Own One Category Or Diversify

Since the start of adult-use sales in late 2019, Michigan has grown to become one of the most exciting cannabis markets in the nation. Over the past year, sales declined in other mature U.S. cannabis markets, due to marketplace changes (e.g., price compression, regulatory strain). However, Michigan experienced continued growth, with monthly dollar sales reaching an all-time high of $250 million in March 2023. With such success, some might wonder “how can our brand win in Michigan?”

The right approach to win in Michigan depends on where your brand and business is situated. For brands looking to enter the state or expand their existing operations into Michigan, one of the most important pieces is understanding the product category dynamics of the best-selling brands in Michigan and evaluating what strategy works best for your business and brand. Several brands in Michigan have delivered huge sales with a product market focus on either a single cannabis form factor or multiple; whichever best matches their business and brand strengths.

A Focus on a Single Cannabis Form to Win in Michigan: Inhalable Products

Looking at the makeup of top brands in Michigan, several brands have dominated the market with a focus mainly or entirely on a single product category. This is especially true amongst brands that have thrown all their eggs into the inhalable form factor basket.

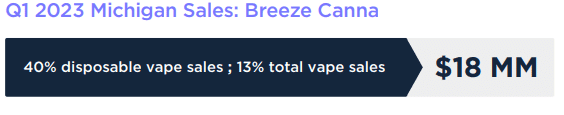

One brand that has dominated the Michigan market with a single product category is Breeze Canna. Breeze Canna focuses entirely on the disposable vape category; has quickly risen to the top. In Q1 2023, Breeze Canna was the number one best-selling vape brand and the number three best-selling brand across the entire market.

Another brand that has risen to the top of the market with a focus on inhalable form factors is Grown Rogue. Grown Rogue built their brand by going all-in on the flower space. Although the brand ventured into the preroll space in 2022, flower has remained its dominant product category. In Q1 2023, Grown Rogue had $11 million in total sales; 94% of which came from flower sales. All of which brought the brand to be the third best-selling flower brand and the seventh best-selling brand overall in Michigan.

To win in Michigan with Smaller Product Categories (e.g., Edibles): A Multi-Category Approach May be the Way

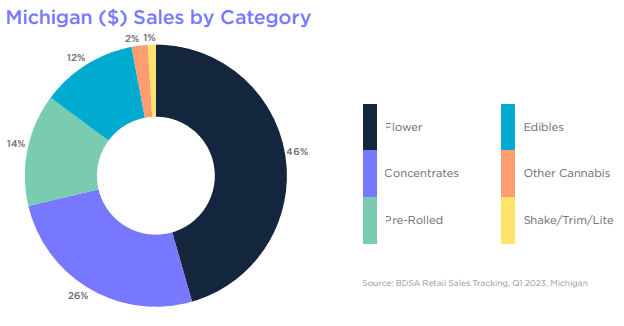

In Q1 2023, edibles accounted for 12% of Michigan dollar sales, versus the 46% from flower and 26% from concentrates. It’s easy to see why brands that only play in the edibles product category in Michigan may struggle to reach the total market’s best-selling brands list. One of the strategies that some of the most dominant brands across the entire state employ is a multi-category strategy that incorporates edible products.

Redbud Roots, the number one best-selling brand in Q1 2023, has gained their position in the market with a product portfolio that includes flower, prerolls, concentrates, and edibles. Another multi-category brand, MKX, has risen to be the number two best-selling brand overall, and the number one best-selling brand in the edible category with a multi-category approach that targets both the concentrate market and edible market.

A Strong contender to Win in Michigan: An Edible-only Multi-State Brand with a Strong Brand Identity

Just because fewer best-selling brands overall focus on edibles doesn’t mean that it’s impossible to be successful in Michigan with an edibles-only approach. Looking at the list of top brands in Michigan, a strong brand identity can be a major factor to seeing success as an edible-only brand. Homegrown edible-only brands are not well represented in the list of top brands across all categories, but several large multi-state brands have used their strong brand recognition nationwide to establish a strong presence in the Michigan edible space. The large multi-state brands Wyld, Wana Edibles, Camino, Dixie, and 1906 all made it onto the list of best-selling edible brands with a singular focus on the edible category. With BDSA forecasting the Michigan market to see 20% growth in total cannabis dollar sales in 2023, it’s clear that the state holds huge opportunities for local brands and multi-state operators alike. But, a careful approach to product category mix is a key for any brand looking to be a major player in the Michigan market. While inhalable categories make up a large enough piece of the market for a brand to focus on flower or concentrates alone, it’s harder for a brand to become a best-seller overall focusing on the smaller edible category.