BDSA Cannabis Insights: 2025 Beverage Category Trends

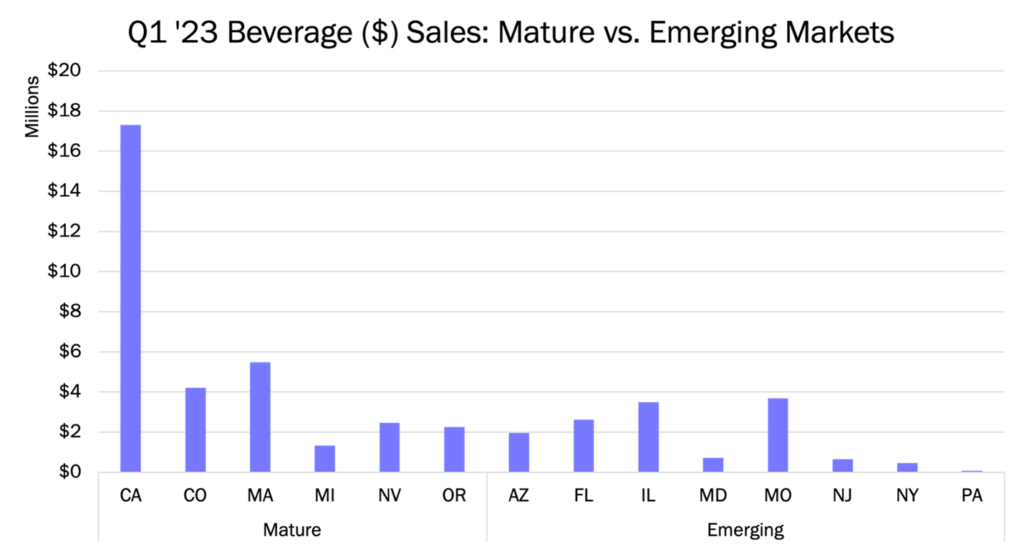

BDSA reports that cannabis beverages, though comprising just about 1% of total cannabis sales, achieved $54.6 million in Q1 2025—a 15% YoY increase. Drinks dominate the category, with emerging markets like Michigan and Ohio driving growth, while mature markets such as Arizona and Colorado see declines. Top brands are consolidating market share.

BDSA Cannabis Insights: The Rise of Intoxicating Hemp Products and Their Impact on the Cannabis Market

With the legalization of low-THC hemp, a new wave of intoxicating hemp-derived products hit the market, disrupting the status quo and carving out a lucrative niche that sidesteps many of the challenges faced by the regulated cannabis industry.

Top Five Best-Selling Brands in the Ohio Medical Market

Ohio became the 24th state to legalize cannabis after 56% of voters said yes to adult-use on November 7, 2023. While rules for adult-use are pending until December 7, Ohio’s robust medical market and diverse brand landscape deserve more attention.

Small Categories, Big Wins: How to Optimize Cannabis Retail for Valentine’s Day

Enduring the trials of price compression means embracing resilience, innovating strategically, and uncovering growth paths previously unseen. With a keen understanding of emerging trends, BDSA provides the guidance brands need to navigate these turbulent waters and emerge stronger, poised for a promising future.

