Whether you’re looking to launch a new venture in the cannabis industry, or looking to expand to a new market, a careful consideration of market dynamics is a vital first step that everyone should take. Part of that consideration should include a detailed look at the different dynamics of medical markets and adult-use markets. Adult-use legalization may be spreading at a rapid rate, but medical cannabis is still expected to bring in roughly a third of total cannabis sales in 2023, so the opportunities in medical-only states should not be ignored. While every state with a legal cannabis market is unique, there are some general trends that can help explain the biggest differences between medical and adult-use markets in the US.

Licensing and Regulatory Dynamics

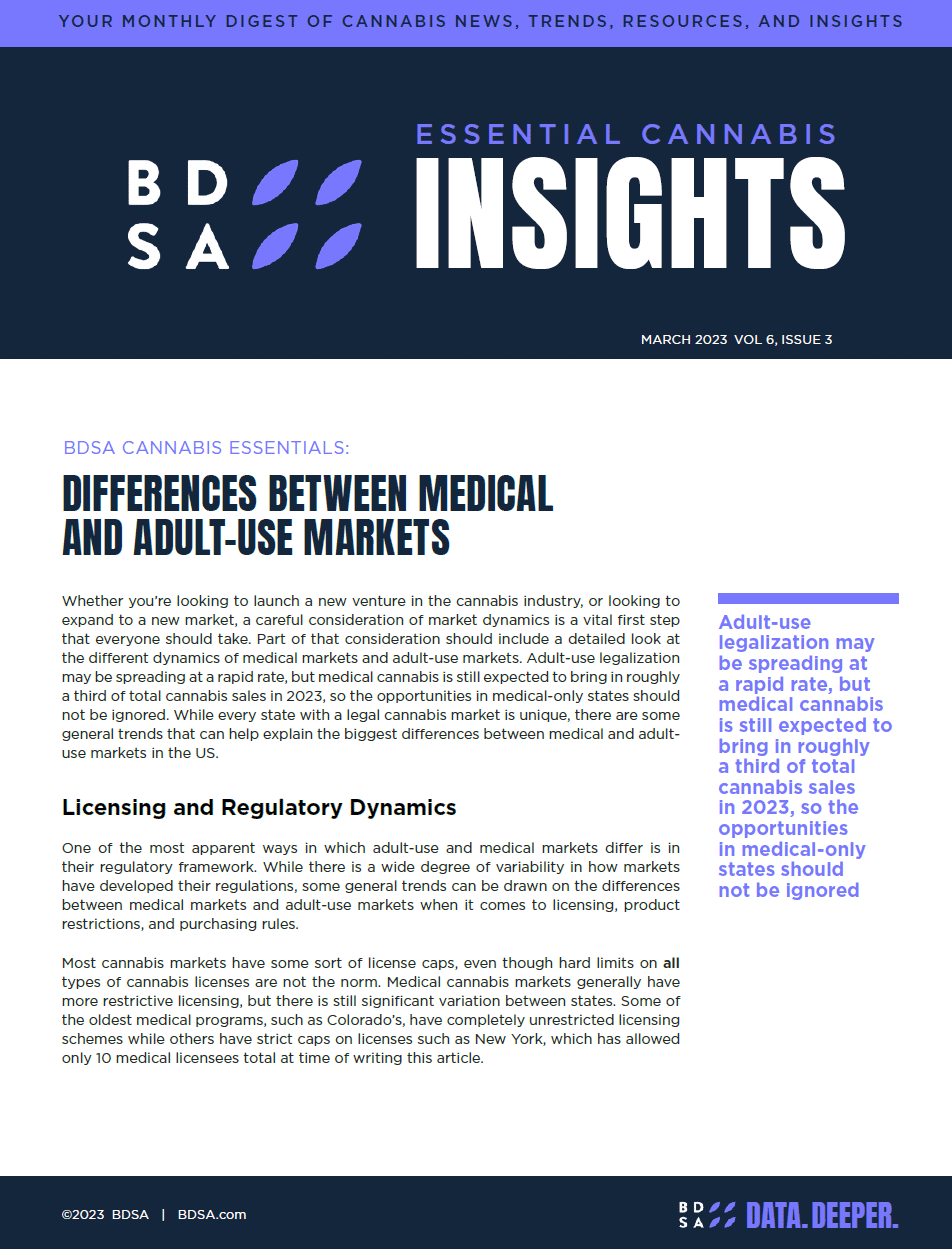

One of the most apparent ways in which adult-use and medical markets differ is in their regulatory framework. While there is a wide degree of variability in how markets have developed their regulations, some general trends can be drawn on the differences between medical markets and adult-use markets when it comes to licensing, product restrictions, and purchasing rules.

