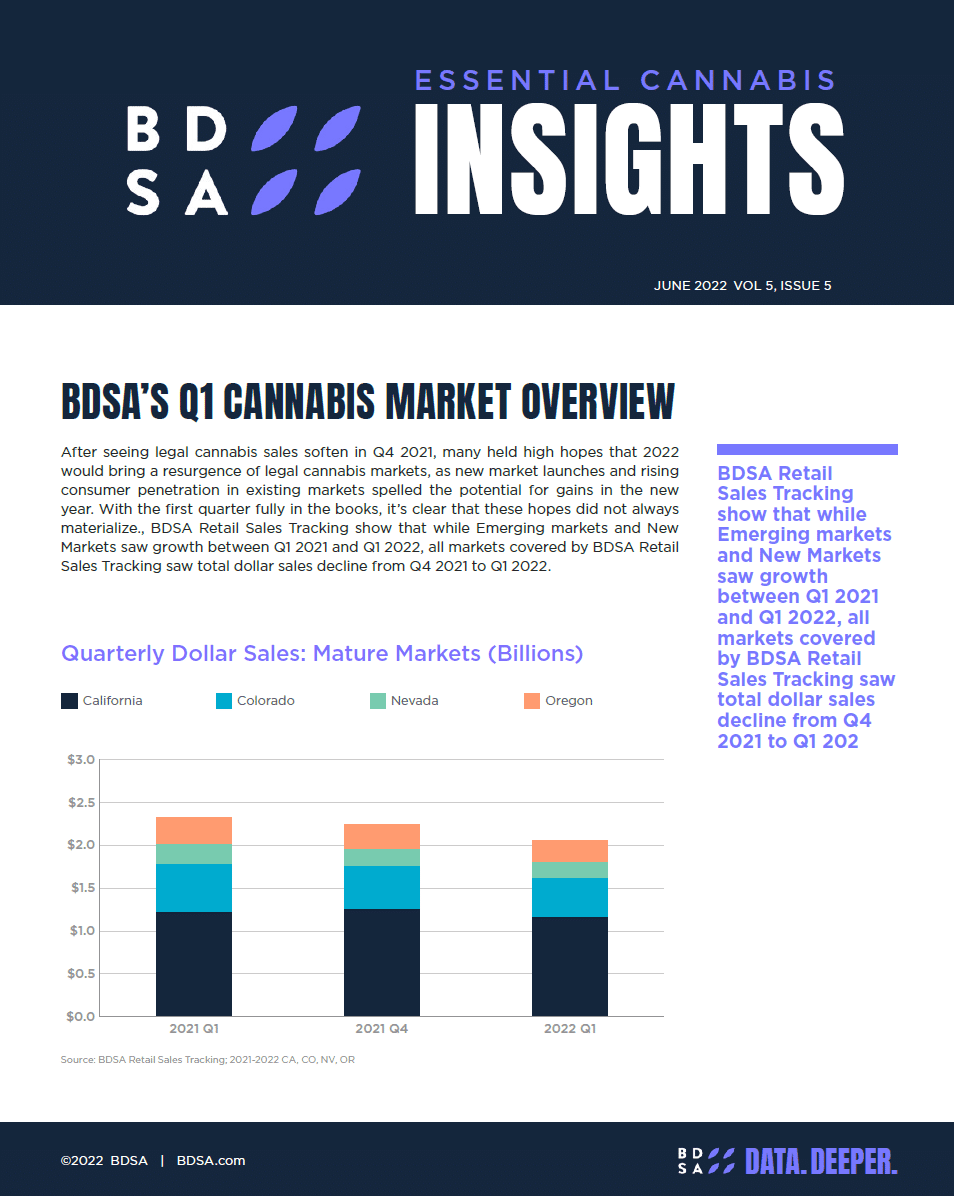

After seeing legal cannabis sales soften in Q4 2021, many held high hopes that 2022

would bring a resurgence of legal cannabis markets, as new market launches and rising

consumer penetration in existing markets spelled the potential for gains in the new

year. With the first quarter fully in the books, it’s clear that these hopes did not always

materialize. BDSA Retail Sales Tracking show that while Emerging markets and New

Markets saw growth between Q1 2021 and Q1 2022, all markets covered by BDSA Retail

Sales Tracking saw total dollar sales decline from Q4 2021 to Q1 2022.

Mature Markets

California, Colorado, Nevada and Oregon

The most established markets tracked by BDSA saw some of the most dramatic declines

in the first quarter of 2022. Across California, Colorado, Nevada and Oregon, total dollar

sales fell ~10% between Q4 2021 and Q1 2022, and fell ~12% from Q1 2021 to Q1 2022.

Some of this decline is due to falling average retail prices (ARPs), with the equivalent

ARP in Q1 2022 falling ~5% from Q4 2021 and remaining almost flat from Q1 2022 across

these four markets, all markets also saw declines in unit sales.

The Nevada market saw some of the most dramatic losses, with dollar sales falling 12%

from Q4 2021 and 22% from Q1 2021, indicative of the effect that the current economic

situation is having on the heavily tourism-dependent Nevada market.

Emerging Markets

Arizona, Florida, Illinois, Massachusetts, and Michigan

After seeing stronger growth than more mature markets for most of 2021, the Emerging

markets of Arizona, Florida, Massachusetts and Michigan began to see sales soften at the

end of the year, with quarterly sales falling ~6% in Q1 2022.

Most Emerging Markets tracked by BDSA saw dollar sales declined from Q4 2021 to

Q1 2022, except for the Florida medical market, which saw ~7% growth from Q4 2021 to

Q1 2022. Surprisingly, the young Arizona adult-use market saw one of the most significant

quarter to quarter losses in dollar sales, falling ~7% from Q4 2021, but still saw a ~40%

increase in sales from Q1 2021, due to the addition of adult-use in early 2021.

Similar to the dynamic seen in Mature markets, average retail prices (ARPs) fell across all

Emerging markets in Q1 2022. Massachusetts saw one of the largest declines, with the

equivalent ARP in the state falling ~9% from Q4 2021.

New Markets

Maryland, Missouri, and Pennsylvania

As legacy adult-use markets began to show signs of slowing in 2021, many looked to

newer, medical markets to be the primary drivers of growth in the cannabis industry

going forward. While unit sales have remained strong across New Markets tracked by

BDSA, sharp declines in average retail prices have led to dollar sales softening and even

declining Compared to Q4 2021 in some of the most promising New Markets. However,

sales were up ~20% compared to the same period last year.

Across the New Markets of Maryland, Missouri and Pennsylvania, sales fell ~4% from Q4

2021 to Q1 2022. The largest decline came in the Pennsylvania market, which saw sales

fall ~6% in Q1 2022. Still, sales in Q1 2022 were ~3% higher than in Q1 2021. The biggest

driver of these declines was crashing average retail prices, though some of this is also

likely driven by the small seasonal decline these markets historically see in February.

Retail prices driving sales declines is clear in the case of the Maryland market, which saw

dollar sales fall ~4%, while also seeing a ~3% increase in equivalent unit sales.