When Colorado kicked-off legal adult-use cannabis sales in the United States in 2014, unbranded flower fully dominated the marketplace, capturing more than 60 percent of all sales. Concentrates, edibles and topicals were far behind.

Five years later, multiple states enjoy legalized adult-use cannabis sales, including the most populous state in the country, California. And the market looks much different. Flower’s dominance of dispensary income has diminished. Consumer preferences among concentrates has evolved dramatically. Sales of CBD-rich products are spiking. Prices are dropping. The market is volatile, and fascinating.

So what was hot in pot in 2018? Let’s examine some of the year’s most compelling trends, ones likely to extend through 2019 and beyond.

- Form factors upending beverage marketplace

Cannabis beverages have been on the receiving end of a fair bit of press during the past year. In August, beverage conglomerate Constellation Brands dropped $4 billion for a 38 percent stake of Canopy Growth, a big Canadian cannabis cultivator. In addition, Molson Coors announced a partnership with HEXO, and ABI InBev with Tilray.

When we examine adult-use states where year-over-year comparisons are useful — for example, Colorado and Oregon, but not California, which last year was a medical state — growth for beverages is solid, at 37 percent. But consumers in different states, for now, drink different kinds of beverages. What we are witnessing in the beverage market is the proliferation of products beyond large bottles of liquid. Powdered drinks, shots, and tea, for example, are making inroads into markets. In California, sales of tea are rising fast, and chipping away at market share from the broad category of “drinks.” In Colorado, water-soluble powders are expanding, and diminishing liquid drinks’ market share. Oregon cannabis consumers have gone crazy for shots. Now, sales of shots are nearly on par with drinks in that state’s beverage market.

With so much investment pouring into beverages, we are likely to witness more and more product innovation and evolution. And form factors beyond bottles or cans of liquid seem like an important part of the future.

- Brands move into flower

Most flower available in retail today is unbranded – aromatic green plant buds in vials that are identified by strain, rather than grower. But that is changing. After the July 1 product testing rules were launched in California, for example, brands like Korova, Nug and Canndescent took off, and are finding footholds in dispensaries and among consumers across the state. We will see more and more branded flower across 2019. We think the landscape in the not-too-distant future might resemble the coffee bean market, which once was dominated by unbranded beans but now is heavily branded by individual coffee roasters. Will we see pot brands as prominent as roasters like Blue Bottle or Peet’s? Probably not next year, but the trend seems inexorable — the branding of flower is well underway.

- Price it low. Sell it high.

This year saw the rise of some companies going big on low prices. Consider the California concentrates market. Back in January, items priced between $35 and $40 were nearly tied with the leading price range, $30 to $35. Meanwhile, items between $25 and $30 were the third most popular price category. Fast-forward to October and we see items priced between $30 and $35 move far ahead of the pack, and items between $25 and $30 nudged into second place, pushing the $35 to $40 range down to third place. Meanwhile, in California we find increasingly more brands selling 500 milligram products for less than $35. And some brands are even selling 1,000 milligram vape cartridges for less than $50, while others charge more than $110 for 500 milligram products. Concentrates pricing today in California and other states is undergoing robust competition and experimentation. Expect to see more price uniformity, including lower overall prices for concentrates, by this time next year.

- Even with the vape market expanding, more exotics are coming on

The modern, legalized cannabis market is being redefined by product innovation. Technology is rapidly changing the face of consumer products in virtually every industry; and as more mainstream companies and investors flock to cannabis, they are bringing those technologies to this space as well. Over the past few years arguably the most significant trend in cannabis has been the emergence of the vape category as a game changer. Across 2018, vape sales were the second largest category following flower. Vape sales contributed 22 percent of revenues at dispensaries in Arizona, California, Colorado, and Oregon combined in 2018. While vape sales continue to grow even newer product categories are emerging and forcing BDS Analytics to expand the hierarchy of products that we classify and track. The new breeds of products include dissolvable powders that can be added to food or beverages, inhalers, orally dissolvable strips, and even suppositories. While sales of these emerging product categories remain relatively small, with added awareness and trialing, their market share will grow, and give us all something to talk about.

- ROI on CBD increasingly A-OK

As CBD increasingly enters the mainstream, with products lining the shelves of traditional stores from California to Pennsylvania, it plays a role with dispensaries and cannabis products. While products high in CBD find homes within flower, concentrates and topicals, it is in the world of edibles where CBD-rich products are emerging with muscle. Consider tinctures in Colorado, a fast-growing type of edible product that has captured 8 percent of edibles sales so far this year.

Sales of tinctures reached $17.45 million through October of this year, and CBD-rich product sales hit $13.9 million. That’s nearly 80 percent of the tincture market. In California, CBD-rich tinctures represent 81 percent of the tincture market.

The story is similar in the smaller chocolate pieces market, which mostly revolves around individual chocolate treats, like truffles. Overall, the market in Colorado, for example, has seen $8.7 million in sales so far this year, and CBD-rich products represented $5.35 million of those sales — that’s 61 percent of the chocolate pieces market. And all growth for chocolate pieces hinges on high-CBD products, which saw growth of 242 percent so far in 2018. Meanwhile, chocolate pieces that are not high in CBD experienced 14 percent decline. It’s CBD to the rescue for chocolate pieces in Colorado!

