Cannabis markets have seen massive changes since the nascent days of legal cannabis. As markets have matured, the brand and retailer landscape has become increasingly dominated by large, multi-state operators (MSOs), especially in emerging markets and markets with more restrictive licensing. While independent, “home-grown” brands still see strong sales across many legal states, MSOs have distinct advantages, ranging from the brand recognition they have with new market launches, to their ready availability to capital for expansion. With most of the growth in legal cannabis in the coming years expected to come from emerging markets, MSOs are sure to see strong growth, but how do MSOs fare in mature markets, given the presence of homegrown brands with strong distribution and consumer loyalty?

How Big Are MSOs?

Without context, the term “multi-state operator” maybe be interpreted several ways. For example, some use the term to describe any brand or company with operations across multiple states, while others strictly use the term for the largest few brand houses with vertically integrated operations across several states. For this analysis and report, we will focus on the performance of the top five best-selling MSO with vertically integrated operations (Retail + Wholesale Brands): Cresco Labs, Curaleaf, Shryne Group, Green Thumb Industries, and Verano.

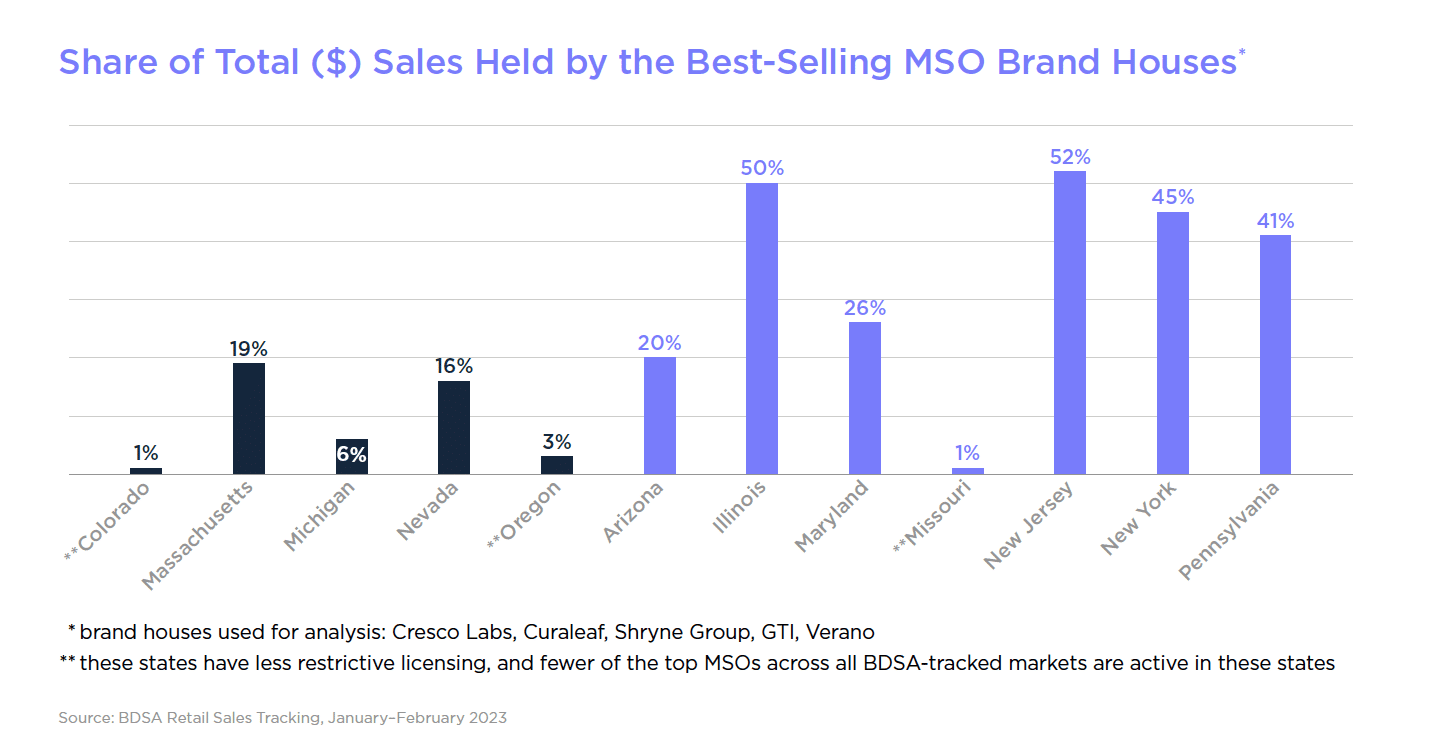

Across BDSA markets (AZ, CA, CO, IL, MD, MA, MI, MO, NV, NJ, NY, OR, PA), MSOs hold a considerable share of total sales. In January-February 2023, BDSA Brand House data show that the five best-selling MSO brand houses made up a 19% share of total dollar sales across all BDSA-tracked markets, with the largest of these MSOs, Cresco Labs, bringing in 4% of dollar sales on its own. To put things in context, Cresco Labs owns 10 of the 2,740 brands BDSA tracks across all markets. Not all markets are created equal, and as with many industry dynamics, there are significant differences in the MSO contribution when comparing emerging and mature markets.

MSO Share of Sales in Emerging Markets

Regulations and market dynamics greatly vary from state to state. Restrictive licensing rules in emerging cannabis markets (AZ, IL, MD, MO, NJ, NY and PA) establish a higher barrier to entry, especially for independent brands with limited access to capital. As a result, such emerging cannabis markets are better suited for large MSO presence. Across emerging markets BDSA Brand House data show that the top five MSO brand houses brought in a 35% share of dollar sales for January-February 2023, of which Curaleaf, the best-selling MSO across BDSA tracked markets, brought in a quarter of that 35% share.

MSO brand houses hold a dominant position in Emerging markets, but there is still significant variation from state to state (within the Emerging market category).

In January-February 2023, the best-selling MSOs across all BDSA tracked markets brought in over half the dollar sales in the Illinois market, with the leading MSO, Cresco Labs, taking in almost 20% of dollar sales over those two months.

MSO Share of Sales in Mature Markets

MSOs developed a strong presence in mature markets (CA, CO, MA, MI, NV and OR), even though market conditions are less conducive to MSOs being dominant. Mature markets are more likely to be home to “legacy” brands that were able to develop a strong brand awareness in the early days of legal cannabis, and are less likely to have been subject to vertical integration requirements. Across mature cannabis markets tracked by BDSA, the five best-selling MSO brand houses made up 11% of dollar sales in January-February 2023.

MSOs brand houses play a more dominant role in emerging markets compared to mature markets, though there are outliers among each market type. Licensing and regulatory conditions in Mature markets may present some barriers to MSOs obtaining the level of dominance they have seen in Emerging markets, but the best-selling MSO brand houses continue to have a solid foothold in Mature markets.