This blog post comes to us from our partner, Apex Trading, and can be seen in it’s original form here on Apex Trading’s blog.

If you work in or follow the cannabis industry, we’re sure you’ve heard about the steep decline in wholesale cannabis flower prices across many of the longer-established, adult-use markets. This isn’t uncommon, but most of us didn’t anticipate such a steep decline in 2021 after such a strong 2020 sales year. In this article, we’re going to dive into the causes and effects as well as go through features Apex Trading provides that can help a grower withstand the market downturn.

Groundwork of Understanding:

First, it’s important to understand that the wholesale flower market has always been volatile and will continue to be while intrastate commerce restrictions are in place. So what causes wholesale flower volatility?

Seasonality

In states with good outdoor growing conditions, the fall harvest, often referred to as “Croptober,” floods the market with oversupply driving prices down. Once anything worth buying is gobbled up, the spring and summer seasons rebound as supply and demand level out. It’s not uncommon to see a 10-30%+ price decrease during this seasonal period. For the indoor craft grower, they often have to slightly reduce pricing, but are able to hold somewhat firm. Yet, it’s the greenhouse and outdoor grower that are forced to race to the bottom to move their harvest.

State Conditions

While seasonality is a predictable factor impacting wholesale prices, we often overlook how specific state market conditions also influence wholesale cannabis flower prices.

First is the market age. In the initial 1-2 yrs of a market, it takes cultivators a while to build out and scale up production to keep up with demand. Demand > Supply = ^$. This is what we see in all limited license states (e.g., IL, medical only) and new adult-use (e.g., MA, MI). But it doesn’t last long – by year 3 and onwards, supply catches up and often surpasses demand driving prices downwards until growers with fewer financial resources, inefficiently run operations, or no established brand fail. This seems to be occurring now in MI.

Next, are the specific state regulations such as canopy and license limits & testing regulations. Canopy size limits are pretty straight forward as a way to control supply. Unfortunately, many states are driven by cannabis tax revenues rather than investing in economic analysis to ensure there is a healthy balance of supply to meet demand. Testing regulations can have a substantial impact as well. For example, in 2015, a new microbial testing regulation wiped out a substantial chunk of the Colorado flower market while cultivators scrambled to comply. Once this new testing mandate was implemented, there was a period of time where supply shrunk, due to producers not being able to pass testing. This in turn drove up demand and wholesale cannabis flower prices upward.

Natural Disasters also can directly impact supply. We’re seeing this on a small scale now with wildfires in the West, but large scale natural disasters can, and most likely will, directly impact the market supply. Wildfires not only destroy facilities, but the metals and other contaminants in the air can directly impact the health of plants and cause harvests to fail testing.

Cross-State Competition is also becoming a factor. We’re seeing this in Colorado. With many of the border states passing their own cannabis legalization and with the emergence of lab derived cannabinoids that get people high, cannatourism is on the decline. It’s also no surprise that many people came to Colorado and other legal states to “stock up (looping)” on flower only to take it back into their state to sell.

What’s gone down since Covid:

2020 – cannabis is deemed essential in most markets. More people are working from home or not working at all. While the government is printing money in the form of stimulus checks, consumers are buying a lot of weed, because they have extra disposable income and are working from home, or not working at all.

Wholesale Impact: Demand starts to surpass supply in most markets resulting in growers being able to command a higher wholesale price. As a knee jerk reaction and under the false assumption that this would continue, many decided to increase existing canopy size or purchase new grows to capitalize on the market demand.

Yet…by the time these became operational and their harvests began hitting the market stimulus checks stopped, vaccine rates went up, and some form of the “new normal” began. This resulted in oversupply which is why….

2021 has not been friendly to the wholesale cultivation market in longer established markets.

Current Wholesale Flower Market:

Since May:

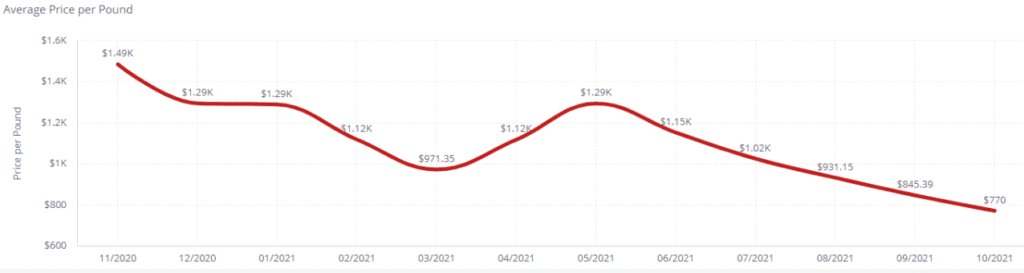

Colorado flower prices have decreased 40% from $1,300 to $775/lb since May 2021.

Could this have been prevented?

In terms of covid – these factors have been out of the grower or industry’s hands: stimulus, pandemic, consumer behavior.

However, there were lessons that should have been learned from the past market fluctuations, especially for those in mature markets that have seen massive price swings in their past. The problem really comes down to a lack of data or paying attention to it.

Business owners, especially cultivators, often make knee-jerk reactions based on short-term market booms rather than looking at historical and projected data. It’s safe to say that an overwhelming majority of the growers in mature markets who increased canopy sizes or purchased new grows as a direct result of the 2020 covid conditions likely wish they would have instead invested that capital in R&D or creating a more efficient business to decrease COGS.

The Apex Trading Solution

Just like growers knee-jerk reactions in 2020 to increase canopy sizes when business is good, they have a tendency to “spray and pray” when business is bad. By “spray and pray”, we mean that cultivators and extractors hop on to every single marketplace or potential sales channel and race to the bottom with many of their peers. While we understand this mentality, it’s much like the lemmings following each other over the cliff to their eventual demise.

Rather than following the herd, Apex Trading provides some alternative solutions and tools that, when used in conjunction with getting out and visiting buyers, results in success.

How do you motivate a buyer to purchase from you when there is so much supply in the market? Create FOMO! Rather than throwing your flower up on a marketplace where you race to the bottom, we provide the ability to directly market and promote your product(s) to buyers through a custom-branded storefront. Even better, by utilizing the expiring pricing tiers and bulk discounts, you are able to market limited-time-only deals to drive sales.

Another method to drive sales is extending net terms through our Aflex Payments “Pay Later” financing solution. We understand that you need money to keep the facility running and often this is dependent on being paid upon delivery. By leveraging Aflex Payments, you are able to extend terms to a buyer while being paid most of the sale upon delivery from us and then we’ll collect from the buyer over time. It’s a win-win!