Colorado’s regulatory experience with legal cannabis has been ploddingly sensible and ordered — the Centennial State is the Switzerland of weed-friendly jurisdictions. California’s long pot journey — the first in the nation with legal medical cannabis, and now the largest adult-use market in the world — has been more like Italy: chaotic, operatic, hazy rules, rampant disregard for regulations and lax law enforcement. The state’s new rules, which began taking effect on January 1 of this year, at least have the potential to introduce more order into the system.

In the medical-only state of Arizona, where voters earlier this month rejected placing on the November ballot a measure to legalize adult-use sales, the environment might feel more like Saudi Arabia. The rules are confining and strict, and the penalties severe.

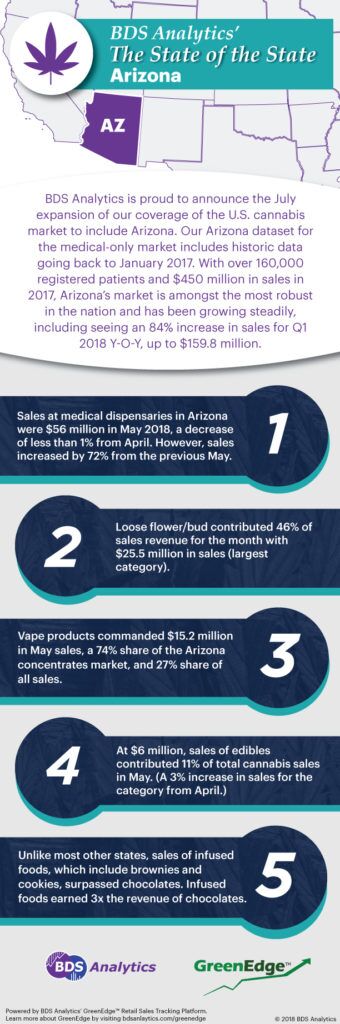

But at least the Grand Canyon State permits some cannabis sales, unlike South Carolina, Texas, and 18 other states. And BDS Analytics now tracks retail sales in Arizona, which despite the many tough rules surrounding sales still supports a strong marketplace, which ranks amongst the highest in the nation. Sales in 2017 at the state’s 130 dispensaries reached $451.5 million.

Before diving into retail trends at the state’s medical shops, let’s examine how cannabis sales work in Arizona.

Pot enthusiasts – with medical justification – in Arizona can thank Proposition 203 for access to their favorite plant. The 2010 measure legalized cannabis for medical use, and tasked the Arizona Department of Health Services to regulate the state’s cannabis program.

Any Arizonan who wants to consume legally must visit a state-licensed doctor, who can recommend medical marijuana if the patient has at least one qualifying condition from a list that includes cancer, AIDS, Crohn’s Disease and severe and chronic pain. The doctor’s visit will cost somewhere between $75 and $150, and the fee for the card is $150.

Armed with a medical marijuana card, patients (the state has about 150,000 residents with medical cards) can start spending at dispensaries. But they are limited to buying no more than 2.5 ounces every two weeks.

Edibles are legal, and concentrates like Live Resin and shatter were too, but a court ruling last month declared that concentrates are not protected under state law. The ruling is being appealed, and dispensaries are selling concentrates now in defiance of the legal status.

What are the state’s medical shoppers buying?

During 2017, flower captured 52 percent of Arizona sales, and pre-rolled joints added another five percent — 57 percent of sales. With an average pre-tax retail price of $9.89, prices are significantly higher than in Colorado, where the average price is below $5. But they are in line with California prices.

Concentrates contributed 31 percent of revenues, with vape products commanding 70 percent of the concentrates market, stats similar to California, Oregon and Washington.

The other large slice of the Arizona cannabis pie, edibles, represents 10 percent of cannabis sales, which is smaller than in other states where edibles’ market share tends to get closer to 15 percent.

As in other states, candy — things like gummies and hard candy — dominate edibles sales. But where chocolate is the No. 2 edible in California, Oregon, Washington and Colorado, in Arizona baked goods like cookies gain the second-place spot for sales, followed by chocolate — and by a wide margin. Baked goods capture 28 percent of edibles sales in Arizona, more than double chocolate’s 10 percent market share.

With our GreenEdge™ platform, we can report on Arizona sales going back to January 1, 2017. The Arizona data became available to all customers in July of this year, marking the fifth state featured in our industry-leading retail sales tracking platform.

May 2018 GreenEdge Data Infographic: