Sales Enablement

Identify sales opportunities, reduce stock-outs, and optimize pricing with real-time dispensary data. No manual tracking required.

Smarter Sales, Fewer Stock-outs, Bigger Wins.

Sales Enablement equips brands and distributors with the real-time data and insights needed to expand retail presence, optimize sales strategies, and drive revenue. No more manual tracking or advanced analytics required. Just clear, actionable intelligence.

Track stock-outs, pricing, product availability, sales, and velocity at the dispensary level. Prioritize high-impact opportunities, align territories, and automate reporting for quicker, more effective sales. Whether used on its own or alongside BDSA’s Retail Sales Tracking, Sales Enablement simplifies distribution and maximizes your market potential.

Increase Distribution

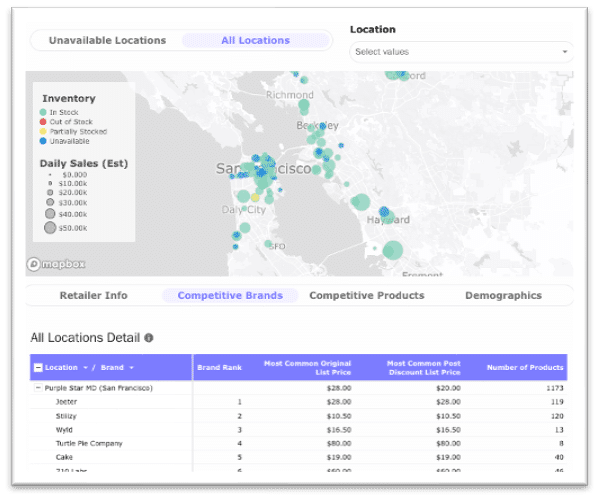

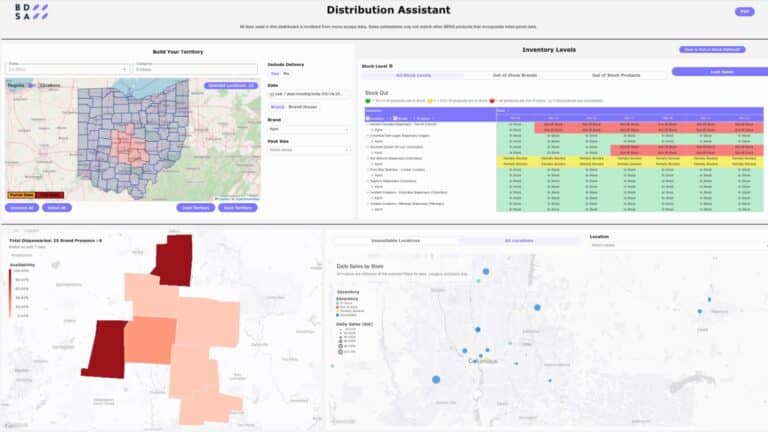

Use our availability heatmap to identify distribution strength and areas of opportunity.

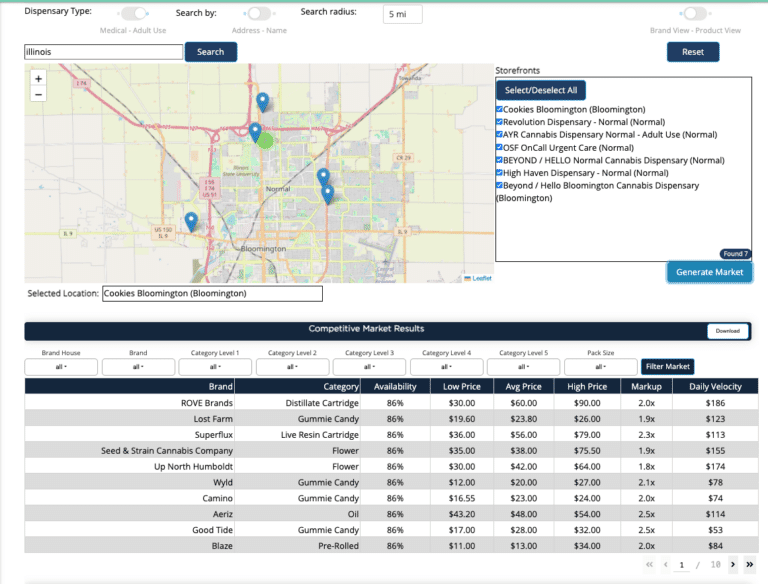

Competitive Assortment

Unpack the fastest-moving, up-and-coming, and the most widely stocked brands and products with insight into markup, velocity, availability, and price.

Refine Pricing

Uncover granular intelligence on store-specific pricing for brands and products.

Inventory Planning

Improve sales strategy by evaluating out-of-stock trends of your own brands and of your competitors.

BDSA Sales Enablement Product Details

Daily Stock-out Alerts

Identify full or partial stock-outs, and size the missed opportunity from those lost sales.

dispensary-level sales detail

Uncover estimated store revenue, with category, brand, and product sales detail.

Prioritized Go-Get Lists

Serve your team an actionable go-get list, a view of prioritized expansion opportunities with respect to each store's ranking for category velocity, total size, and level of saturation

Customize sales territories

View go-get lists and local insights by the territories that align with your business, whether that's by region or accounts.

CPG-Grade Performance Metrics

Utilize metrics like Sales, Velocity (sales speed), %ACV (distribution reach), and Availability to set benchmarks, evaluate success, and isolate strengths for sales stories.

BDSA Sales Enablement Capabilities

Identifying stock-outs is just the beginning. Offer your team a prioritized go-get list to focus and maximize sales efforts.

- Utilize brand availability gaps, store sizing, category velocity and saturation to direct sales efforts. Better yet, use our automated Top Expansion Opportunity generator to do it for you.

- Differentiate your strategy from that of your nearby competitors, through assortment, pricing, or a mix of the two.

- Uncover strengths and weaknesses of competitive brands referencing pricing, velocity, and out-of-stock data to sell directly against them.

Empower your sales team to address stock-outs and size lost opportunities.

- Evaluate trending out-of-stock patterns of your own brand and your competitors by region or individual location, with the flexibility to view categories, brands, and products.

- Assess demand planning based on historic out-of-stock trends by brand and product.

- Track when your competition sells out or has restock issues

Uncover critical indicators of brand strength and opportunities with key information such as pricing, markup, availability, and velocity.

For Retailers:

- Identify new products to introduce based on strong or growing availability and velocity metrics.

- Perform data-backed due diligence during the buying process.

- Uncover average wholesale to retail markup.

For Brands:

- Build detailed, data-backed “why my product/brand” sales stories to retailers.

- Benchmark top performing, and up-and-coming competitive products.

Empower your sales team with BDSA Sales Enablement.