Solving Consumer Needs with Product Innovation & Minor Cannabinoids

Minor Cannabinoids are a blessing to brands, manufactures, and retailers. It is a lever that each can use to communicate, engage, and market to consumers. Minor cannabinoids have become a tool to market mood & effect messaging directly to consumers, in a manner that they easily understand.

BDSA Forecasts Strong Growth in CBD Products In The US

Sales of products containing cannabidiol (CBD) have been brisk over the past two years, pacing rising consumer awareness of the substance and greater availability of hemp-derived CBD products beyond the regulated dispensary channel. This robust but fledgling market holds opportunities for companies already in the cannabis space, consumer packaged goods companies and makers of pharmaceuticals.

Understanding the CBD Consumer

The popularity of CBD products has exploded in the U.S. in recent years, with sales in the U.S. cannabis dispensary channel alone rising from $8.4 million in May 2016 to $56.9 million in May 2020. And hemp-derived CBD products, containing less than 0.3% THC, are increasingly available via general retail channels, though CBD ingestibles are […]

CBD: Cannabidiol Breaks Out of the Legal Dispensary Channel

The latest Cannabis Intelligence Briefing from Arcview Market Research and BDS Analytics: CBD: Cannabidiol Escapes the Dispensary details CBD’s move from legal cannabis dispensaries to the general retail market. At present, the bulk (65%) of the $1.9 billion in annual spending on CBD products in the U.S. takes place through licensed dispensaries in legal cannabis states.

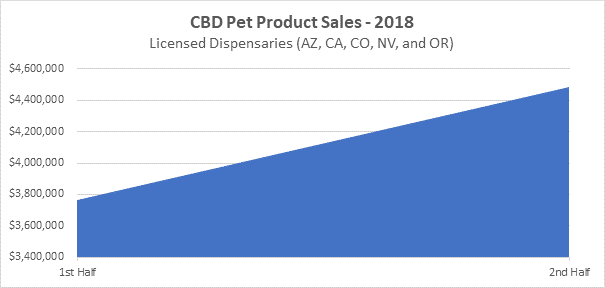

Pets, Pain and CBD: The Many Applications of Cannabinoid Products Webinar Recap

CBD: it spans product categories, retail channels, regulatory landscapes – and even species. Last month’s webinar covered the current cannabis market as it relates to pain management as well as pet care, both within the dispensary channel (CBD from marijuana) and in the general retail market (hemp-derived CBD). While pain management and pet care might […]

BDS Analytics’ Top 5 Insights From Our Upcoming Pet & Pain Webinar

Our August webinar, Pet, Pain, and CBD: The Many Applications of Cannabis Products is coming up this week. Here is some of what you can expect to learn – be sure to tune in on Thursday for the full story.

The $20 Billion CBD Race

Whether or not you keep up with the cannabis industry, you’ve likely heard the term “CBD” recently. Seemingly overnight, CBD is appearing everywhere from beauty product lines to burger joints. As it turns out, there’s legitimate reasoning behind “today’s” latest hype.

It Might Not Get You Buzzed (On Its Own), But Consumers Are High on CBD