BDSA launched the latest addition to its GreenEdge® platform: BDSA’s Cannabis Brand Portfolio. This new premium BDSA service provides a granular view of the performance of the largest “house of brands” in the cannabis industry.

BDSA’s Cannabis Brand Portfolio tracking looks at granular retail sales of the brands owned by parent companies, as verified, mapped, and updated by BDSA. Within the dashboards, clients can view the sales and market share of the parent companies or “house of brands” over time and then drill down to see sales performance for cannabis brands by state, category, and brand. At launch, the product includes 25 BDSA-verified parent companies and their 123 brands across 11 BDSA-tracked states.

Let’s take a closer look at Illinois as an example.

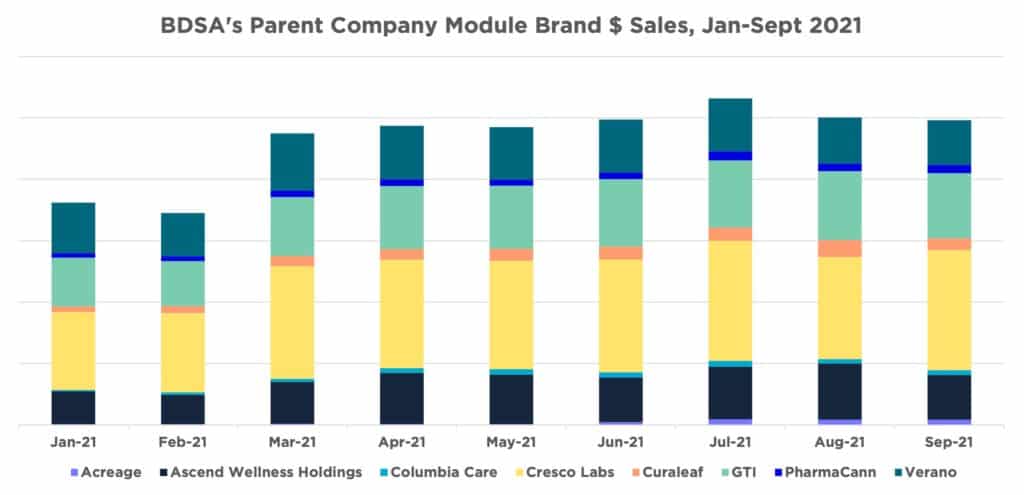

BDSA tracked ~$1.2 billion in total sales during the first three quarters of 2021 in Illinois. BDSA has verified nine parent companies in Illinois, accounting for almost $840 million of that (~70% of total IL sales) through sales of their 27 brands (of 99 total Illinois brands).

Illinois’ top verified parent company during that period was Cresco Labs, with ~25% share of sales. Drilling further into Cresco, we can see that Cresco Labs performance in Illinois is driven by their inhalables brands: Cresco Cannabis accounted for ~50% of the parent company’s sales in Illinois during the first three quarters of 2021, followed by High Supply at ~30% and Good News Cannabis at ~10%.

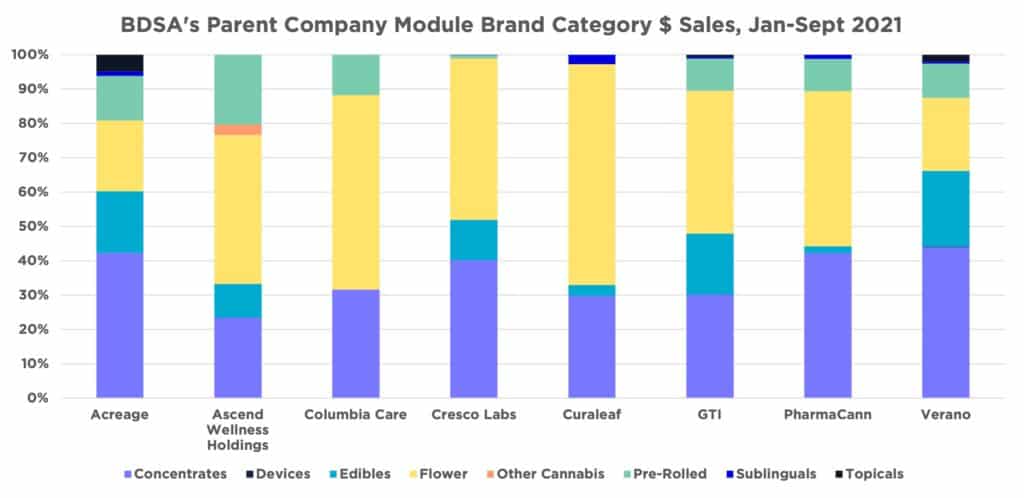

Using that same drilling technique, we can look into what categories are driving parent company brand retail sales. Not surprisingly, inhalables accounted for ~90% of sales for parent companies during the first three quarters of 2021, with ~50% from flower, ~40% concentrates, and ~10% pre-roll.

This level of detail is, of course, available for all states and BDSA-verified parent companies. For more information on BDSA’s new Cannabis Brand Portfolio tracking or to arrange a demonstration, Click Here.