Most cannabis markets have some sort of license caps, even though hard limits on all types of cannabis licenses are not the norm. Medical cannabis markets generally have more restrictive licensing, but there is still significant variation between states. Some of the oldest medical programs, such as Colorado’s, have completely unrestricted licensing schemes while others have strict caps on licenses such as New York, which has allowed only 10 medical licensees total at time of writing this article.

While many adult-use markets have a more open licensing scheme, some markets restrict the number or size of cultivation licenses, particularly when markets begin dealing with oversupply issues. This has been the case in the California market, where regulators have limited the overall canopy space allowed for certain cultivation licenses, and Oregon, where a long-term supply glut led regulators to implement a moratorium on new licenses.

In the early stages of a medical cannabis market, product restrictions are not uncommon. The most common restrictions in nascent medical markets are prohibitions on certain inhalable and ingestible products. As medical programs become established, many regulators give in to pressure from patients and activist groups and reduce limitations on allowable form factors. We’ve seen this shift occur in several medical markets, such as Florida, where initial restrictions on smokable flower were rolled back in January 2019, or Maryland, which loosened restrictions on edibles in August 2019.

Another area of difference in the regulation of adult-use and medical markets is seen with purchase limits. While regulations in adult-use markets generally set daily purchase limits that are in the same ballpark from market to market, medical markets usually have higher daily purchase limits, or set purchase limits for given period based on an individual patient recommendation.

[Source: BDSA]

Product Category Share

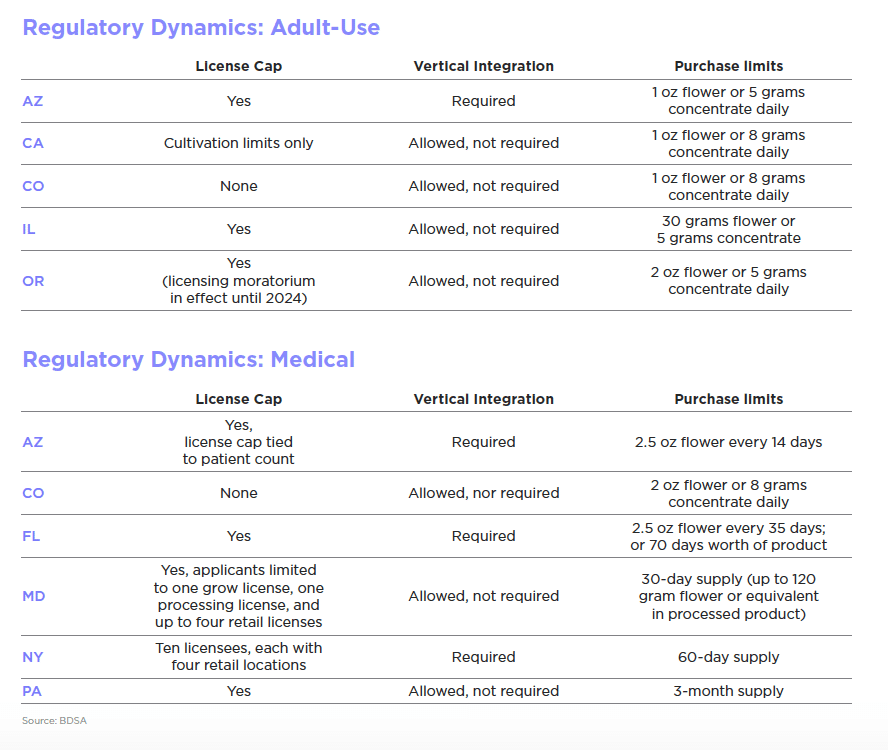

When we examine the product category makeup of adult-use channels compared to medical channels, BDSA Retail Sales Tracking data consistently show flower and dabbable concentrates making up a larger share of total sales in medical channels, with adult-use markets seeing other categories make up larger shares of sales.

Across the aggregate of all markets tracked by BDSA, medical markets (AZ, CO, FL, IL, MA, MD, MI, MO, NV, NJ, NY, OR, and PA) saw flower bring in a 42% share of dollar sales in Q4 2022, while adult-use markets (AZ, CA, CO, IL, MA, MI, NV, NJ, OR) saw flower make up a 37% share of dollar sales. While the restrictions on edible form factors play a part in the dominance flower has in certain medical-only states (like PA), we also see flower make up a larger portion of sales in the medical channel of the most mature markets. In Colorado, where medical patients have access to a wide range of edibles (including high dose edibles), flower made up a 48% share of dollar sales in the medical channel in Q4 2022, compared to a 36% share of dollar sales seen in the Colorado adult-use channel over that same period.

