The Battle of Data Versus the Story You Want to Tell: Framing Up Cannabis Industry Insights

Exploring the tension between consumer data and brand narratives in cannabis marketing.

BDSA Cannabis Insights: The Rise of Intoxicating Hemp Products and Their Impact on the Cannabis Market

With the legalization of low-THC hemp, a new wave of intoxicating hemp-derived products hit the market, disrupting the status quo and carving out a lucrative niche that sidesteps many of the challenges faced by the regulated cannabis industry.

Maximizing Cannabis Brand Revenue through Product Mix Optimization and SKU Rationalization

As competition intensifies, strategic pricing is essential for cannabis brands to maintain profitability and margins, capture market share, and drive sustainable growth.

Pricing Optimization Tactics in Competitive Cannabis Markets

As competition intensifies, strategic pricing is essential for cannabis brands to maintain profitability and margins, capture market share, and drive sustainable growth.

BDSA Product Enhancements Offer Faster and More Accurate Data

In an industry more competitive than even, cannabis brands need to be able to stay nimble by implementing solutions to take advantage of the most accurate actionable data available. BDSA has been working hard to provide these data solutions that you need to stay on top of your cannabis market, and on July 2nd, BDSA will be rolling out the next evolution of our Retail Sales Tracking data solution, making it faster and more accurate.

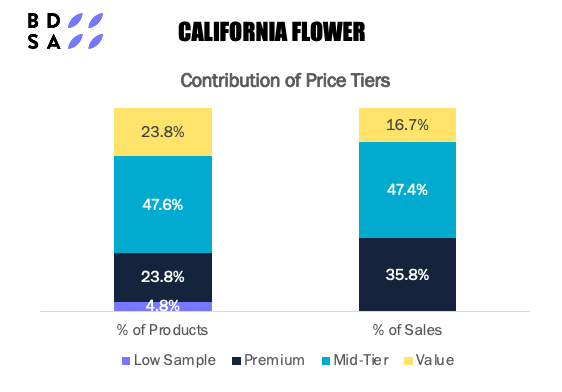

Using Price Tiers to Price Right in your Cannabis Market

With mature markets like California still struggling from two years of price compression, and emerging markets like New York struggling to compete on price with the illicit market, pricing presents a particularly difficult challenge to cannabis brands looking to boost revenue and gain market share.

From Hazy to Clear: Incorporating Data in your Cannabis Business

In today’s hyper-competitive cannabis landscape, a data-driven culture can make all the difference. Those who leverage data can confidently estimate the total addressable market, evaluate risk and opportunity, track performance, and execute against opportunities.

Fastest Growing Disposable Vape Brands

Between Q1 2022 and Q1 2024, disposable products grew their share of vape dollar sales by +92%, and the disposable category now makes up a 25% market share of vape sales across BDSA-tracked markets. With 56% of vape consumers citing ease of use and 44% citing convenience as their reasons for choosing vapes, disposable vapes are well positioned to meet vape consumers need states and are expected to see strong growth for years to come.

Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market

Enduring the trials of price compression means embracing resilience, innovating strategically, and uncovering growth paths previously unseen. With a keen understanding of emerging trends, BDSA provides the guidance brands need to navigate these turbulent waters and emerge stronger, poised for a promising future.

How to Maximize Cannabis Sales Leading up to Christmas

Despite a -20% decrease in total available shopping hours, the week leading up to Christmas day has shown incremental daily cannabis sales growth versus non-holidays weeks across all BDSA-Tracked markets for the last two years.