Most cannabis businesses today understand that consumers are increasingly turning to cannabis for a diverse set of need states. Minor cannabis like CBD, CBN, and CBG can be utilized to better position a brand’s products as a support for needs like sleep and pain relief, and further differentiate a brand’s products from competitor’s product offerings, especially those of brands that have not caught on to the benefits of utilizing minor cannabis in product formulations and consumer-facing information.

BDSA Consumer data show that cannabis consumers have become more knowledgeable about minor cannabis in cannabis products and their potential benefits – in the Fall of 2019 only 11% were familiar with CBN and only 8% were familiar with CBG, however by Fall 2021 familiarity of CBN increased to 14% and familiarity of CBG increased to 13%. And consumers’ increased familiarity with minor cannabis is translating to manufacturer interest which in turn is increasingly being converted to sales of CBN and CBG-containing products.

In Q1 2022 there were ~70% more products containing CBN than there were in Q1 2021 across CA, CO, IL, MA, MI, NV, and OR, and in Q1 2022 there were more than twice as many products containing CBG than there were in Q1 2021 in those markets.

In more “mature” markets like CA, CO, OR, and NV, Q1 2022 sales of products containing CBN are up double, and triple digits compared to Q1 2021. In these same markets, sales of CBG-containing products are up triple and quadruple digits in Q1 2022 vs. Q1 2021.

SALES $ CHANGE FOR PRODUCTS CONTAINING MINOR CANNABIS, Q1 2022 VS. Q1 2021

| CBN | CBG | CBD | |

| California | 29% | 655% | -24% |

| Colorado | 145% | 1251% | -19% |

| Nevada | 30% | 1105% | -29% |

| Oregon | 22% | 1185% | -17% |

While total sales of products containing CBD in these markets in Q1 2022 are still on average three times that of CBN containing products and more than nine times that of CBG containing products on average, sales of CBD-containing products have softened significantly by double digits in Q1 2022 vs. Q1 2021.

In less mature adult use cannabis markets like AZ, IL, MI and MA, sales of CBN-containing products posted even steeper growth than the more mature cannabis markets, albeit from a smaller base. And in AZ and MI, sales of CBG-containing products in Q1 2022 vs. Q1 2021 posted quadruple and triple digit growth, respectively. Unlike more mature adult-use markets, sales of CBD-containing products increased in Q1 2022 vs. Q1 2021 in three of the four newer adult use markets; MI was the exception with CBD-containing product sales down ~5%.

Given that sales of products containing CBD are declining in more mature markets and shares of CBN and CBG are rapidly increasing across all markets, brands who invested heavily in CBD-containing product lines in newer markets like AZ, IL, and MA will want to take note of the shifts in growth for CBD in the more mature markets. As these newer markets become more mature consumers may start gravitating away from purchasing CBD in the dispensary channel, and more novel CBN and CBG-containing formulations may provide more ample opportunity in the future.

Although CBN and CBG are found across product categories, the majority of Q1 2022 sales dollars for products containing CBN or CBG come from Gummies (~75% and ~70%, respectively). Aside from gummies, chocolate and tinctures make up the next largest categories in terms of sales of CBN-containing products (~5% each), while tinctures and taffy rank second and third in terms of sales of CBG-containing products (~10% and ~5%, respectively).

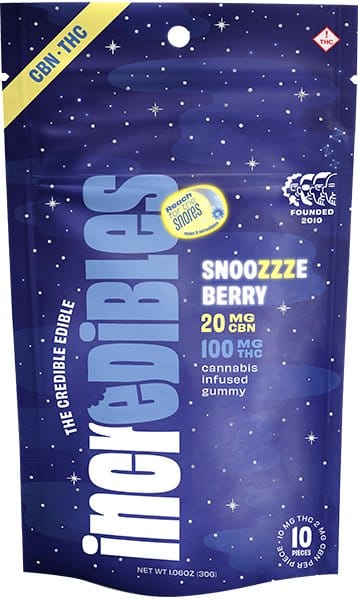

Within CA, CO, and IL, the top selling CBN products are positioned around sleep, with Wyld’s 2:1 Indica Elderberry gummies taking the top position in both CA and CO, and Incredibles’ 5:1 Snoozzzeberry ranking #1 in sales in IL. In both CA and IL, Kiva’s Midnight Blueberry Camino gummy ranks 2nd in terms of sales. Wyld’s 1:1 CBG Pear Hybrid gummy is the top selling CBG containing product in both CA and CO and Wonder Wellness’ (Cresco) 1:1 CBG Focus gummies rank #1 in IL.

It’s clear that minor cannabis have huge potential to generate sales growth, especially as consumer knowledge continues to expand and the number of products containing CBN and CBG grows. In time, BDSA predicts that the desire for consistent, repeatable cannabis experiences among consumers will drive cannabis shoppers to search for items based on minor cannabis content, rather than older consumer-facing information such as Indica/Sativa/Hybrid classification.