Green Wednesday: What Retailers & Brands Need to Know Heading Into Thanksgiving Week

As the cannabis industry heads into one of its most important sales weeks of the year, BDSA’s 2024 Green Wednesday insights offer a clear signal: consumers are showing up early, buying bigger, and responding strongly to promo-driven value. With holiday competition heating up and budgets tightening nationwide, Green Wednesday has cemented itself as the #2 […]

BDSA Cannabis Insights: 2025 Beverage Category Trends

BDSA reports that cannabis beverages, though comprising just about 1% of total cannabis sales, achieved $54.6 million in Q1 2025—a 15% YoY increase. Drinks dominate the category, with emerging markets like Michigan and Ohio driving growth, while mature markets such as Arizona and Colorado see declines. Top brands are consolidating market share.

The Battle of Data Versus the Story You Want to Tell: Framing Up Cannabis Industry Insights

Exploring the tension between consumer data and brand narratives in cannabis marketing.

From Hazy to Clear: Incorporating Data in your Cannabis Business

In today’s hyper-competitive cannabis landscape, a data-driven culture can make all the difference. Those who leverage data can confidently estimate the total addressable market, evaluate risk and opportunity, track performance, and execute against opportunities.

Maximizing 4/20 Success: Insights and Strategies for Cannabis Retailers and Brands

The essence of a winning 4/20 approach lies in the careful calibration of attractive discounts with genuine value, while not cutting deeply into costs. This can be achieved through strategic promotions for the potent, high-quality products this holiday shopper seeks. Reel in the shopper’s wandering eye with an attractive sale that doesn’t break the bank on margin.

Targeting Medical Consumers to Make the Most of the Extract Market

Extracts may not be driving the bulk of cannabis sales, but BDSA Consumer Insights still show that a sizable segment of consumers report consuming extracts, and brands can still drive market share with a careful approach to the extract market. BDSA Retail Sales Tracking shows that extracts have held a significantly higher market share in medical channels, and medical consumers across adult-use and medical markets report consuming extracts at a higher rate.

Adult-Use Brings Rapid Growth to Maryland Legal Cannabis Market

It’s no surprise why Maryland is one of the most closely watched markets in 2023, as the state posted massive sales growth in July with the addition of Adult-Use market on July 1st. Here are some of the top takeaways from the first month of legal sales in the Bay State.

