How to Calculate Your Total Addressable Market in the Cannabis Industry

Use your Total Addressable Market (TAM) to identify growth opportunities, make informed strategic decisions, and benchmark your brand’s market position against the competition. Cannabis brands looking to dominate their market need more than just good products—they need to know how to find their Total Addressable Market (TAM). Cannabis-specific TAM is a market forecasting tool that […]

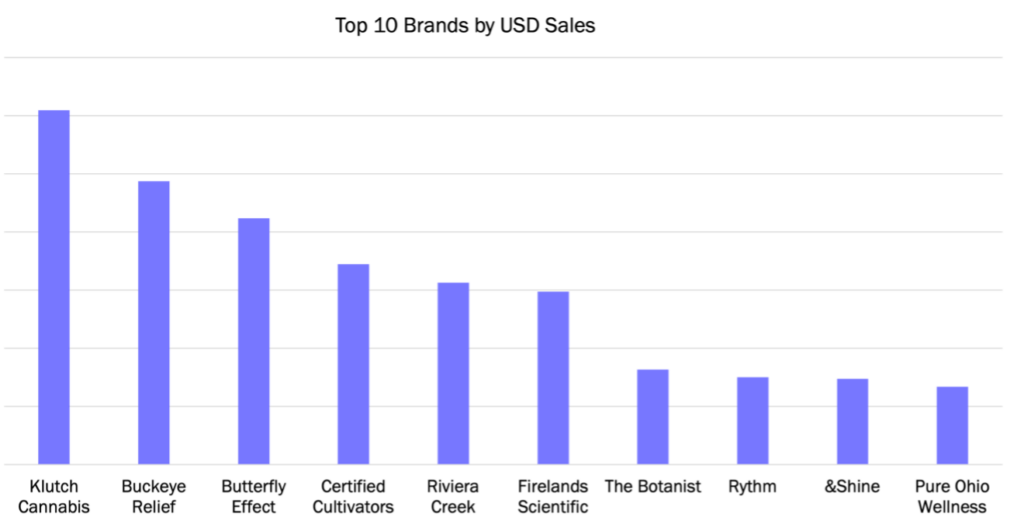

BDSA Brand Insights: Best-Selling Ohio Cannabis Brands

Just eight months after the legalization of adult-use cannabis, Ohio has already launched adult-use sales! Legal sales kicked off on August 6, 2024, with 98 retailers approved to sell cannabis for adult-use.

Top Five Best-Selling Brands in the Ohio Medical Market

Ohio became the 24th state to legalize cannabis after 56% of voters said yes to adult-use on November 7, 2023. While rules for adult-use are pending until December 7, Ohio’s robust medical market and diverse brand landscape deserve more attention.

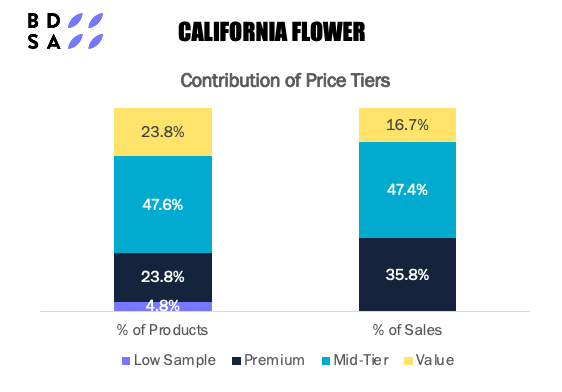

Using Price Tiers to Price Right in your Cannabis Market

With mature markets like California still struggling from two years of price compression, and emerging markets like New York struggling to compete on price with the illicit market, pricing presents a particularly difficult challenge to cannabis brands looking to boost revenue and gain market share.

Fastest Growing Disposable Vape Brands

Between Q1 2022 and Q1 2024, disposable products grew their share of vape dollar sales by +92%, and the disposable category now makes up a 25% market share of vape sales across BDSA-tracked markets. With 56% of vape consumers citing ease of use and 44% citing convenience as their reasons for choosing vapes, disposable vapes are well positioned to meet vape consumers need states and are expected to see strong growth for years to come.

St. Patrick’s Day Cannabis Sales: Capture More Sales with this Green Opportunity

In recent years, it’s not just beer and whiskey fueling St. Patrick’s Day festivities—cannabis has become a major player in the holiday rush.

Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market

Enduring the trials of price compression means embracing resilience, innovating strategically, and uncovering growth paths previously unseen. With a keen understanding of emerging trends, BDSA provides the guidance brands need to navigate these turbulent waters and emerge stronger, poised for a promising future.

How to Maximize Cannabis Sales Leading up to Christmas

Despite a -20% decrease in total available shopping hours, the week leading up to Christmas day has shown incremental daily cannabis sales growth versus non-holidays weeks across all BDSA-Tracked markets for the last two years.

The Impact of US Cannabis Rescheduling

Rescheduling has the potential to provide a huge benefit to the U.S. legal cannabis industry. However, there are still a lot of unknowns and differing opinions about how the cannabis industry will be impacted.

BDSA Adds Ohio as 15th Retail Sales Tracking Market

BDSA has expanded Retail Sales Tracking & Menu Analytics to include the Ohio Medical market! In recent years, many have turned their focus to the booming Midwest; and for good reason. The Midwest markets have delivered exceptional performance. The Ohio Medical market is no exception. BDSA estimates that the Ohio Medical Program totaled $480 million last year and is on track to reach $520 million this year.