- Flavors trending more toward orchard & field versus jungle

Gummies are the most popular form of edible cannabis in the market. In California alone, they represent 27 percent of all edibles products, dwarfing things like chocolate bars (7 percent) and baked goods (10 percent). The most popular flavor in the state? Watermelon, followed by blackberry, lemon, blue raspberry, cherry cola, sour apple and strawberry. Flavors like tropical punch, tangerine, and pineapple coconut do appear in the top 20 flavors, but are roundly defeated by flavors more common to the United States and Canada — that is, by the kinds of fruits we more commonly incorporate into pies, drinks and ice cream.

- Micro-standardization comes to California chocolate

When adult-use sales were first legalized in Colorado, chocolate bars were the most popular individual edibles product, and most of them were divided into 10 squares. Each square contained 10 milligrams of THC, which is how Colorado defines a maximum single serving.

But as the microdosing movement gains footholds across the country, the standard dose is shrinking. In California so far this year, for example, the top six chocolate bar products are all divided into 20 servings, with each serving containing 5 milligrams of THC. It has taken a lot of small steps over a long period of time, but microdosing is beginning to change how we think about cannabis edibles servings.

- The science of cannabis is influencing the wants of customers

As the cannabis industry matures, investments increasingly flow into the sector. And some of those dollars are being used for scientific research, the first of its kind on the long-banned plant. The cannabinoid CBD, which has merged with the mainstream, was borne out of scientific research. Now, researchers are studying terpenes and other cannabinoids found in cannabis, and developing new products based on findings. Our consumer research reveals the degree to which cannabis enthusiasts leverage cannabis for everything from sleep to pain to anxiety-relief. It’s significant. In total in excess of half of all cannabis consumers use it for what are essentially medical reasons. And brands are meeting the demand with things like disposable vape pens that are infused with terpenes for sleep, energy and focus; tinctures loaded with CBD and cannabinoids that enhance sleep; and much more.

- Flower prices gradually declining but consumers are happy paying $19.99 for gummies

Diminishing prices for flower receive a fair amount of press attention, but we don’t hear as much about the flip-side — relatively stable and even spiking prices for branded products. Gummies during 2014 in Colorado, for example, averaged $18.80 per unit sold. But between January and October of 2018, the average price was $18.19 — a dip, but nothing like flower’s price plummet. Colorado chocolate bars sold for $13.29 during 2014, but through October of this year the average price rose to $19.05. Vapes in Colorado sold for $34.80 in 2014, and this year are averaging $32.15 — another incremental price diminution. Some products in Colorado, like tinctures, have seen fairly dramatic price hikes (increasing 56 percent from 2014 to 2018).

In short, the price deflation in cannabis relates to unbranded flower, rather than branded products. This is great news for manufacturers of branded products — their most expensive ingredient, flower, continues to fall, even as their product prices remain roughly stable, or even rising.

- Brands are hot

When the Colorado market took off in 2014, it was all about the flower, jars of sticky buds grown for dispensaries and sold in the manner of things like rice and peanuts in health food stores — in bulk, and unbranded. Times have changed.

Now, market share is roughly tied at 48 percent each for branded products — edibles, most concentrates and topicals — and unbranded products, including most flower and pre-rolls. And dollar sales growth through 2018 is led by branded products. In fact, in Colorado and Oregon, where year-over-year comparisons are useful (as opposed to California, which last year was a medical marketplace only), dollar sales of flower are down 6 percent through October of this year. Meanwhile, growth for edibles in the same states reached 21.5 percent through October; growth is even stronger among concentrates.

——

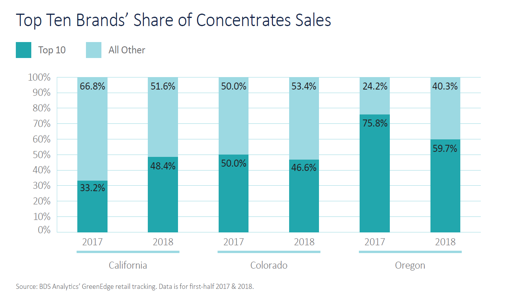

Brand strength is about more than growth. When we compare data from the first half of 2017 with the same period in 2018, we find the top 10 brands in Colorado and Oregon command both higher prices on average and significantly more market share than competitors. But today’s brand leaders may fall away with fresh competition. We found that in California, four new brands had gained a spot in the top 10 in 2018 since the first half of 2017, with one of those managing to take the No. 1 spot. Even the slightly older Colorado market saw the same kind of churn as California, with four new brands entering the top 10. Opportunity remains ripe in all states with adult-use cannabis sales.

We found it nearly impossible to distill a Top 10 list of product trends from the $11 million 2018 legal US retail market. Our list is truly a sampling of the bevy of storylines that presented this year. So like us, enjoy your cannabis in 2019, and make sure to check back in this time next year.

Data powered by BDS Analytics’ GreenEdge Market Tracking Platform

Analysis powered by BDS Analytics’ Industry Intelligence Division