A similar dynamic is seen with the dabbable concentrate subcategory. In medical markets, dabbables made up 26% of concentrate sales in Q4 2022, while adult-use markets saw dabbables make up only 18% of dollar concentrates sales. This trend of dabbables taking up more share in medical also holds true when looking at different channels in the same state. In Colorado’s medical channel, dabbables made up 48% of dollar dabbable sales in Q4 2022, compared to a 31% share in the Colorado adult-use channel.

[Source: BDSA Retail Sales Tracking; All Markets; Q4 2022]

Cannabis Pricing Dynamics

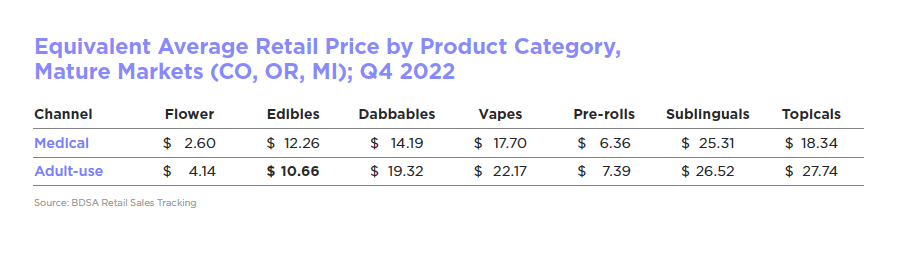

Diving into a pricing comparison of medical markets and adult-use markets, a cursory glance can give you the impression that medical markets always see higher average retail prices, with BDSA Retail Sales Tracking showing that equivalent average retail prices were ~9% higher in the aggregate of medical markets than in the aggregate of adult-use markets. But a closer analysis shows a more complicated situation, as emerging markets, particularly medical-only markets, have yet to be hit hard by price compression and thus are still seeing higher prices at retail. The Pennsylvania medical market, for example, held an equivalent average retail price (EQ ARP) for flower that was almost four times that of the EQ ARP for flower in the Colorado medical channel.

Making a comparison of the medical and adult-use channels of mature cannabis markets can give us a different view into how pricing evolves in each channel. When comparing pricing in some of the most mature markets (CO, OR and MI), the equivalent average retail price across all products was over 50% higher in the adult-use channel than the medical channel.

Comparing these channels by product category also yields some interesting results. Inhalable form factors see significant price differences between medical and adult-use channels, with flower, dabbables, and vapes all coming in at significantly higher prices in the adult-use channel. The pre-roll and sublinguals categories saw some of the smallest price differences, while the edible category saw lower prices at retail in the adult-use channel.

[Source: BDSA Retail Sales Tracking]

Consumer Dynamics

Both adult-use markets and medical markets have seen strong growth in consumer participation in recent years. BDSA’s most recent Consumer Insights data show past six-month consumer participation has reached 50% in adult-use states (a 7% increase over the past two years), and 42% in medical states (a 10% increase over the past two years).

With the greatly increased access that adult-use markets offer consumers, one might expect consumer dynamics to differ greatly between adult-use markets and medical markets, but while there are plenty of differences, Consumer Insights data also show some key similarities. In adult-use states, 75% of dispensary buyers describe their cannabis use as recreational, 58% as medical, and 48% as “quality of life” use. Dispensary buyers in medical-only states are more likely to describe their consumption as medical, with 73% describing their cannabis use as such, but there is still plenty of recreational consumption among this segment, with 66% describing their cannabis use as recreational, and 51% consuming for “quality of life”.

One area where medical and adult-use state consumers diverge is with shopping frequency. Dispensary buyers in medical markets are likely to purchase cannabis more frequently, with BDSA data showing that 49% of these consumers purchase at least weekly, spending an average of $111 per visit. By comparison, 41% of dispensary buyers in adult-use states report weekly purchasing, spending an average of $94 per visit.

Looking into the opportunities in legal cannabis, it may be tempting to ignore the potential of medical cannabis markets in favor of the growth opportunities in adult-use states. Adult-use markets are expected to contribute most of the growth to total cannabis sales in the coming years, but medical markets are still expected to bring in over $9 billion in legal sales out to 2027. Regardless of what type of market your new venture is targeting, a thoughtful, data-based approach analysis of market dynamics is a crucial first step on the road to success in the highly competitive cannabis industry.