Cannabis Beverages have held the attention of many since the early days of legal sales, with everyone from veteran cannabis businesses to investors and traditional beverage industry professionals excited to see how the beverage form factors can perform in the fledgling cannabis industry.

Cannabis Beverages may not by the industry giant that some expected, but Beverages have carved out a solid niche in the cannabis edible space. Beverage sales totaled $47 million across BDSA-tracked markets in Q1 2023, a 6% share of dollar Edible sales, and 1% of total legal cannabis sales across BDSA-tracked markets.

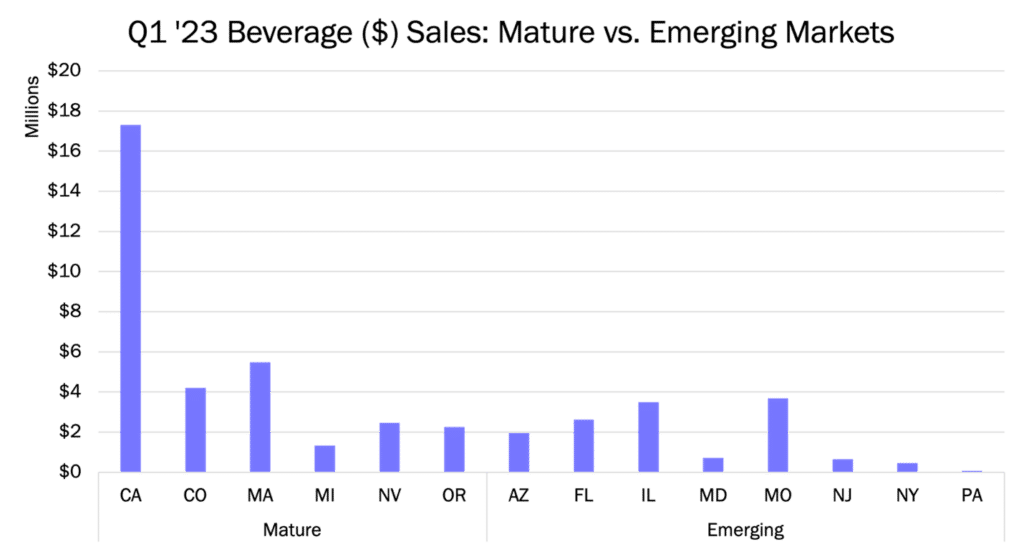

The beverage landscape diverges significantly when we compare Mature markets with Emerging markets, with BDSA data showing different product category makeup, pricing trends, and brand and product saturation between Mature markets and Emerging markets.

Source: BDSA Retail Sales Tracking, Q1 2023

Mature vs. Emerging: Bev Cat Share and Differences

Looking at the beverage category landscape shows some significant differences between Mature and Emerging markets. In Mature markets (CA, CO, MA, MI, NV, OR), Beverages were 1% of total sales and 7% of edible sales in Q1 2023. 81% of Beverage dollar sales were Drinks. The next largest subcategories were was Powdered Mix products (7% of Beverage $ sales), and Shots (7%).

By contrast the Beverage category made up a smaller share of Edible sales in Emerging markets (AZ, FL, IL, MD, MO, NJ, NY, PA), with 5% of dollar edible sales in Q1 2023 coming from Beverages. Drinks made up a smaller portion of Beverage sales in these markets, with 59% of Bev dollar sales coming from drinks. “Other Beverages” (such as cannabis “mocktails” drink mixes) brought in a 20% share. After that, Powdered Mix products were the largest with a 15% share, then Shots with a 6% share.

Beverages Drive Higher Prices in Emerging Markets

Emerging and Mature markets also display differences when it comes to the average retail price (ARP) of Beverages. While Beverages hold lower prices than the total Edible category in both market types, the difference between Beverage average retail prices and average retail prices for the whole Edible category is much greater in Mature markets, potentially making Beverages better positioned for premiumization in Emerging markets.

| Market Type | EQ ARP: Edibles | EQ ARP: Beverages | Difference |

|---|---|---|---|

| Mature Markets | $13.02 | $9.31 | Bev. priced -28.5% lower than edibles |

| Emerging Markets | $19.51 | $16.13 | Bev. priced -17.3% lower than edibles |

Source: BDSA Retail Sales Tracking, Q1 2023

Brand and Product Presence by Market Type

Mature markets also diverge from Emerging markets when we look at brand and product trends. BDSA data show that the Beverage space is significantly more saturated in Mature markets, with more active brands and individual products than in Emerging markets. BDSA Retail Sales Tracking data show that there were 106 Beverage brands and 712 unique SKUs across Mature Markets in Q1 2023. By contrast, Emerging markets were home to 47 Beverage brands and 241 unique SKUs. While the fact that Mature Markets have been active for longer is a contributing factor to the higher Beverage brand and product count, Emerging Markets having more restrictive licensing is another likely driver of this trend.

Mature and Emerging markets also differ in that brands owned by Brand Houses hold a higher share of sales in Emerging markets than in Mature markets. Again, this is likely a factor of the licensing structure of Emerging Markets, as limited licensing schemes benefit large multi-state operators. BDSA Brand House data show that 78% of Beverage dollar sales in Mature Markets were from Brands House Brands, while Brand House owned brands held an 88% share of total Beverage dollar sales in Emerging Markets.

There are some stark differences between Mature and Emerging markets when it comes to Beverage products. Beverage products already have of strong foothold in Mature markets, but pricing and brand trends show that Emerging markets present strong opportunities for Beverage brands and products. With BDSA forecasting the total US cannabis Beverage market to reach $200 million in 2023, the small but mighty Beverage category holds big potential in the legal cannabis space.

Looking for more insights on the exciting Beverage space? Wondering which markets present the best opportunities for a Beverage venture? BDSA has you covered with granular data and insights to win with this exciting category.