By Rob Hill | January 9, 2017 | MG Retailer

The people, the products, the progress and the trends that keep the vape business burning!

Greg Shoenfeld – BDS Analytics’ Director of Operations

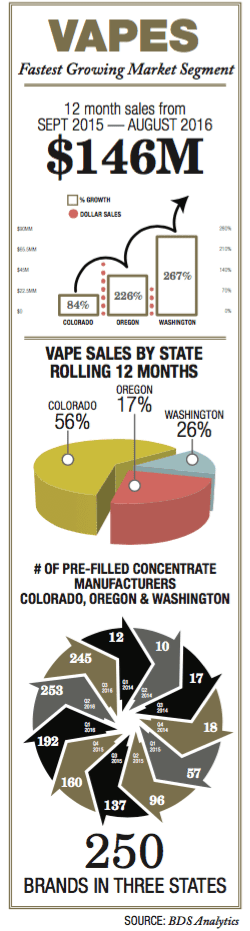

Greg Shoenfeld – BDS Analytics’ Director of OperationsAccording to BDS Analytics, 2016 was a year of solid growth for the overall vape sector. In fact, judging by the company’s data for more than 600 dispensaries and more than 50 million transactions, Director of Operations Greg Shoenfeld said some vape sub-categories are exploding. For example, sales of vape cartridges in Colorado, Oregon, and Washington alone reached $146 million, a whopping 132-percent increase year-over-year.

“The rapid growth within the category has led to the proliferation of brands and products,” said Shoenfeld. “In 2016, BDS dispensary partners have sold vape products from over 200 brands.”

And that’s just the tip of the iceberg. With multiple recreational and medicinal initiatives approved by voters in November, dispensary owners are scrambling to acquire more square footage and/or expand to additional locations in order to keep up with all the new products looking for homes on their shelves. Pep “Blackbeard” Tintari, who founded the Greenlight Discount Pharmacy in Sylmar, California, just bought the retail store next door because “the competition is only going to get fiercer,” while Studio City’s popular Buds and Roses dispensary is looking to carve out the proper retail space to maximize efficiency in all departments in order to keep a steady customer flow. This is potentially good news for vape companies.

Where the sales are

Currently, Washington dispensaries sell the most vapes. According to BDS, the state’s cannabis retailers enjoyed a 267-percent increase in sales from August 2015 to August 2016, while Colorado saw an 84-percent increase. Oregon, once a hot vape market, did not grow as much due to changes in testing requirements for concentrated oils.

“In 2017, we expect to see vape sales in Colorado, Oregon, and Washington exceed a billion dollars,” noted Shoenfeld. This sentiment is driven largely by an explosion in the pre-filled cartridge segment. Almost 250 brands operate in the three states today, compared to just 160 in 2015. Expect that number to grow in 2017.

The power of the pen: affordable and interchangeable

Although vapers compose a large segment of dispensary customers, selling the devices in dispensaries has remained elusive. Currently, vape hard goods represent only a small percent of overall sales. Most vapers still buy their hardware from head shops, online, or direct from the manufacturer. “In the last twelve months, vaporizer devices accounted for $14.5 million in sales—or just 10 percent of total vape sales,” Shoenfeld said. Of those sales, most were pen devices that are more affordable and, of course, interchangeable, he noted.

“Pen-style vaporizers have allowed an abundance of competitors to emerge that supply both the battery/device as well as the concentrates sides of the equation,” said Shoenfeld. “In the future, expect to see more proprietary delivery devices that will command higher price points and will keep consumers locked into their proprietary formats.”

…