As the legal cannabis industry has expanded across the country, branding and consumer facing information has become increasingly sophisticated. For example, consumers have now come to see brands in the edibles category leaning heavily into specific moods and effects labeling. However, in the flower category strain name remains the backbone of signaling the effect or product experience to the knowledgeable consumer. So, when it comes to improving and winning in the flower category, an important tactic is staying on top of the latest strain trends. This is especially true for brands in the highly competitive California market, and also brands across the country looking to California for indications of trends to come in their markets.

California Cannabis Check-in

It would be unfortunate to jump straight into the strain trends & top strains in California without first mentioning the status of the California legal cannabis market. Although California is the biggest cannabis market in the country, there have been strong headwinds (illicit competition and price compression in particular) negatively impacting the market since late 2021. For context, California had a strong upward sales trend that began in the Spring 2020, followed by a sales fall in Q2 2021. That fall intensified in late 2021, as price compression began hitting California hard; driving a -20% decline in total dollar sales from Q2 2021 to Q1 2023. Despite the challenges of the market, California cultivators and brands have continued to innovate by crossbreeding to bring more strains to the market. In fact, the number of strains available at retail grew consistently and reached an all-time high of 3,485 strains in Q1 2023. This may sound favorable — a recipe for category growth and increasing the pie size — especially given the market share and strong sales held by top strains. However, most strains possess less than 1% of total sales. Combining that with the sales declines in the California market, the increase in strains means there are more strains competing for a piece of a shrinking pie.

Consumer Insights: How Does Strain Name Affect Shopping Behavior?

Strain name has a significant effect on where and how consumers choose to shop. This was clearly highlights in the quantitative and qualitative data from BDSA Consumer Insights. In particular, when asked what influences where they shop for cannabis, 27% of California consumers claimed that a retailer having the strains or products they like is a significant driver of retailer choice. Strain name also significantly influences product choice at retail. 18% of California consumers claim that they choose cannabis based on it being a strain they have used before, while 15% claim that they choose their cannabis by strain name. Consumer data also show that consumer shopping drivers may influence strain loyalty, with 30% of consumers claiming that they are willing to pay more for products that deliver consistent, repeatable benefits.

Trends In California Cannabis Strains

There have been some big shakeups in the list of best-selling strains in California. Some strains have lost their dominant position in the flower category, while others have seen massive increases in sales.

Shakeups at the Top

“Cake” strains, like Wedding Cake and Ice Cream Cake, have a sizable presence in the California market. However, over the past few years, these “cake” strains have had significant decline in sales. For example, Wedding Cake had 1.8% share of dollar flower sales in Q1 2021 and dropped to 1% in Q1 2023. Similarly, the share of Ice Cream Cake strain fell from 1.1% of flower dollar sales in Q1 2021 to 0.3% in Q1 2023. Just because a strain has seen its share of total sales fall does not mean that it’s losing relevance in the market. Wedding Cake and Ice Cream Cake remain the number three and number nineteen best-selling strains in the state, and the decline of Wedding Cake and Ice Cream Cake is also likely due to the increase in the number of “cake” strains across the market, many of which draw their lineage back to these two strains. Between Q1 2021 and Q1 2023, the number of strains with “cake” in the name increased 20% in the California market.

Fast Rising Strains

Newer strains, such as Lemon Cherry Gelato, are making a name for themselves with rising sales in the California flower category. BDSA Retail Sales Tracking data show that Lemon Cherry Gelato’s share of total flower sales grew from .05% in Q1 2021 to .8% in Q1 2023. Kush Mints and Runtz are two strains that have grown their share of sales after being in the market for years. Between Q1 2021 and Q1 2023, Kush Mints grew its share of dollar flower sales from .7% in Q1 2021 to just over 1% in Q1 2023, while the share of flower sales held by Runtz increased from .24% to 1.3%. The increase in share of sales by Runtz is particularly impressive when we consider that the number of Runtz-derived strains has increased significantly in the market. BDSA Retail Sales Tracking data show that the number of strains with “Runtz” in the name grew from 13 in Q1 2021 to 75 in Q1 2023. The fact that the ‘original’ Runtz has grown its sales so significantly even while similar strains have continued to be added to the market showcases the popularity of the strain among California consumers,

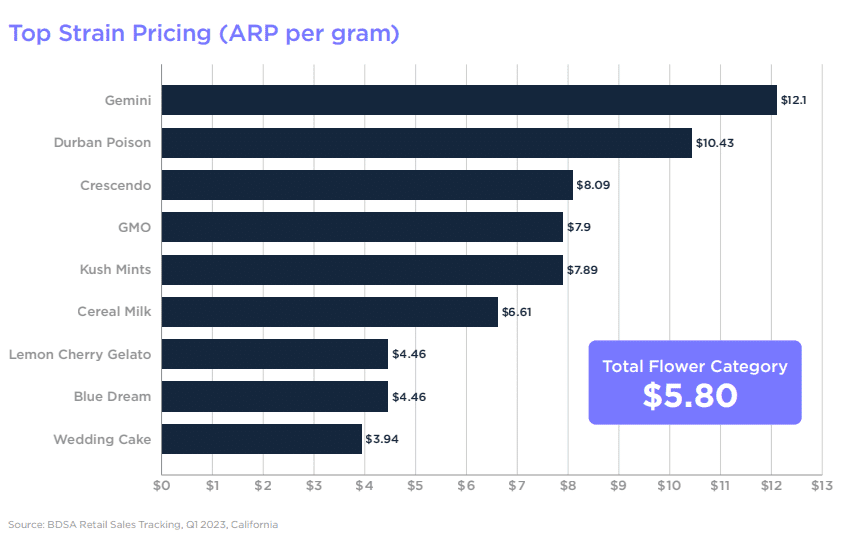

Pricing Trends by Strain

Flower retail pricing, especially among best-selling strains in California, have some interesting trends. Some leading strains, particularly those that have been on the rise recently, have average retail prices (ARPs) that are significantly higher than the aggregate of all flower. In Q1 2023, Kush Mints held an ARP that was 36% higher than the total category, while Runtz held an ARP that was 17% higher than the ARP for all flower products. On the other hand, strains that have declined in the market have mixed trends. While strains like Wedding Cake and Blue Dream sold for significantly less than the market average, others like Durban Poison were positioned with higher ARPs- as high as 80% higher than the entire category ARP.

The cannabis industry is rapidly evolving, and so are cannabis consumers. Consumers are becoming more knowledgeable about strains and are factoring it into their purchasing decision. While there are other tactics brands and retailers use to drive sales when shopping for flower the strain matters. Any brand that wants to win in the competitive California market, especially the flower category, must understand and factor in top trends in cannabis strains.