price compression: the equivalent average retail price for Maryland cannabis fell -42% between Q1 2021 and Q4 2022.

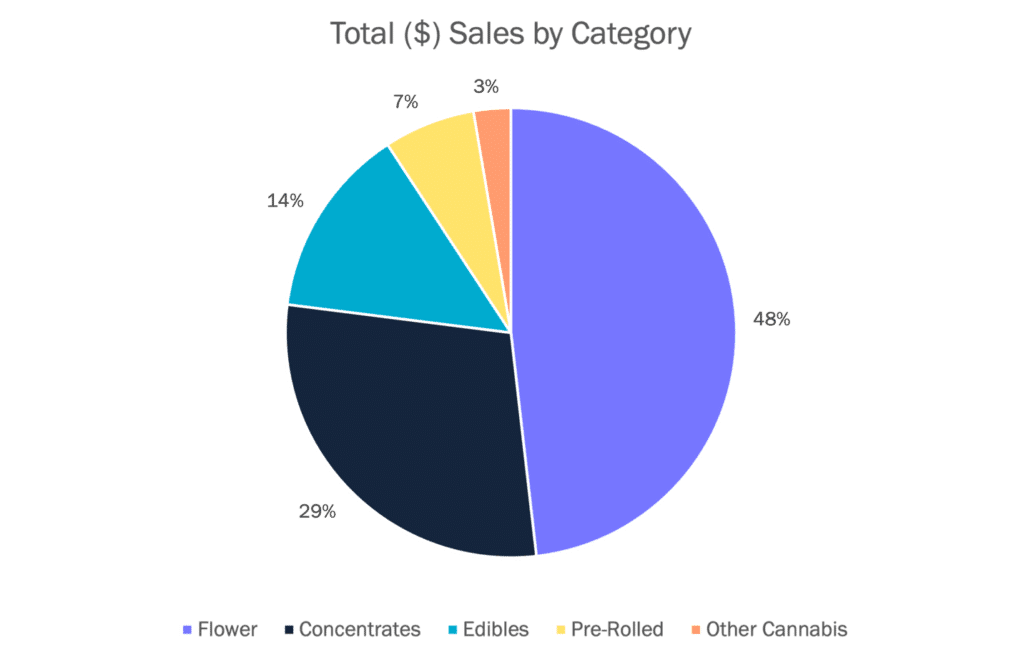

The Maryland product category mix is more dominated by flower than the average cannabis market, which is typical for most medical markets. BDSA data shows that flower made up 48% of dollar sales in Q1 2023, with concentrates making up 29% of dollar sales.

[Source: BDSA Retail Sales Tracking; Maryland; Q1 2023]

What to Expect from Adult-Use Cannabis in Maryland

The Bay State may have taken longer to get adult-use sales off the ground than recently adult-use legalized Missouri, but the state is primed for strong growth. Maryland regulators opted to allow adult-use sales through existing medical retailers. With 102 licensed dispensaries as of June 2023, Maryland has built a strong retail landscape leading up to the start of adult-use.

This existing infrastructure from the medical program is important for the early years of adult-use in Maryland, as the state will be able to avoid the growing pains from limited retail access that markets like New York have experienced. Maryland regulators will also be awarding additional licenses beginning in January 2024.

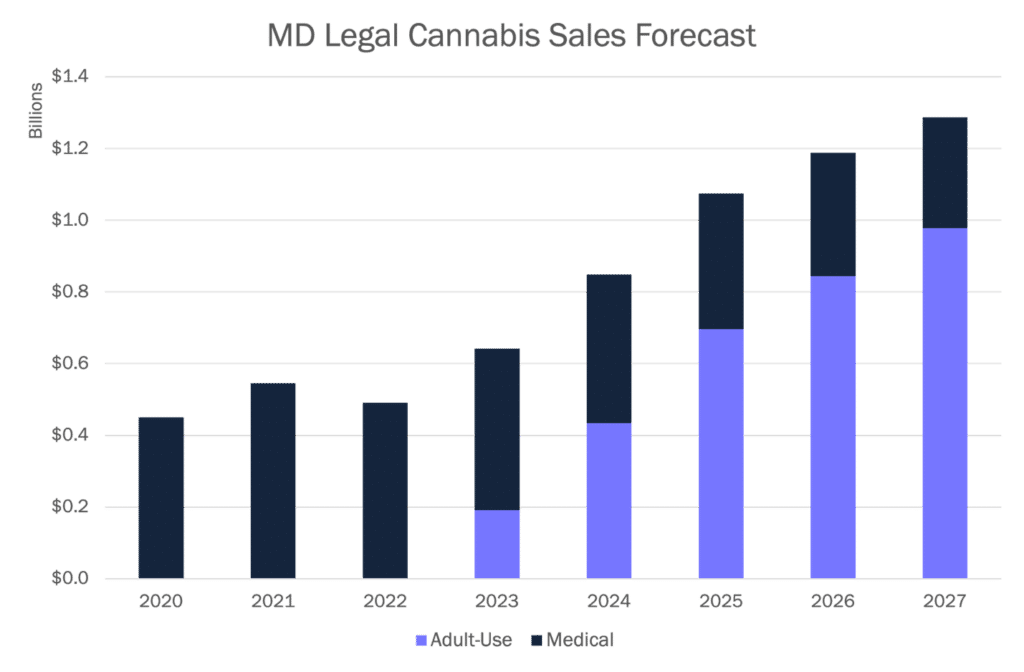

[Source: BDSA Q2 2023 Market Forecast; Maryland]

Despite declines in the medical channel, adult-use is expected to help the Maryland market return to growth for years to come. BDSA forecasts that legal sales in Maryland will total $642 million in 2023; nearly a third from adult-use. Maryland is set to become a billion-dollar market in 2025 — with total sales forecast to reach $1.1 billion that year and continue to grow to $1.3 billion by 2027.