Cannabis edibles are a key driver of legal cannabis sales, accounting for 15% of total spending at present. That share is forecast to increase over time: By 2025, sales of edibles are expected to grow to 2.4 times 2020 sales volume versus 2.1 times growth in the total legal cannabis market—where sales are forecast to expand from $16.2 billion in 2020 to $34.5 billion in 2025.

These and other insights into the cannabinoid edibles space were presented in BDSA’s webinar “Eat: Insights into the Edibles Market,” presented Nov. 24 to 173 viewers (watch the recording HERE.) BDSA’s Jessica Lukas was joined by a panel of industry experts including Cameron Clarke of Sunderstorm, Ryan Crandall of MariMed and Steve Johnson of Coda Signature for a lively discussion of cannabis edible and industry topics.

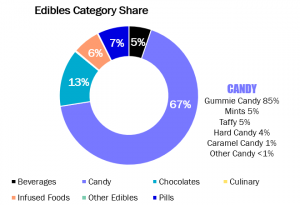

The edibles category is composed of a wide variety of product types—in U.S. markets by the candy category, with chocolates in second place. These categories hold 67% and 13% share, respectively, of total edibles category spending in states where BDSA has retail tracking. Candy is, in turn, driven by gummy candies, which account for 85% of candy category sales.

.

The majority (71%) of cannabis Consumers consume edibles, according to BDSA Consumer Insights’ survey of adults 21+ in fully legal states conducted in the first quarter of 2020. Of those, 33% prefer edibles to other types of cannabis products. Reasons for consumption vary but the top three are: to sleep better (48%), to relax/be mellow (45%) and to relieve pain (43%). Taste/flavor drives purchases for 38% of respondents, though low price (30%) and brand familiarity (27%) are also important factors.

Cannabis Acceptors, those who do not currently consume cannabis products but would consider doing so in the future, are also interested in edibles, according to BDSA Consumer Insights research. Among Acceptors, 49% say they would consider consuming edibles, versus 58% who would consider using topicals and 24% who would consider inhalable cannabis products.

And, the regulated dispensary channel represents just a fraction of the potential for edibles containing cannabinoids. Cannabidiol (CBD) is a non-psychoactive cannabinoid found naturally in both cannabis and hemp—which is technically also cannabis, but legally defined as cannabis containing very low levels of tetrahydrocannabinol (THC) (<0.3% THC in the U.S.) Cannabis-derived CBD products have already gained considerable share in U.S. dispensaries, with nearly 63% of edibles brands offering at least one CBD SKU.

Products containing CBD have begun to take off in U.S. general retail but current Food and Drug Administration restrictions on using CBD as a food additive have kept legitimate manufacturers away from offering CBD edibles in the general retail channel. BDSA expects the FDA to lift those restrictions in 2021, opening the way for edible products in what could be a $13.2 billion market for non-THC cannabinoids in U.S. general retail.

BDSA’s webinar was the first in a three-part series called “Eat, Drink and be Merry.” The second, titled “Drink: In-Depth Look at US and CAN Beverages,” will be held Dec. 8. The third, titled “BE MERRY: Consumer Segments and Need States,” will be held Dec. 18th.

{{cta(‘1b283c19-2569-4cb4-969c-2d0392101401’)}}