The Impact of US Cannabis Rescheduling

Rescheduling has the potential to provide a huge benefit to the U.S. legal cannabis industry. However, there are still a lot of unknowns and differing opinions about how the cannabis industry will be impacted.

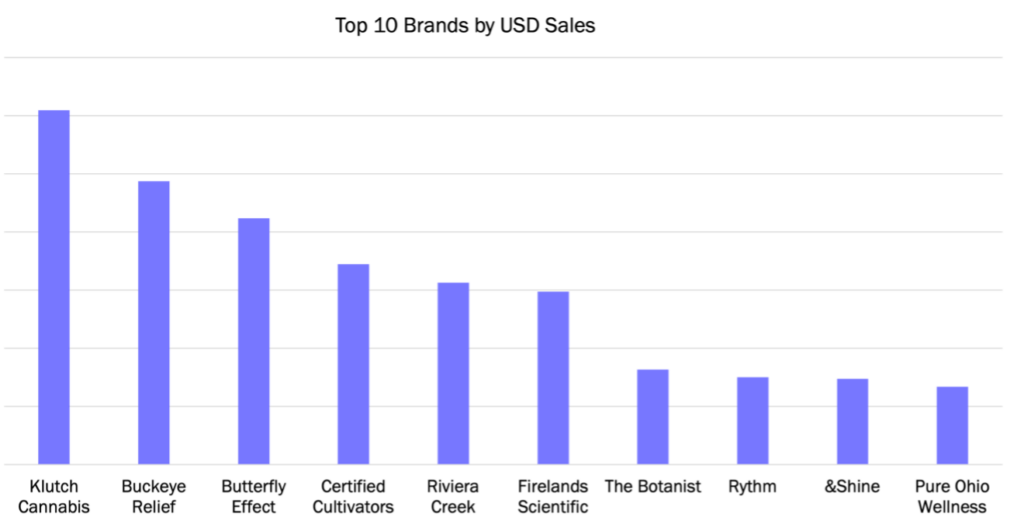

BDSA Adds Ohio as 15th Retail Sales Tracking Market

BDSA has expanded Retail Sales Tracking & Menu Analytics to include the Ohio Medical market! In recent years, many have turned their focus to the booming Midwest; and for good reason. The Midwest markets have delivered exceptional performance. The Ohio Medical market is no exception. BDSA estimates that the Ohio Medical Program totaled $480 million last year and is on track to reach $520 million this year.

From Hazy to Clear: Incorporating Data in your Cannabis Business

In today’s hyper-competitive cannabis landscape, a data-driven culture can make all the difference. From day one, cannabis businesses should strive to incorporate data into operations to make more informed decisions, problem-solve effectively, and understand the cannabis consumer and what drives their purchase decisions.

What’s in Store for Legal Cannabis this Holiday Season?

When we take a close look at the biggest holidays for cannabis, there is much more to the picture than just cannabis-focused holidays like 420. In recent years, the Fall and Winter holiday seasons have grown to present some of the biggest opportunities for boosting sales.

Michigan and Midwest Regional Cannabis Industry Takes Center Stage at MJ Unpacked Detroit

October 10th marked the beginning of MJ Unpacked Detroit 2023, where the cannabis industry gathered at the Motorcity Casino Hotel for three days of insights-packed presentations, elevated exhibitions by brands, and cannabis-powered networking opportunities.