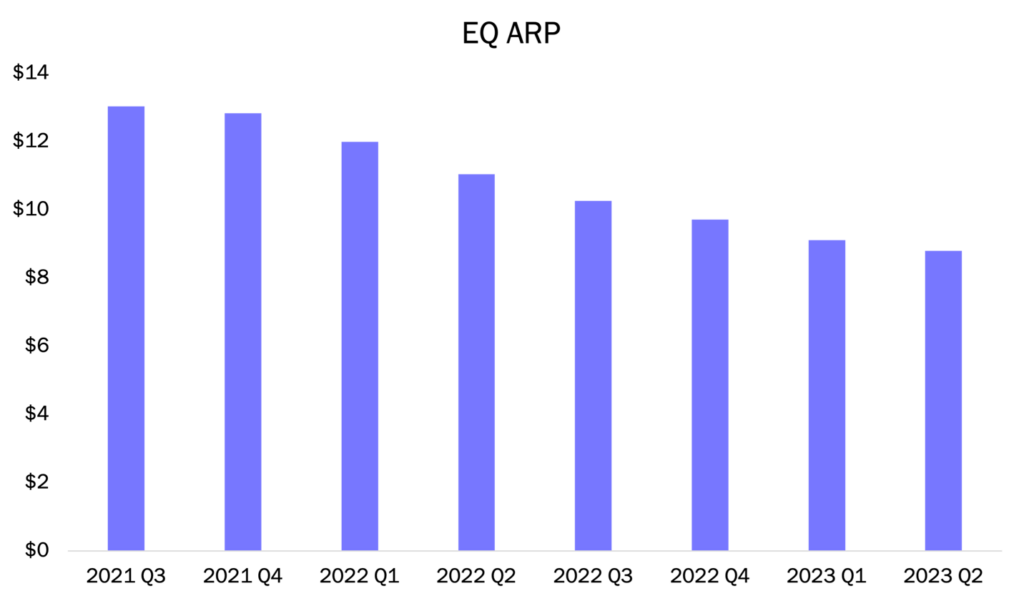

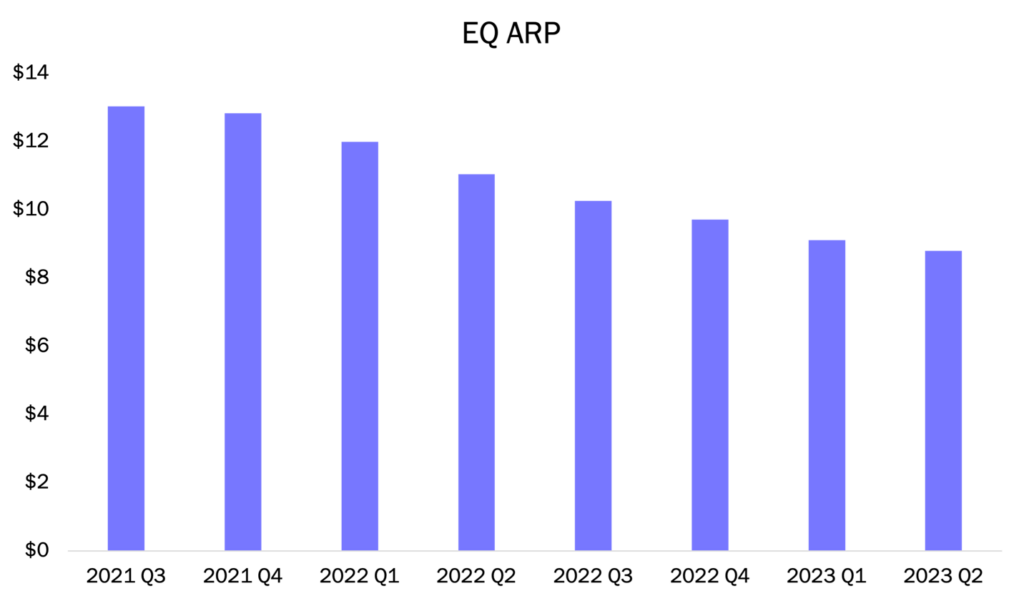

Cannabis Industry Shift: Pricing Compression & Brand Consolidation

With the evolution and growth of the legal U.S. Cannabis Industry, there have been significant shifts due to competitive pricing trends and overall competitive brand landscape. Both have left a major impression and fueled significant issues in the legal U.S. Cannabis Industry.

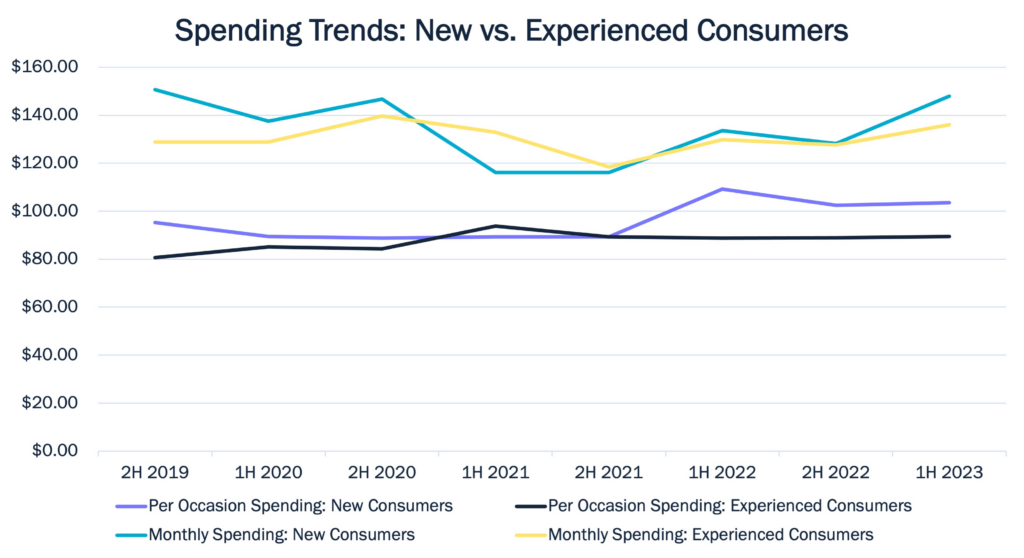

Industry Growth & Transformation: Unveiling Today’s Modern U.S. Cannabis Consumer

As cannabis legality spreads throughout the U.S., consumer consumption has increased. In Spring 2023, BDSA Consumer Insights broadcasted that 46% of consumers in Adult-Use & Medical legal states consumed cannabis in the past six-months.

Cannabis Consumer Boom Continues: BDSA’s Consumer Insights Shows Consumer Penetration Over 50% Across Adult-Use Markets

With legal cannabis spreading to more and more states every year, we are nearing the milestone of 50% of adults in the US with access to legal cannabis! As legal access has spread, attitudes towards cannabis across the country have warmed, and more and more Americans are choosing to consume cannabis. In BDSA’s newest wave […]