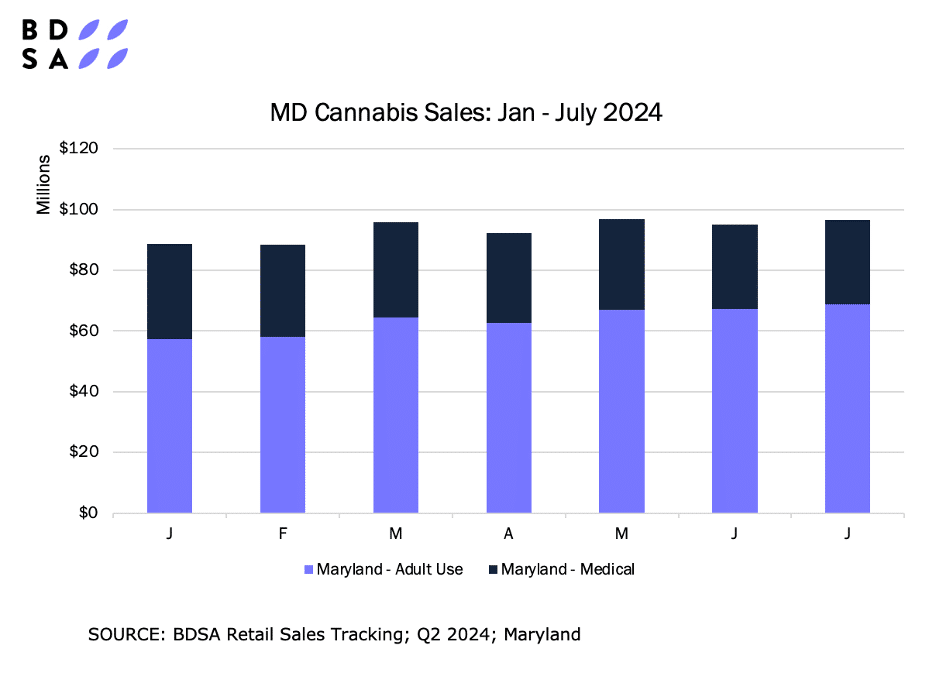

Top Five Best-Selling Brands in the Maryland Adult-use Market

Maryland adult-use is still growing after its strong launch. BDSA projects Maryland adult-use sales to reach $795MM in 2024, pushing total sales to $1.07B.

What’s in Store for Legal Cannabis this Holiday Season?

When we take a close look at the biggest holidays for cannabis, there is much more to the picture than just cannabis-focused holidays like 420. In recent years, the Fall and Winter holiday seasons have grown to present some of the biggest opportunities for boosting sales.

Solving Consumer Needs with Product Innovation & Minor Cannabinoids

Minor Cannabinoids are a blessing to brands, manufactures, and retailers. It is a lever that each can use to communicate, engage, and market to consumers. Minor cannabinoids have become a tool to market mood & effect messaging directly to consumers, in a manner that they easily understand.

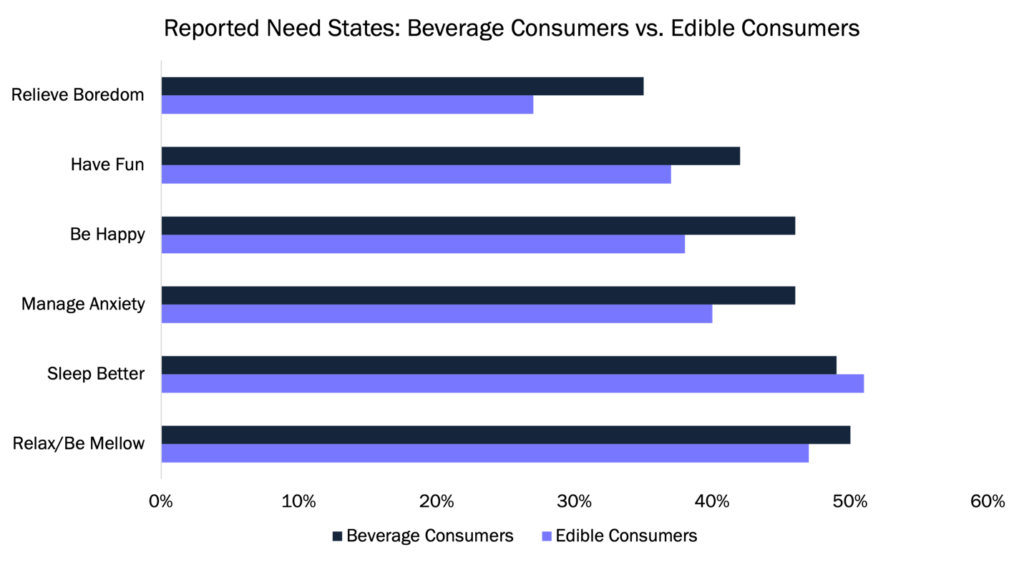

Realizing the Opportunity of the Cannabis Beverages Market

Even with all the opportunity in the Beverage space, building a winning cannabis Beverage venture is not a simple task.

Cannabis Beverages Hold Significant Opportunity Across Saturated Mature Markets & Open Emerging Markets

Maryland begins legal adult-use sales on July 1, 2023. Despite declines in the medical channel, adult-use is expected to help the Maryland market return to growth for years to come, with adult-use sales contributing nearly a third of the forecasted 2023 state legal sales of $642 million.

Top 5 Best-Selling Cannabis Brands (Beverage) 2023

Maryland begins legal adult-use sales on July 1, 2023. Despite declines in the medical channel, adult-use is expected to help the Maryland market return to growth for years to come, with adult-use sales contributing nearly a third of the forecasted 2023 state legal sales of $642 million.