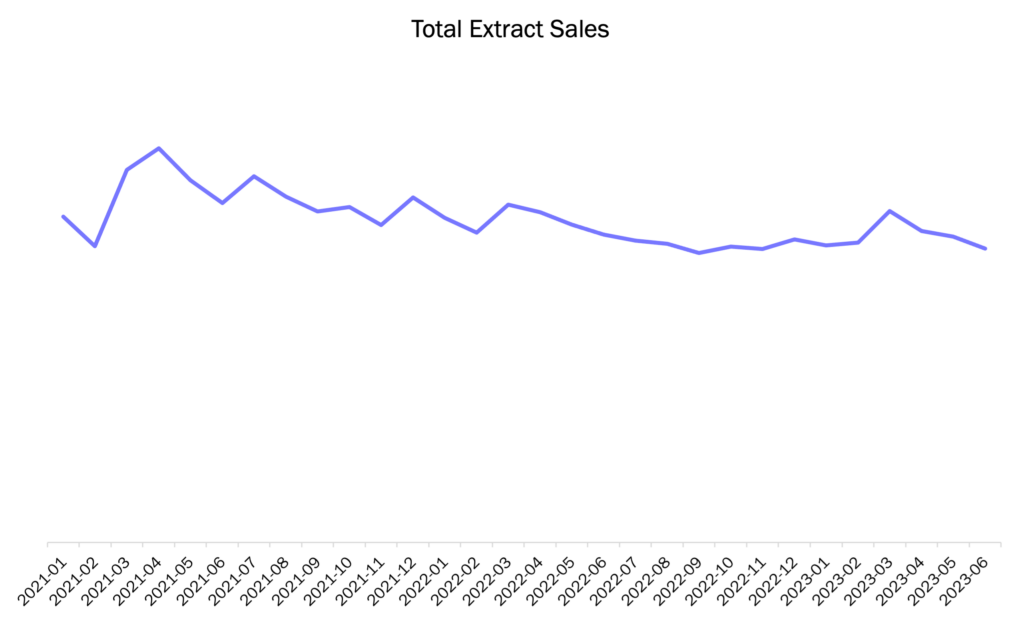

What Impact do Extracts have in the Current Cannabis Industry?

Extracts play a different role in the cannabis market compared to just a few years ago. While the category is dwarfed by other categories like flower and vape, savvy brands can still use extracts to build consumer loyalty and grow their sales.

Solving Consumer Needs with Product Innovation & Minor Cannabinoids

Minor Cannabinoids are a blessing to brands, manufactures, and retailers. It is a lever that each can use to communicate, engage, and market to consumers. Minor cannabinoids have become a tool to market mood & effect messaging directly to consumers, in a manner that they easily understand.

