Cannabis extracts are some of the oldest cannabis products in history, with use of traditional hashish going back almost a millennium. However, the extracts product category has seen tremendous innovation in recent decades – especially due to progress in legalization.

Currently, consumers across the country have access to a wide array of extracts, ranging from traditional hash to rosin to modern solvent concentrates. Even with these developments, BDSA Retail Sales Tracking shows that extracts are consistently losing market share across legal markets. So, what role and impact do extracts have in the cannabis industry?

Extract Sales Breakdown

Encompassing everything from kief, to wax, to shatter, to traditional pressed hash… did we lose you? While there are an ever-increasing number of ways to process the cannabis plant, BDSA classifies all cannabis concentrates outside of vape products as extracts.

Looking back to 2021, the extract category held a more prominent position across legal cannabis markets. In Q1, the extract category brought in 10% of total dollar sales across BDSA-tracked markets (AZ, CA, CO, FL, IL, MA, MD, MI, MO, NV, OR, NJ, NY, and PA), and a 4% share of equivalent (EQ) unit sales. BDSA Retail Sales Tracking demonstrates that extracts made up 8% of sales in Adult-Use compared to 13% of sales in Medical.

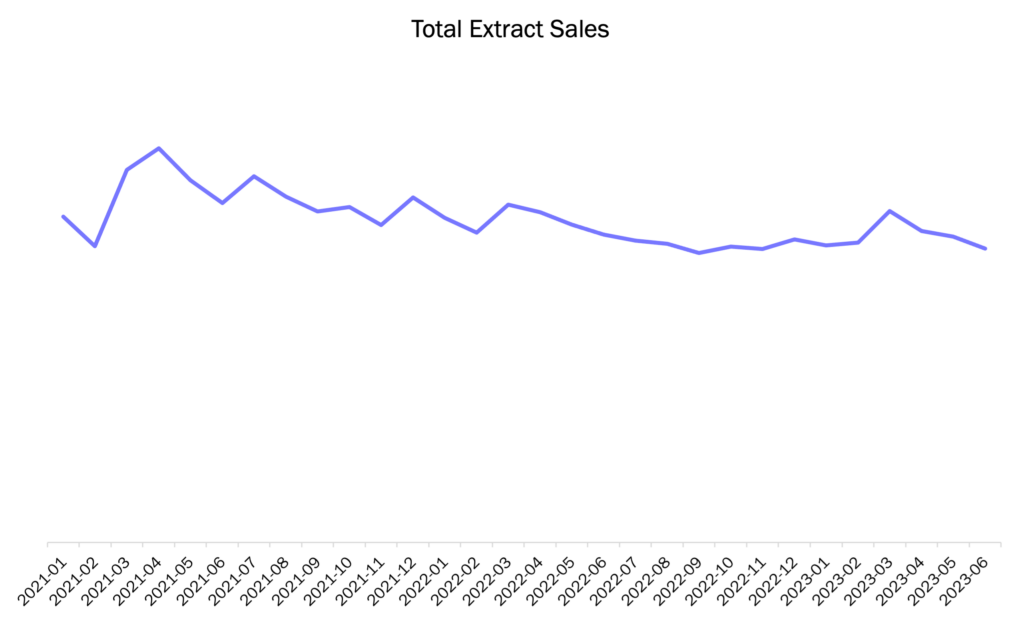

Fast forward to Q2 2023, the extract category has declined significantly. Extract sales fell -18% while dollar market share fell by -37% since Q1 2021. All in all, the extracts category only delivered 6% of total sales. The unit market share dropped by -40%, with extracts making up just 2% of total unit sales in Q2 2023. However, BDSA Retail Sales Tracking shows that extracts hold a larger market share in medical markets vs. adult use markets. Specifically, the extracts product category delivered 8% of USD medical sales versus 5% in adult use.

Fat dabs and sticky hash joints may not be the favorite of every cannabis consumer, but one fifth of consumers still report consuming extracts, with 6% of all consumers citing extracts as their preferred form factor. Savvy retailers, brands, and manufactures can increase extract product trail, adoption, and velocity with a data-backed approach to evaluating what’s working and what’s not.

* * * * * * * * * * * * *

Hungry for more insights? Check out our recent blog in the Industry Landscape Shift Series.

Want to learn more about how BDSA can serve as your data & industry partner? Request a demo.

Recent Post

- Fastest Growing Disposable Vape Brands

- Maximizing 4/20 Success: Insights and Strategies for Cannabis Retailers and Brands

- Emerald Earnings: St. Patrick’s Day’s Surprising Impact on Cannabis Sales

- Small Categories, Big Wins: How to Optimize Cannabis Retail for Valentine’s Day

- Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market