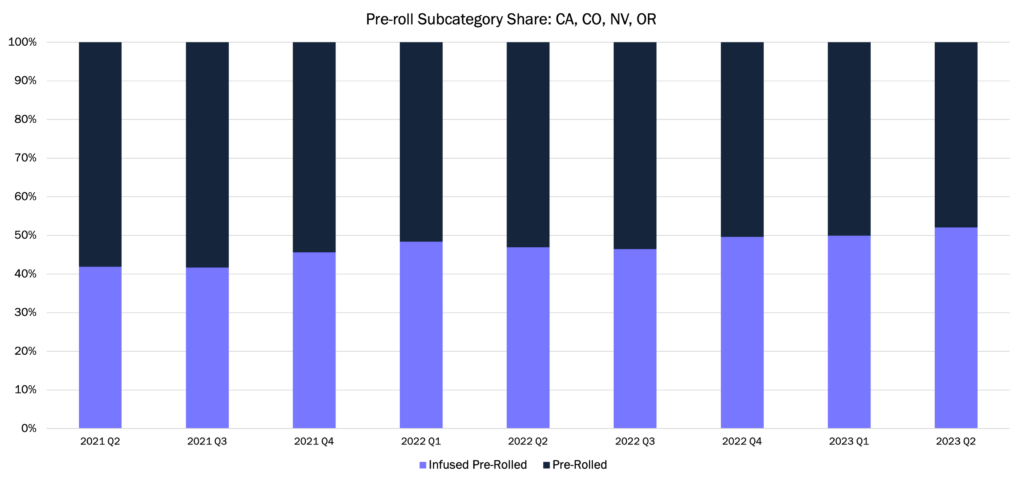

USD Sales Share Shift: The Power of Infused Pre-rolls & Solventless Concentrates

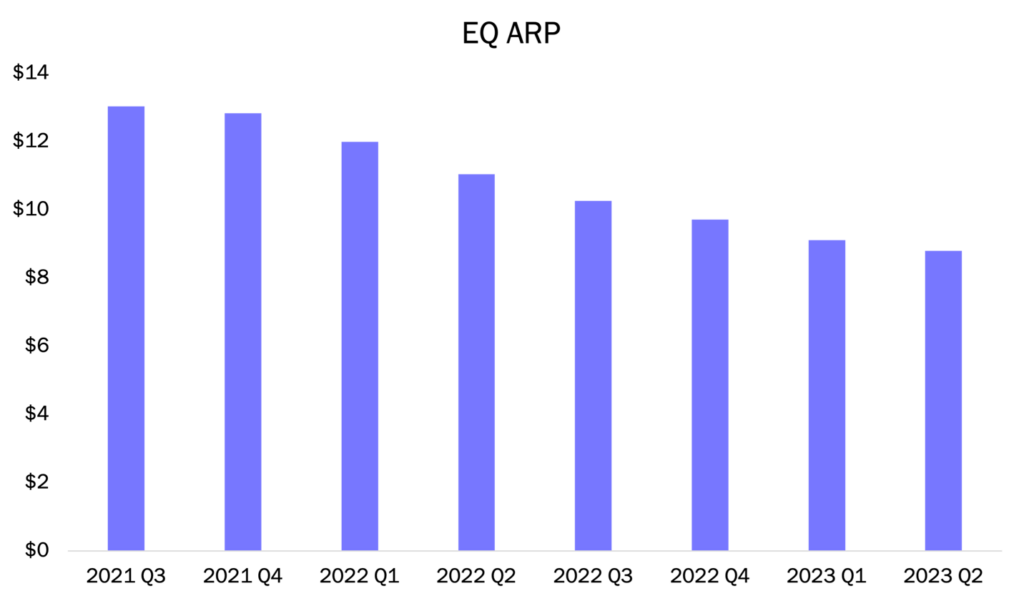

The pressure to price competitively and produce winning premium consumer-loved cannabis products is greater than ever, especially given the current state of the U.S. legal cannabis industry.

The state of the U.S. Legal cannabis industry may seem very doom and gloom, but it’s not. If anything, it’s an opportunity to strategically think outside the box, understand the needs of today’s modern U.S. consumer, and develop winning products that solve those needs. By leaning into rising product subcategories like infused pre-rolls and solventless concentrates, brands can grow their sales by appealing to a targeted set of consumers that seek out premium products and are willing to pay for quality.

Cannabis Industry Shift: Adult Use Markets Launch Quicker and Medical Channel takes the Hit?

In 2022, total U.S. legal cannabis sales increased to $26.4 Billion (+38% vs. total 2020 annual sales). This sales growth is just one of many stories that reflect the evolution of the U.S. legal Cannabis Industry.

Not only are Adult Use channels increasingly driving growth, but Adult Use markets are coming online faster. With a highly competitive brand landscape, diverse and innovative product category mix, and enticing consumer, brands in cannabis experience the same issues as their counterparts in other consumer-driven markets. Brands are constantly working to find new ways to build consumer loyalty, and a thorough understanding of the evolution of Adult Use and Medical markets is key to targeting specific consumer segments.

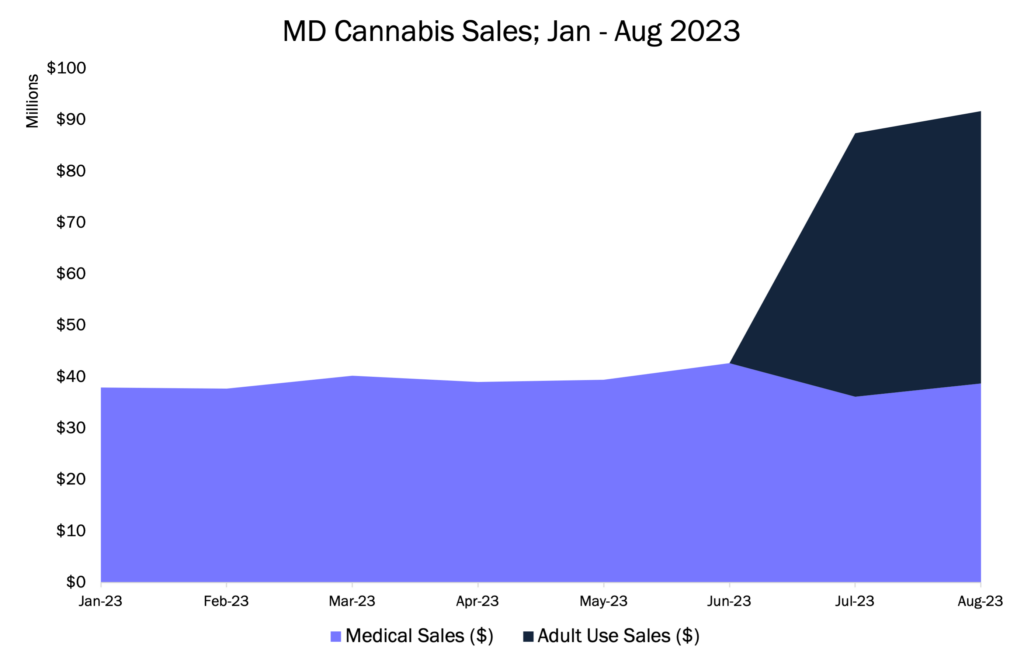

Adult-Use Brings Rapid Growth to Maryland Legal Cannabis Market

It’s no surprise why Maryland is one of the most closely watched markets in 2023, as the state posted massive sales growth in July with the addition of Adult-Use market on July 1st. Here are some of the top takeaways from the first month of legal sales in the Bay State.